Majority of APAC Consumers Prefer Remittance Services to Be Offered in a Super App

by Fintech News Singapore May 22, 2023Six in ten consumers in Asia-Pacific (APAC) prefer to use digital-only solutions for their remittance and money movement needs, a trend that’s emerging on the back of changing consumer preferences and demand for greater convenience, better planning and improved inclusivity, a new survey conducted by Western Union found.

Results of the Western Union Global Money Transfer Index, which are based on a poll of 30,500+ consumers globally, were released on March 22, 2023 and revealed that digital transformation is progressing quickly across the region as consumers grow frustrated with slow, inefficient and burdensome traditional remittance methods.

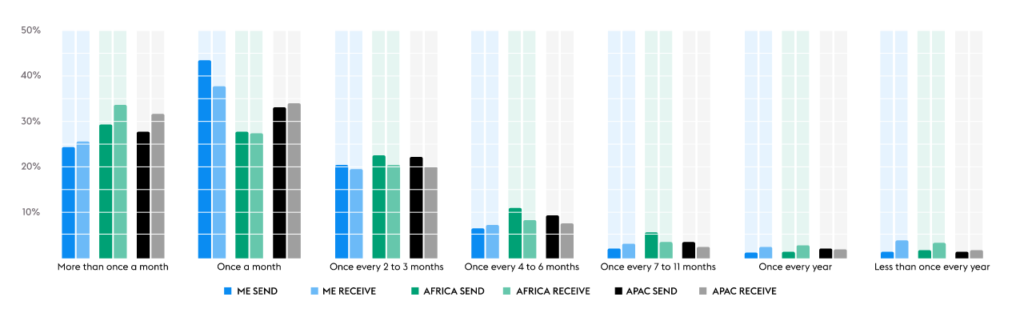

Remittances Set to Increase Across Regions

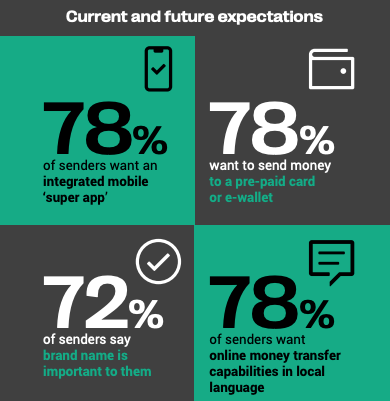

71% of APAC senders and receivers said they were irritated with the repetitive and time-consuming paperwork associated with cross-border money transfers. In fact, 78% of senders said they would prefer facial recognition and biometric technology for instant and reliable registration.

APAC consumers are looking for a broader range of channels and options for money transfers. 74% of the remittance receivers polled in the region said they wanted the possibility for their funds to be disbursed on a prepaid card or e-wallet that does not require a bank account, and 80% said they wanted the option of collecting in different currencies.

Consumers are also open to trying out new technologies that could improve speed and convenience, including cryptocurrencies and biometrics. In particular, they showed high eagerness for integrated super-apps, with 79% of APAC receivers sharing interest in a money transfer service that’s integrated into one mobile app, allowing them to manage remittances alongside other financial products with ease.

Across the APAC markets studied, Philippine consumers were found to be craving innovation the most. 89% of local remittance receivers said they wanted transfer services via one integrated mobile super app, the highest rate in APAC. 84% said they wanted the ability to receive remittances on a pre-paid card or e-wallet, and 75% said they wanted the ability to access funds using a hassle-free product such as a virtual gift card.

Philippine senders on the other hand are interested in innovation that would accelerate the transfer process, such as using facial recognition and biometric data for registration (82%), as well as cryptocurrency transfer services (80%).

APAC consumers also showed high interest in the ability to borrow money for remittances through so-called “send now, pay later” options. These arrangements allow customers to boost their cross-border money transfers by accessing short-term loans that are repaid in multiple installments over a period of time.

79% of Chinese remittance senders said they would take advantage of a send now, pay later option, a rate that stands at 78% for Vietnamese, 67% for Indonesians, 61% for Malaysians, 50% for Singaporeans and 44% for Australians.

Despite a clear preference for digital-only solutions as well as rising demand for more digital features and capabilities, some consumers still prefer face-to-face interaction when accessing remittance services, the study found.

In the Philippines, for example, 37% of remittance receivers said they preferred face-to-face interaction, and 17% said they wished to collect cash only in person.

In addition, APAC is home to a large population of unconnected and unbanked people who cannot access digital transfer services at all, having instead to resort to cash transactions.

According to Western Union, these aspects mean that physical agents remain of relevance in APAC, calling for money transfer providers to embrace an omnichannel approach that combines both digital and in-person experiences.

Results of the Western Union survey corroborate with findings of a recent Visa research which found that users in APAC are adopting app-based digital remittances at a rapid pace.

The study, which polled nearly 15,000 remittance senders and receivers in December 2022, found that 73% of Singaporean respondents and 71% of Filipino respondents relied on digital remittances. In Singapore, 61% of surveyed consumers reported using digital-only means for sending money internationally because of ease of use and security (53%).

Digital cross-border remittances, which amounted to US$295 billion in 2021, are expected to grow by 45% through 2025 to reach US$428 billion, according to Juniper Research estimates. The active user base for digital remittances is projected to increase by 66%, reaching 95 million by 2025 from 57 million in 2021.

This growth will be driven by booming adoption of digital payments by consumers, and increased investment in digital offerings from traditional money transfer services providers, the research company says.