The core tenets of open banking are users’ financial data stored in banks are shared with third-party applications with the users’ consent. This gives users more options and the power to make their money work more.

Instead of traditionally going to a bank and being at its mercy for services ranging from payment transfers to loans, as that was the only place with the user’s information, the data can now be made available to whom the user wants via open APIs (application programming interfaces).

So instead of being limited to using the bank’s debit or credit cards, the user can utilise other payment gateways since the user’s information is permitted to be viewed by a third party.

These ‘payment gateways’ are based on the open API standard that was first established in 1997. It revolutionised retail banking by introducing an ‘open’ standard adopted by all major players, such as Microsoft and Intuit, instead of developing their proprietary APIs. This contributed to the coining of the term ‘open banking’.

Why is open banking relevant?

Open Banking is intended to promote competition in the financial services industry and give consumers more control over their data.

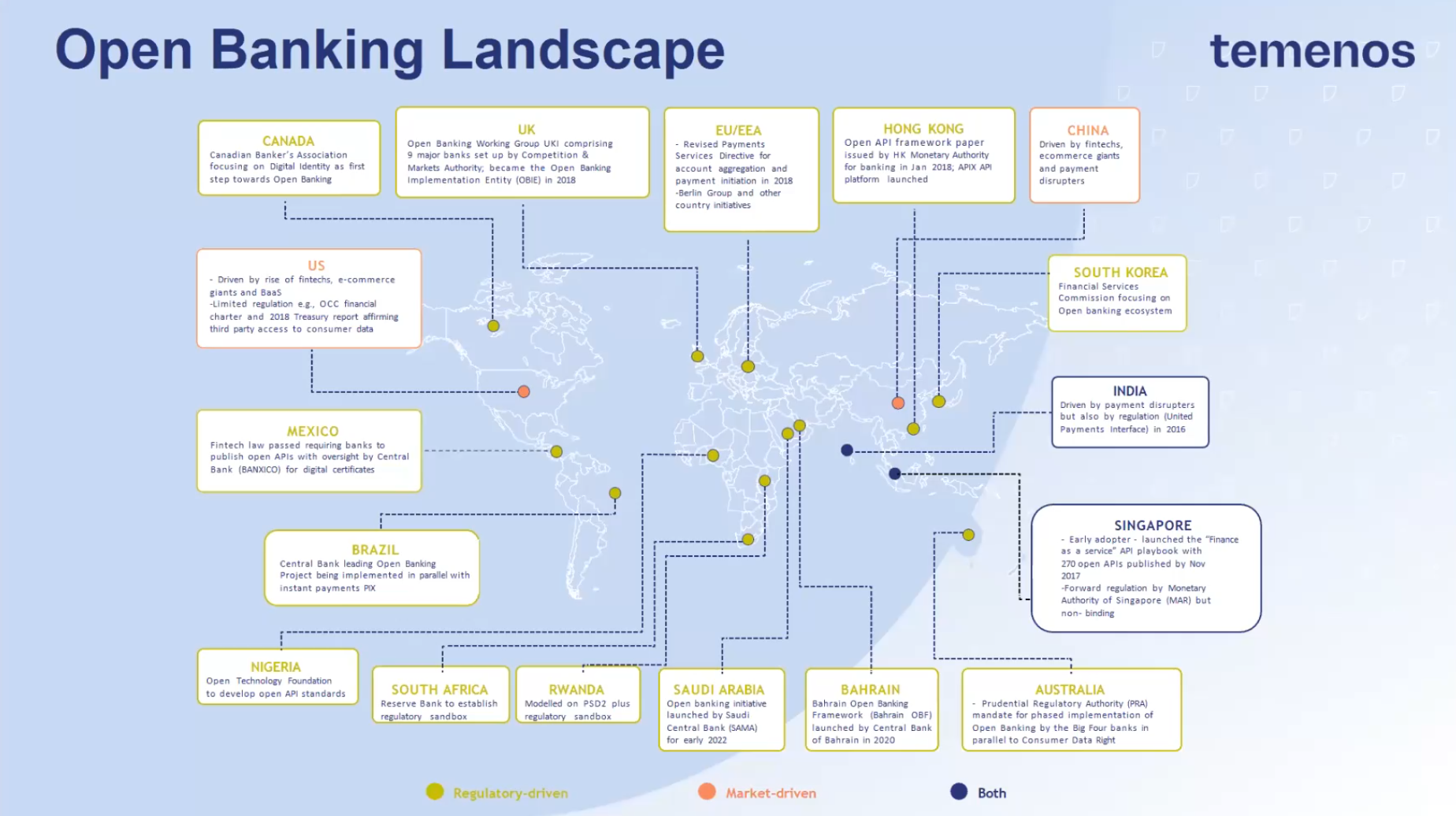

It is already being implemented worldwide, such as in the United Kingdom, Australia, and Canada. In 2015, the European Union also issued a directive on open banking.

In Southeast Asia, open banking is still in its early stages but rapidly gaining traction. Several countries in the region, such as Singapore, the Philippines, and Indonesia, are already making significant progress in open banking readiness.

This is a significant development as it will allow for greater competition and innovation in the banking sector. It will also make it easier for customers to compare financial products and services.

Southeast Asia’s open banking system

Southeast Asia’s open banking system is taking on its own flavour. The user data source is not derived solely from banks.

Singapore Financial Data Exchange, for instance, gives its users access to their personal financial information from SGX Central Depository, participating banks, and government agencies such as the Housing Board and the Central Provident Fund Board.

It is a government-owned and operated infrastructure. This gives a glimpse of how the other ASEAN countries could be crafting their data-sharing gateways with their goal of financial inclusion for all.

Instead of relying on financial data from banks when millions of the populace do not have a bank account, their data can be gathered from non-bank sources such as rental records and utility and mobile phone bills.

ASEAN shifting open banking strategy is driven by financial inclusion

