Southeast Asia Digital Economy Set to Hit US$100 Billion in Revenue

by Johanan Devanesan November 20, 2023In an era marked by rapid technological advancements and economic unpredictability, Southeast Asia stands out with a digital economy that is not just surviving, but thriving.

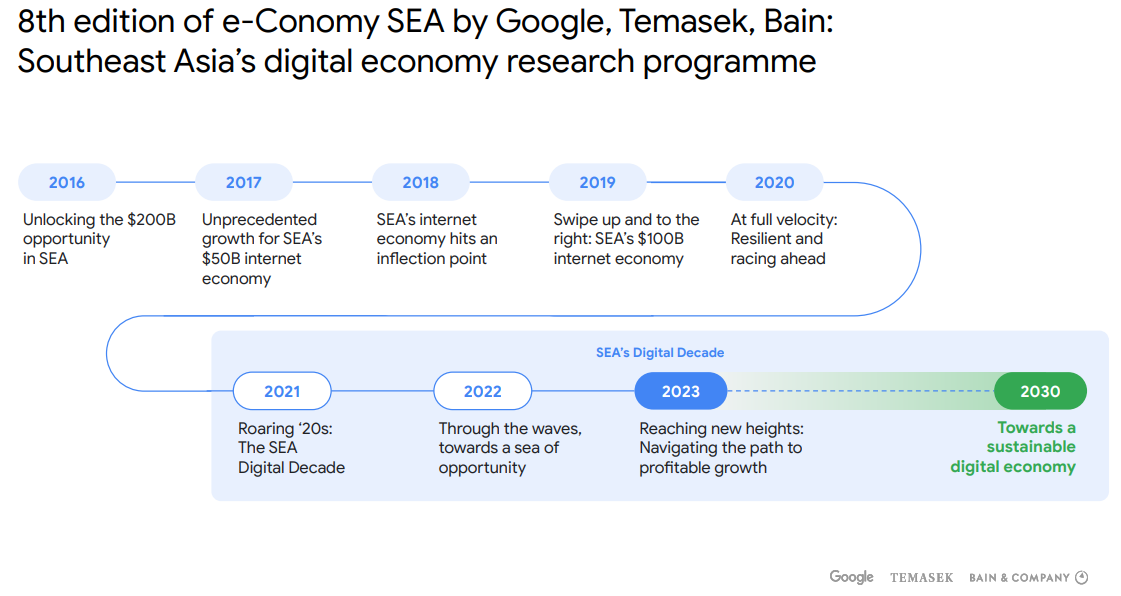

The e-Conomy SEA 2023 report from Google, Temasek, and Bain & Company provides a testament to the region’s remarkable adaptability and robust growth, forecasting an expansion that could see the sector’s revenue reach a monumental milestone of US$100 billion this year.

This growth is no small feat, representing an eightfold increase in revenue for digital businesses over the last eight years, a clear indicator of the vibrant entrepreneurial drive and digital innovation pervading the region.

A Shift Towards Profitable Growth

Despite facing a myriad of global economic challenges, Southeast Asia’s digital economy is poised to outpace them, with projections indicating a transaction value of US$218 billion in 2023. This represents a noteworthy 11% increase from the previous year, as detailed by the eighth edition of the joint report from the industry giants.

The report sheds light on a significant shift in the digital landscape of Southeast Asia. Digital companies, which once chased growth relentlessly, are now pivoting towards profitable sustainability. This strategic realignment is propelling the region’s digital revenue to grow at a rate that is 1.7 times faster than the region’s overall transaction value.

The trend spans across the core sectors of the digital economy, including e-commerce, travel, food and transport, online media, and digital financial services, covering the six major economies of Southeast Asia, while leaving out the smaller populations of Brunei, Cambodia, Laos, Myanmar, and East Timor.

Digital Inclusivity in the Southeast Asia Economy

Sapna Chadha, Vice President at Google Southeast Asia, emphasised in the report the strategic importance of digital inclusivity:

“Keeping the focus on the digital participation gap and resolutely removing barriers to enable more Southeast Asians to become active users of digital products and services will help the region unlock further growth in the digital decade.”

Her statement underscores a commitment to not only broadening access but enhancing the quality of digital participation across one of the fastest-growing regions in the world.

The business landscape is witnessing a paradigm shift with online enterprises moving away from high-cost user acquisition strategies towards deeper engagement with existing customers. This strategic move has been bolstered by significant progress in digital inclusion, with some rural areas witnessing up to a 3x increase in connectivity since 2015.

