Payments Innovation in Indonesia to Drive Economic Growth and Financial Inclusion

by Fintech News Singapore January 8, 2024Payments innovation in Indonesia holds significant promise for contributing to the nation’s economy and helping bring about a more inclusive, accessible, and equitable financial system.

This system is also supporting the country’s digital economy and connecting Indonesians across its large geographically dispersed set of islands. But to fully realize the sector’s potential, stakeholders must focus on nurturing a robust ecosystem by enhancing capital access, attracting and retaining top talent and fostering a strong demand for payment solutions, a new report by Emerging Payments Association Asia (EPAA) says.

The report, titled Exploring Payments in Indonesia: An Industry Outlook and released in November 2023, provides an overview of the country’s payment landscape, highlighting the dynamic ecosystem of payment providers, the role of regulators and policymakers, and the outlook for payments in Indonesia.

According to the report, the Indonesia payment industry is experiencing exponential growth, driven by high smartphone penetration, Internet usage and the government’s push for a cashless society. But with about 50% of the population still unbanked, the sector is poised for greater growth.

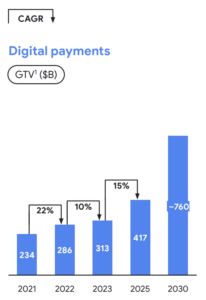

In 2023, the Indonesian digital payment market reached a gross transaction value (GTV) of US$313 billion, making the country the largest digital payment market, well ahead of Malaysia (US$165 billion GTV in 2023), the Philippines (US$93 billion GTV in 2023), Singapore (US$128 billion GTV in 2023), Thailand (US$134 billion GTV in 2023) and Vietnam (US$126 billion GTV in 2023), according to the e-Conomy SEA 2023 report by Google, Temasek and Bain and Company.

The figure represents a 10% increase from US$286 billion GTV in 2022, the data show. This growth is expected to carry on this year onwards, growing at an estimated 15% through 2025 to US$417 billion and to US$760 billion by 2030.

Digital payments annual gross transaction value (GTV) (US$B) in Indonesia, Source: e-Conomy SEA 2023, Google, Temasek and Bain and Company, Nov 2023

JakobRost, CEO of open finance platform Ayoconnect, and Chris Yeo, CEO of digital wallet service Doku, said in their interviews for the report that the introduction of the Quick Response Code Indonesian Standard (QRIS) has been a game-changer for payments innovation in Indonesia, allowing for interoperability between different payment systems and making it easier for consumers to make digital payments.

This infrastructure, which was launched in 2019, has considerably helped boost digital payment usage, with Doku reporting a fourfold increase in e-money transactions on its platform in 2022, compared with 2021.

Between January and October 2023, QRIS transaction volume reached 1.6 billion, exceeding the 1 billion transactions targeted in 2023, Fitria Irmi Triswati, director of Bank Indonesia (BI)’s payment system policy department, said during a government QRIS press event held in December 2023 and quoted by the Jakarta Post. The total number of QRIS users stood at 43.44 million at the end of October 2023, while the number of merchants supporting the payment method reached 29.63 million, BI also reported.

According to the EPAA report, payments innovation in Indonesia moving forward will be supported by favorable demographic and economic trends, including the country’s rising working-age population, growing middle-income class and booming Internet economy.

With over 270 million people, Indonesia is the fourth-most populous country in the world and the most populous one in Southeast Asia. According to Indonesian news agency Antara, the population of people in the productive age group reached 140 million in 2020, representing more than half of the country’s total population. By 2045, Indonesia’s population is expected to reach 318.96 million, with 207.99 million people in the productive age group.

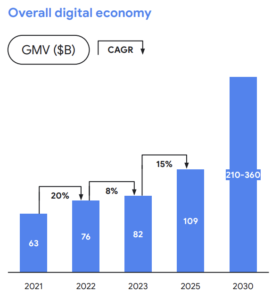

Indonesia also has the largest digital economy in Southeast Asia, a sector that reached a gross merchandise value of US$82 billion in 2023. By 2025, Indonesia’s digital economy is projected to rise to US$109 billion, growing at a compound annual growth rate (CAGR) of 15%. By 2030, that value is forecasted to stand in the US$210-360 billion range, according to the e-Conomy SEA 2023 report.

Indonesia’s overall digital economy, Source: e-Conomy SEA 2023, Google, Temasek and Bain and Company, Nov 2023

But in order to fully unlock payments innovation in Indonesia, the EPAA report warns that stakeholders must cultivate a strong ecosystem characterized by the availability of capital and talent, the establishment of a supportive and forward-looking regulatory framework, and the presence of a robust demand for payment solutions.

Fintech companies require adequate access to capital to grow, invest in research and development (R&D) and expand their reach, making capital access critical for the development of the fintech sector and subsequently digital payments, the report says. Talent is another critical resource for payment innovation and development, and is essential for fintech companies looking to succeed in the competitive payment landscape.

Regulators and policymakers must also establish a conducive regulatory framework that creates a stable and predictable environment for industry players to operate in. Finally, fostering a strong demand for payment solutions requires continuous education and awareness efforts to encourage consumers and businesses to adopt digital payments.

Indonesia’s burgeoning fintech sector

Indonesia’s fintech sector has grown tremendously over the past years. According to the Indonesia Fintech Association (AFTECH), a forum for fintech established in 2016 by the Financial Services Authority (OJK), its membership count grew from a mere 24 fintech members in 2016 to 366 at the end of 2022, with online lending accounting for 30% of all members, followed by digital finance innovation (25.9%) and digital payments (11.8%).

Indonesia Fintech Association (AFTECH) membership analysis, Source: AFTECH Annual Member Survey 2022/2023

Despite the dominance of digital payments and digital lending in the Indonesian fintech sector, a fintech map produced by AFTECH reveals a wide and diverse landscape comprising companies in various verticals including Islamic fintech, insurtech, wealthtech, electronic know-your-customer (e-KYC) and digital banking, reflecting the maturing of the industry beyond these key segments to include increasingly more sophisticated products and services.

The landscape of fintech in Indonesia as represented by AFTECH, Source: Exploring Payments in Indonesia: An Industry Outlook, Emerging Payments Association Asia (EPAA), Nov 2023

According to a joint report by Indonesian early-stage venture capital firm AC Ventures and global consulting firm the Boston Consulting Group, the growth of Indonesia’s fintech sector has been largely fueled by increased adoption of digital financial services. In 2020, the Indonesian payment segment counted over 63 million active e-wallet users, a number that’s expected to grow at a rate of 26% annually between 2020 and 2025.

In the lending space, the number of peer-to-peer borrower accounts reached 30 million in 2021, rising at a CAGR of 50% between 2018 and 2022. Total loan disbursement totaled US$17 billion in 2022, growing at an annual rate of 140% between 2018 and 2022.

In the wealth vertical, the total number of investors in the Indonesian capital market increased 37.5% year-over-year (YoY), reaching 10.3 million investors in December 2022 from 7.48 million investors at the end of December 2021, according to data from Kustodian Sentral Efek Indonesia, a central securities depository in the Indonesian capital market, show.

Fintech software-as-a-service (SaaS) is also experiencing a surge in adoption, the EPAA report notes, with six million small and medium-sized enterprises (SMEs) now using SaaS platforms, marking a stunning 26-fold expansion over the previous three years.

Customer penetration for payments, lending, and wealth in Indonesia, Source: Indonesia’s Fintech Industry is Ready to Rise, AC Ventures/BCG Group, March 2023

Featured image credit: edited from unsplash