Internet-of-Things Poised to Disrupt Banking and Insurance

by Fintech News Singapore January 18, 2017The Internet-of-Things (IoT) is set to be one of the biggest technological transformations on the horizon, promising to radically change the way we live and how we conduct business.

The IoT refers to the interconnection via the Internet of computing devices embedded in everyday objects, enabling them to send and receive data.

Applications of the IoT range from smart homes with equipment that consumers can control with their voices, wearables and smartwatches, to connected cars, or vehicles that are able to optimize its own operation and maintenance, and smart cities where the IoT promises to solve traffic congestion issues and reduce noise, crime, and pollution.

IHS forecasts that the IoT market will grow from an installed base of 15.4 billion devices in 2015 to 30.7 billion devices in 2020 and 75.4 billion in 2025.

According to McKinsey, the total IoT market size in 2015 was up to US$900 million and is expected to grow to US$3.7 billion in 2020, attaining a 32.6% CAGR (compound annual growth rate).

The IoT promises improved efficiency, accuracy and economic benefits in a number of industries including banking and insurance.

In insurance, the concept has already been applied through telematics for instance, which allow for the monitoring of driver behavior for car insurance. In the UK, Neos claims to be the country’s first connected home insurance company, providing customers with connected technologies to monitor potential threat in real-time.

“These days, most consumers and definitely the customers if financial services firms expect services to be centered around them and their needs,” said Romain Doutriaux, chief marketing officer of tech startup Dataiku, as quoted by Hays.

“IoT will fine-tune products, for instance by offering specific pricing for a loan or an insurance contract, but will also help in fraud prevention, churn defection (customers turning to other companies), as well as contributing to a more accurate segmentation of customers.”

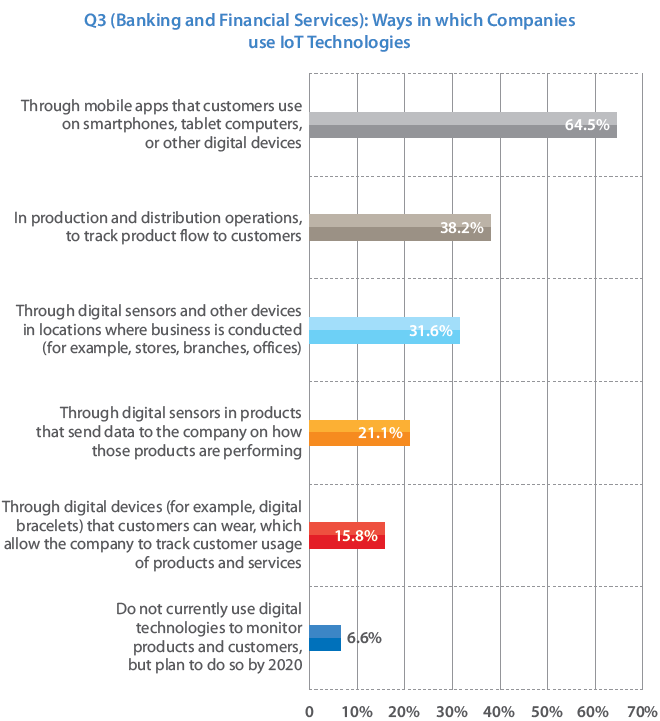

In the banking sector, IoT technologies are used mainly to monitor customers to understand and engage better with them, according to a report by Tata Consultancy Services. The next common IoT application is monitoring the supply chain, the research found.

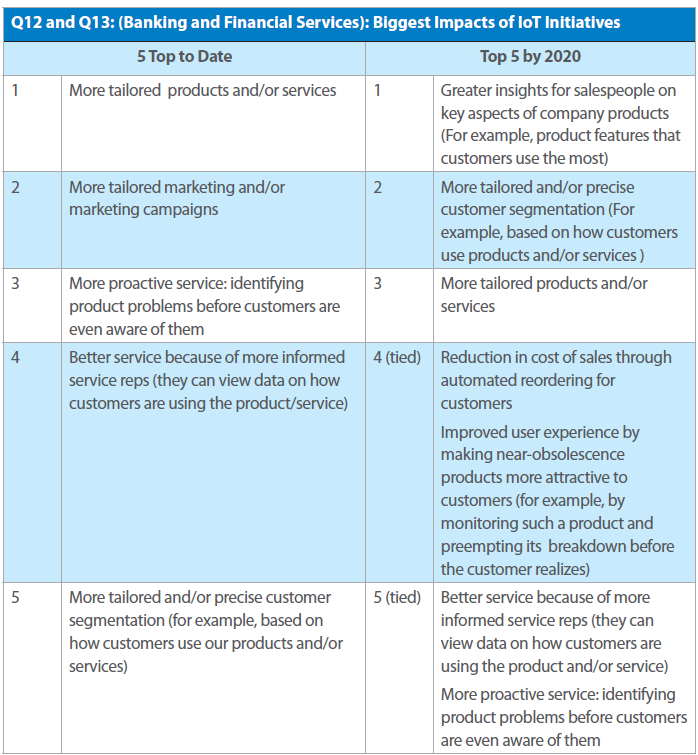

For financial institutions, the IoT focus has been on product which they’ve perceived as a way to provide more tailored products and services as well as better targeted marketing campaigns.

The report says that large banks have been investing heavily in IoT technologies with a reported average IoT budget of US$117.4 million in 2015. Financial institutions plan to spend US$153.5 million by 2018.

According to Dharmesh Mistry, UXP and digital product director at financial services software provider Temenos, the IoT will allow financial institutions to respond in real-time to customer needs and transform products so they become more personalized to suit an individual’s own lifestyle.

“With connected homes, one account for a family could connect utilities with the bank, linking a smart meter to the bank account and switching between suppliers to get the best deals; meanwhile in the kitchen, your fridge will manage your shopping, and possibly even work with the bin to record which items have been taken from the cupboard,” he told ITPro.

“As the concept of connected cities comes to fruition, banks will become more helpful in day-to-day situations. Your bank could send a warning to skip Starbucks that day if you have overspent on sundries that month; it could prompt you to think twice about buying a takeaway pizza if you haven’t exercised that day; or could suggest delaying going into the city by an hour, to avoid peak toll fees caused by current congestion. In connected cities, banks will have a sizeable role to play in the facilitation and control of payments.”

Smart homes becoming a reality in Asia

According to a report released on Monday by global management consulting firm A.T. Kearney, the smart home market in Asia is expected to reach US$115 billion by 2030, accounting for 30% of the global share which is predicted to surge to US$400 billion.

Growth in Asia will be driven by China and Japan, with highly connected economies such as Singapore, South Korea and Taiwan also playing a key role. More specifically, China is expected to become the biggest market in Asia, thanks to the phenomenal number of households that are seeing increased incomes as well as the strong local manufacturing and technology ecosystem.

Commenting on the report release, Nikolai Dobberstein, partner and Asia-Pacific head of communications for media and technology at A.T. Kearney and a co-author of the research paper, said:

“Asia’s socio-economic landscape provides a great opportunity for the region to be a global driver of growth in the smart home sector over the next few years. While the smartphone market is peaking out, the smart home market is becoming the next promising market.”

The firm highlighted the key trends and shifts that are accelerating market expansion of smart homes: the advancements in technology and processing power of smartphones, Big Data and artificial intelligence, interoperability among products from different manufacturers, the declining costs of vital technology and parts, and the emergence of new monetization models.

Featured image credit: Internet-of-Things concept via Shutterstock.com.