In this digital era, the spotlight is on high-value users, who account for a staggering 70% of the regional digital economy’s expenditure. These users are dispersed throughout Southeast Asia, and they are the linchpin for achieving sustainable unit economics.

However, this impressive progress does not mask the persisting issue of the digital economic divide, particularly for individuals residing outside metropolitan areas. Investments in digital ecosystems are imperative to bridge this divide, supporting not just immediate growth but also securing the future of the digital economy.

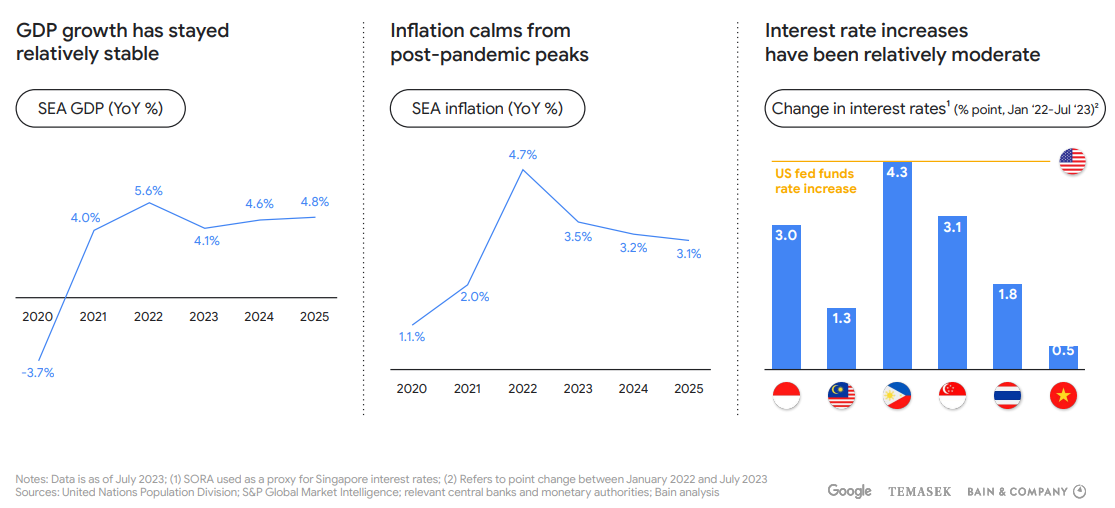

Current economic conditions, such as rising inflation and the increasing cost of capital, have seen private funding hit a six-year low. However, the concept of “dry powder” — capital ready to be invested — has seen an uptick in Southeast Asia. Companies in the digital sector are now required to present clear and viable paths to profitability to attract this capital.

Meanwhile, sectors like health tech, education tech, and automotive are experiencing an uptick in investor interest, indicating a diversification of investment portfolios across the region.

Singapore’s Digital Dominance

Singapore’s digital economy is an exemplar within the region, projected to experience a 12% increase, potentially reaching US$22 billion. The city-state’s recovery in the travel sector and its dominance in e-commerce are primary growth drivers, underpinning its status as a regional hub.

With an enviable urbanisation rate of 100%, high internet penetration, and a strong infrastructure, Singapore leads the charge in digital penetration across multiple sectors. Its digital services market, particularly in media, is bolstered by the population’s readiness to embrace digital solutions.

Looking ahead, while Singapore’s GDP growth might hover in the lower single digits due to its ageing population and developed economy status, the digital economy emerges as a beacon of growth. The country’s gross merchandise value (GMV) in the digital space is set to outpace GDP growth from 2023-2030.

A significant portion of this growth can be attributed to high-value users, who have shown a propensity to increase their online spending across a number of verticals.

The Outlook for Southeast Asia’s Digital Economy

The future of Southeast Asia’s digital economy is brimming with potential. Favourable demographics, growing wealth, and an urbanising populace lay the foundation for sustained economic expansion. The transition towards more balanced competition and profitability is likely to further stabilise the digital market.

For the digital economy in Southeast Asia to reach its zenith, the report suggests a concerted effort towards inclusive digital participation is vital. By nurturing nascent sectors, investing in infrastructure, and enhancing regional collaboration and policies, Southeast Asia is positioning itself to fully leverage the digital revolution.

The digital economy in Southeast Asia is marked by promising demographics, escalating wealth, and urban expansion, laying a fertile ground for future growth. The sector is expected to rationalise competition and focus on sustained profitability. By expanding digital participation, nurturing emerging sectors, investing in infrastructure, and enhancing regional policies, Southeast Asia’s digital economy is well on its way to unlocking its full potential.