In Singapore, micro and small merchants (MSMEs) are responding to the ever-increasing consumer demand for cashless options, and are swiftly embracing QR payment solutions. Looking ahead, the Monetary Authority of Singapore (MAS) has introduced the SGQR+, an innovative concept aimed at revamping Singapore’s QR payments infrastructure for the future.

Building upon SGQR, SGQR+ represents the next generation of interoperable payments for merchants., designed to align with the country’s vision of a seamless, accessible, and interoperable payments ecosystem.

In an ambitious move, the interoperable SGQR+ was showcased through a Proof of Concept (POC) spanning the entire month of November 2023, coinciding with the Singapore Fintech Festival (SFF). This venture marks a significant stride towards creating a QR code payments framework that promises smoother, more secure, and universally accessible transactions.

The POC witnessed major collaborations with five merchant acquirers, a plethora of over twenty payment schemes from both local and international origins, and a widespread network of merchant acceptance points exceeding a thousand, located within the SFF and the Changi district. This phase was instrumental in refining SGQR+ and exploring its scalability for future implementation.

The whitepaper studying this transformative era is supported by data and research from the SGQR+ POC, undertaken by the EY organisation, Banking Computer Services (BCS), and MAS. This initiative, underpinned by thorough research and market understanding, is set to forge a resilient and forward-looking payment infrastructure.

Here are five interesting takeaways gathered from the interoperable SGQR+ trials.

Streamlining Customer and Merchant Experience

Businesses now prominently showcase a single SGQR label instead of displaying multiple QR labels for different payment options, greatly simplifying the process for both themselves and their customers. This standardisation not only makes it easier for customers to recognise and use a payment QR code but also reduces the burden on merchants to protect against fraud associated with multiple labels.

However, the challenge arises when accommodating various payment schemes, as each merchant must be independently set up with their respective settlements and statements for income reconciliations. This situation often leads to complexities and administrative burdens, as merchants find themselves managing diverse relationships and processes with different payment providers.

SGQR+ enters the scene as a promising solution to invigorate interoperable open-loop QR payments in Singapore. Its goal is to unify a broad spectrum of payment providers, thus offering a seamless and convenient payments experience for both customers and merchants.

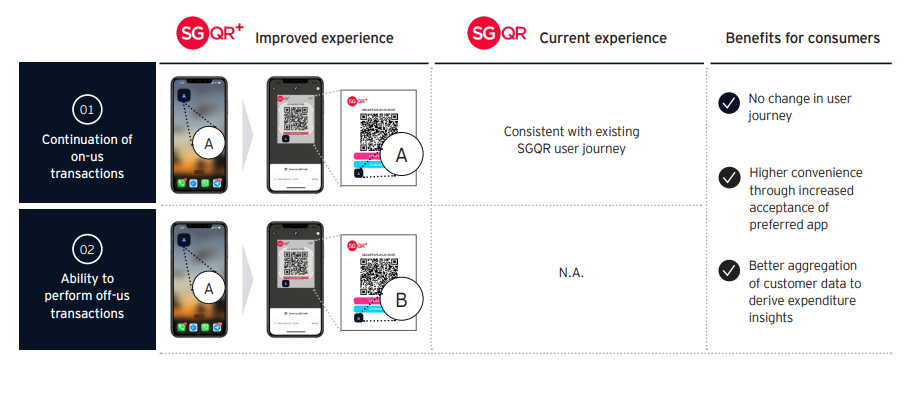

By registering with a single acquirer, merchants can now accept multiple payment schemes, leading to a more streamlined transaction journey. As demonstrated in the POC track II, NETS’ solution capitalises on the Push payment model via SGQR. This allows participating wallets (both local and cross-border) and merchants to have a common standard interface for sending and receiving payment notifications.

The customer experience remains unchanged, allowing users to continue scanning with their preferred app. There is also no alteration required for existing wallet issuers who are already capable of utilising the NETS QR payload.

While SGQR continues to be a reliable and standardised QR code solution, SGQR+ offers merchants an opportunity to significantly widen their consumer base and take advantage of the benefits provided by an interoperable payments scheme.

Simplifying Merchant Relationships and Reconciliations

In 2018, SGQR was established as the universal QR code standard, amalgamating multiple payment schemes into a single SGQR label. This standardisation significantly simplified and streamlined payment processes for both consumers and merchants, effectively doing away with the necessity for multiple QR codes.

Despite this, SGQR in its current form largely acts as a repository for multiple payment schemes. During the SGQR+ POC Track II, NETS stepped in as the master merchant acquirer, providing interoperable QR payments. This initiative allowed merchants to accept a variety of payment methods, offering customers a seamless way to transact both domestically and internationally using their preferred payment app.

Merchants participating in this scheme can now accept payments from a broader array of local wallets and payment apps, as well as from various global and national payment partners. The NETS Merchant Portal facilitates this by offering integrated reports and validation for merchant transactions and settlements, ensuring a streamlined process.

In this scenario, NETS assumes the role of the primary acquirer for merchants, taking full responsibility for the merchant-acquirer relationship. This includes overseeing essential functions such as onboarding, settlement, and reconciliation, thereby significantly simplifying the process for merchants.

SGQR+ to Pave the Way for Cross-Border Connectivity

Globally, the potential of interoperable QR payments has been recognised, with countries implementing strategies to develop well-connected and inclusive payment ecosystems. In Southeast Asia, notable systems include Indonesia’s Quick Response Code Indonesian Standard (QRIS), Malaysia’s DuitNow QR, QR Ph in the Philippines, and Thai QR established by the Bank of Thailand. These systems not only facilitate seamless payments for inbound customers but also increase inbound transactions through cross-border linkages.

