Ravi Menon Announces Project Greenprint’s Next Phase with Gprnt Launch

by Fintech News Singapore November 16, 2023Ravi Menon, the Managing Director of the Monetary Authority of Singapore (MAS), unveiled the next phase of Project Greenprint, aimed at revolutionising the financial ecosystem with a new integrated platform named “Gprnt” at the Singapore Fintech Festival 2023.

The Greenprint initiative is set to be propelled by a newly established entity, Greenprint Technologies, and will receive collaborative support from prominent partners, including HSBC, KPMG, MUFG, and Microsoft, in addition to MAS. Meanwhile, Temenos is the first core banking software vendor to collaborate with Gprnt.ai.

The primary objective of this new platform is to consolidate and synergise ongoing pilot projects under Project Greenprint, delivering advanced capabilities to facilitate Singapore’s national-level sustainability reporting and data requirements.

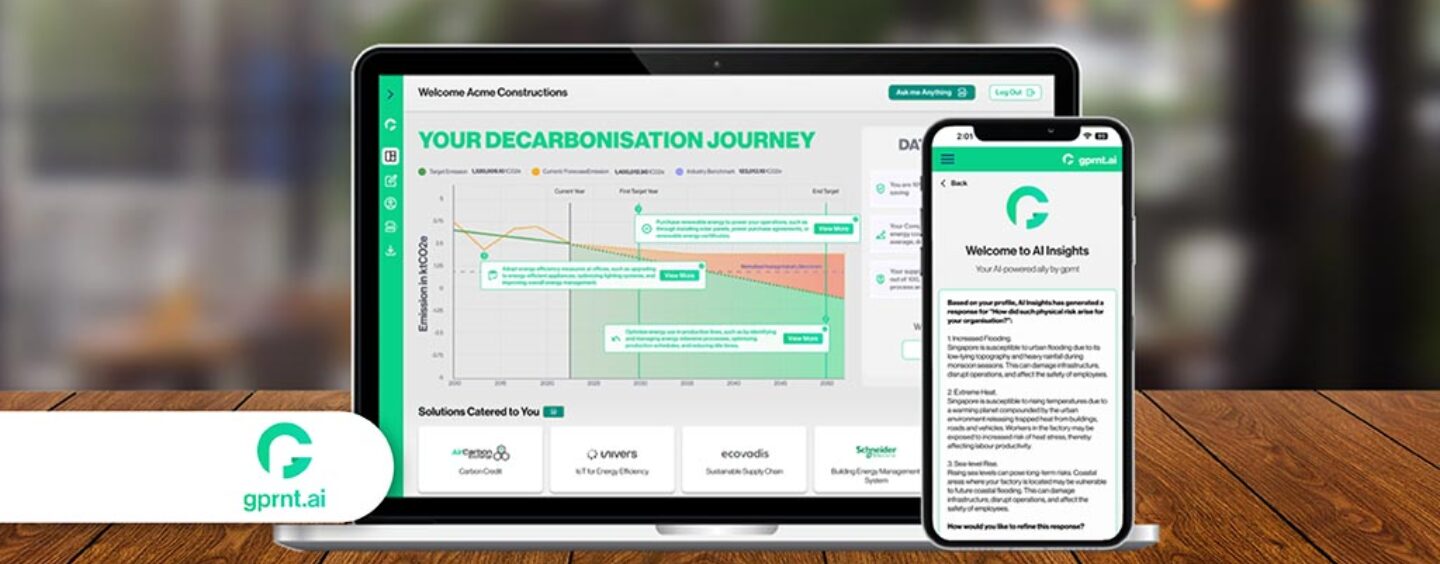

One of the standout features of Gprnt.ai is its simplified ESG reporting tool, designed with a focus on SMEs. This tool is expected to streamline the reporting process, making it more accessible and cost-effective for SMEs.

Reporting entities will have the option to consent to the release of relevant data from their day-to-day digital systems, which may include data from utility meters, business accounting and payroll software, as well as building and waste management systems. Singaporean users will have access to trusted government-maintained data via the MyInfo business platform.

Greenprint will aggregate this data into ESG-related outputs, providing valuable insights to the reporting entities. In cases where source data is unavailable, artificial intelligence tools will allow users to upload documents and extract critical data. Notably, a Microsoft GPT-4 powered chatbot will assist in bridging data gaps and crafting sustainability narratives.

Menon expressed the vision for Greenprint to become a benchmark for how companies report ESG data, setting a new standard in transparency and accountability.

Beyond Singapore’s borders, Greenprint has ambitious plans to collaborate with partners worldwide and gather data from countries and sectors where financial institutions face pressing needs. This effort aims to bolster climate risk management and support the transition to a net-zero future.

The official launch of Greenprint is scheduled for February of the coming year, with plans to progressively expand its capabilities throughout the year.

The initiative’s broader goal is to establish a collaborative system that ensures the availability of high-quality data, laying the foundation for collective efforts toward achieving the 2050 net-zero targets.

Parties interested in learning more about the Gprnt.ai platform and exploring potential partnerships may visit the Greenprint booth in Hall 5.