In this matter, ASEAN is advancing from open banking to open financing and open data. Their strategy, driven by financial inclusion, is already bearing fruit.

Open banking around the world, Source: Temenos

In Indonesia, the Financial Services Authority (OJK) is developing progressive guidelines in the fintech space and has released its Integrated Payment Systems Blueprint 2025.

Bank of Indonesia (BI) also released an open API specification comprising data, technical, security, and governance standards to enable a seamless data-sharing framework.

Meanwhile, the Philippines Central Bank has approved guidelines on an open finance framework in a bid to promote financial inclusion and expand access to financial services for all Filipinos.

Adopting an open finance model will give customers uniform access to all their data and guarantee an expected level of customer protection in which their financial data will be secured.

With these guidelines in place, the Philippines is one step closer to a more inclusive financial system that will benefit all Filipinos.

In a 2021 progress report, ASEAN noted that it has already achieved its goal of reducing average financial exclusion from 44 percent to 30 percent. Four years earlier than its projected 2025 timeline. In a joint statement last April, the average now stands at 27.92 percent.

This is in line with the accelerated digital transformation the region has seen necessitated by the pandemic, supported by a young population quick to adopt new technology and plenty of start-ups eager to pave better ways to reach more customers – the banked, unbanked and underbanked – and go even further.

Acknowledging the impact of start-ups

“Start-ups are making a significant impact in the development of e-commerce, fintech, transportation and logistics, travel and hospitality, and other areas of the digital economy.

Some also support other entrepreneurs and micro, small and medium-sized enterprises (MSMEs) in adopting technology to enhance efficiency and market reach,” the report said.

The stakeholders, from governments and citizens to financial service providers, each play a role in inclusive growth.

Sharing financial data empowers users to have more control and choices in their monetary decision-making. It also generates more competition and creates new avenues for better products and more efficient service from traditional banks and the new players.

With ASEAN prioritising financial inclusion and each member state devising and implementing its national strategy to cater to its unique needs, open banking evolution to open finance and open data could be in the cards.

Featured image credit: freepik