These countries have established cross-border linkages amongst themselves, achieving varying degrees of interoperability, with some having well-connected cross-border QR payment systems in place. With its established cross-border connectivity, SGQR+ aims to increase inbound transactions through these linkages, while ensuring a seamless payments experience for inbound customers.

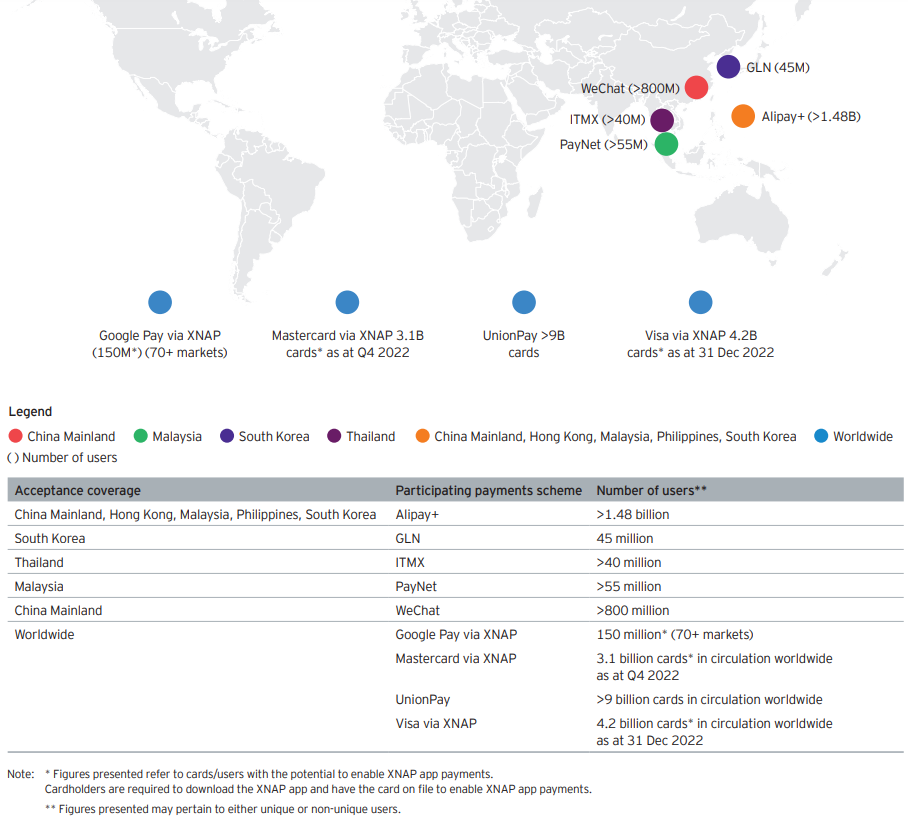

Under the SGQR+ POC, payment schemes from mainland China (AliPay+ and WeChat), South Korea (GLN), Thailand (ITMX), Malaysia (PayNet), as well as global schemes via XNAP card and app store payment options, will be accommodated. A larger range of merchant acquirers, local issuers, and participating international schemes have shown interest, indicating a move towards establishing seamless QR payments across numerous countries.

Bolstering Financial Inclusion to Unlock the Potential of MSMEs

SGQR+ will enable acquirers to gain a more comprehensive view of a merchant’s cash flows, in contrast to closed-loop payment ecosystems like SGQR. This broader perspective facilitates alternative credit scoring methods, potentially increasing lending to previously unserved or underserved segments.

By seamlessly connecting payment providers and merchants, SGQR+ aims to tackle existing merchant challenges and open up new avenues for digital inclusion. Emphasising interoperability, scheme participants are encouraged to develop service offerings focused on both merchants and consumers. This is facilitated by leveraging the enhanced propositions made possible through scheme incentives and favourable unit economics.

For many of Singapore’s neighbouring countries, MSMEs participating in interoperable QR system payment rails will aid in improving financial inclusion for the unbanked and underbanked populations, thereby driving economic development in these regions.

Ensuring a Competitive and Diverse Market

The EY study reveals that different countries have varied motivations for pursuing interoperability in their payment systems, which, in turn, shapes the future state of these systems. While some countries focus on financial inclusion, aiming to extend digital payment services to all segments of the population, others are more focused on enhancing competition and innovation within their payments industry.

SGQR+ is set to provide access to more granular data, previously confined within proprietary closed loops, giving regulators better oversight of the QR payments market. This enhanced oversight allows for timely intervention when necessary to ensure fair competition and diversity among QR payment providers.

As established in the POC, payment providers – whether existing members of SGQR or part of an open-loop scheme – will have the opportunity to join SGQR+. SGQR+ will act as a scheme aggregator, seamlessly connecting all participants and enabling their payment options to be accepted at merchant stores acquired by any scheme member.

This approach democratises access and inclusion for all scheme participants, potentially improving the proposition for merchants due to increased competition among acquirers. In essence, SGQR+ is not just a technological advancement but also a strategic move towards a more inclusive and competitive market landscape, benefiting a wide range of stakeholders in the digital payment ecosystem.

The Road Ahead for SGQR+

The future of SGQR+ looks promising, with the potential to revolutionise merchant experiences and consumer interactions in the payments sector. This interoperable QR payments infrastructure is poised to enhance merchant experiences by streamlining transaction journeys and reducing administrative burdens.

It will also expand the acceptance points for various payment apps and wallets, allowing both domestic and international consumers to transact seamlessly using their preferred payment applications. By fostering seamless cross-border payments, SGQR+ is expected to play a pivotal role in enhancing regional payment connectivity.

In fact, if the SGQR+ initiative successfully navigates its planned trajectory, it will represent a groundbreaking development on a global scale, positioning Singapore at the forefront of digital payment innovation.

Feature image credit: Edited from freepik

Get the hottest Fintech Singapore News once a month in your Inbox