How can Financial Providers Respond to the Needs of a Changing Customer?

by Fintech News Singapore February 28, 2017Financial service providers should rethink how they service their customers, in light of changing consumer behaviours and expectations. To track consumer patterns, Accenture Financial Services Global Distribution & Marketing Consumer Study found that providers who can deliver a compelling new digital service model, as well as retain traditional values around trust and service, will edge out competitors.

The study sampled 33,000 financial services consumers and surveyed their views on banking, insurance and investment advisory across 18 markets globally. The research identified insights on how customers want to interact with financial providers in future, and where digital innovation must play its part.

Consumer trends

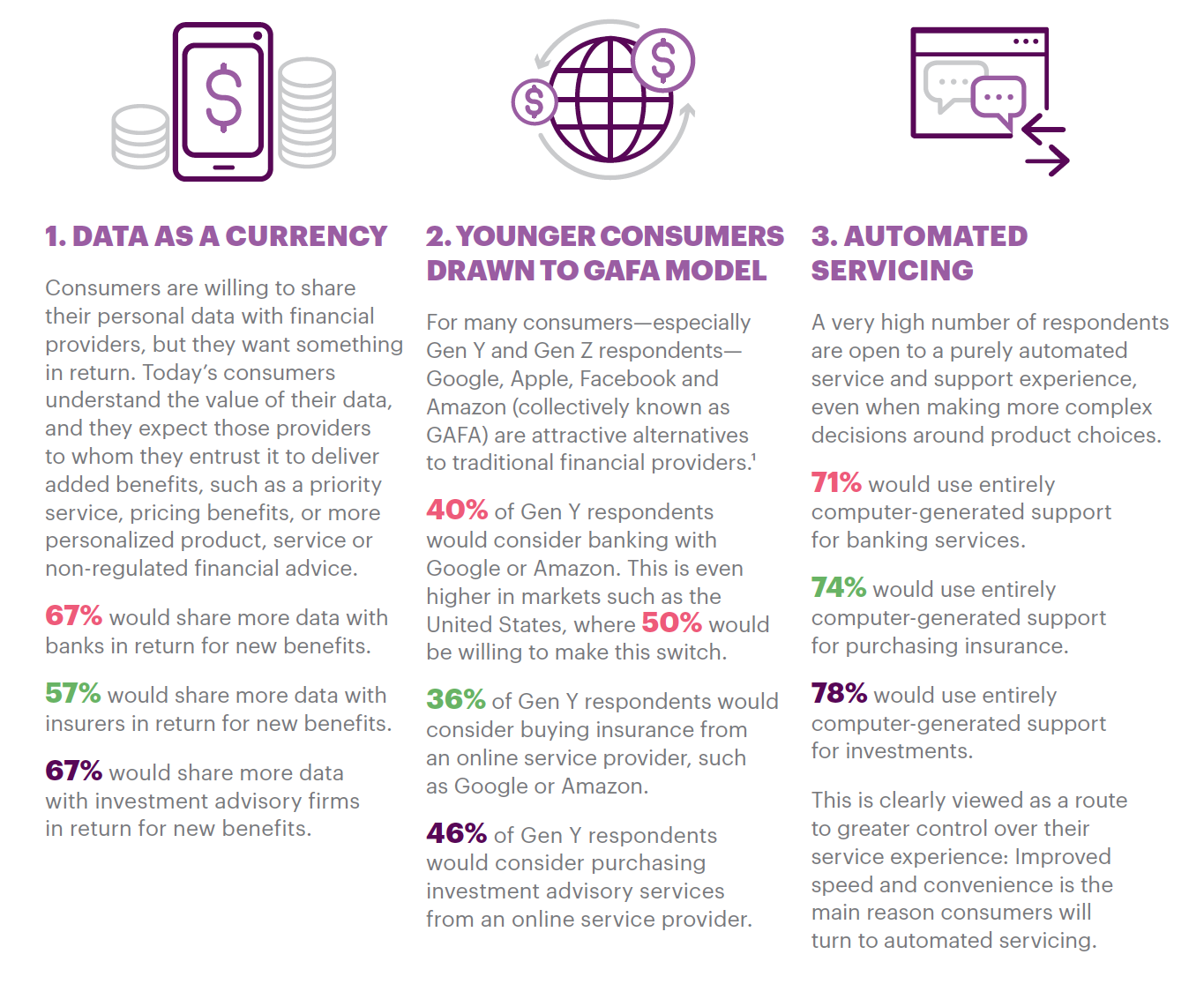

The study found five new trends that consumers want the financial sector to deliver, namely data as a currency, banking with online service providers such as Google, Amazon, Facebook or Apple (GAFA) companies, automated servicing, personalisation and channel agnostics.

Consumers are willing to share their personal data with financial providers but they want something in return, said majority of respondents. 67 percent would share more data with banks for more benefits, with the same figure feeling the same way with investment advisory firms.

And 40 percent of Gen Y and Gen Z respondents would consider banking with Google or Amazon, with the trend more prevalent in the United States, where 50 percent would be willing to make the switch.

Over 70 per cent of respondents would use entirely computer-generated support for banking, insurance and investments. The study sugests that this trend is a route to greater control over the service experience, with improved speed and conveneince the main reason consumers will turn to automated servicing.

More individuals are expecting interactions to be personalised and relevant to their financial needs and objectives. 63 per cent and 64 per cent of respondents say sharing data should deliver product and services advice for both banking and insurance sectors respectively.

Most customers added that they are less likely to care about which channel they use to communicate with their bank, insurer or investment advisor, as long as they can get their needs met quickly and easily. Nearly 60 per cent of respondents replied that they don’t mind which channel they use to communicate with their bank, insurer or investment advisor.

Consumer personas

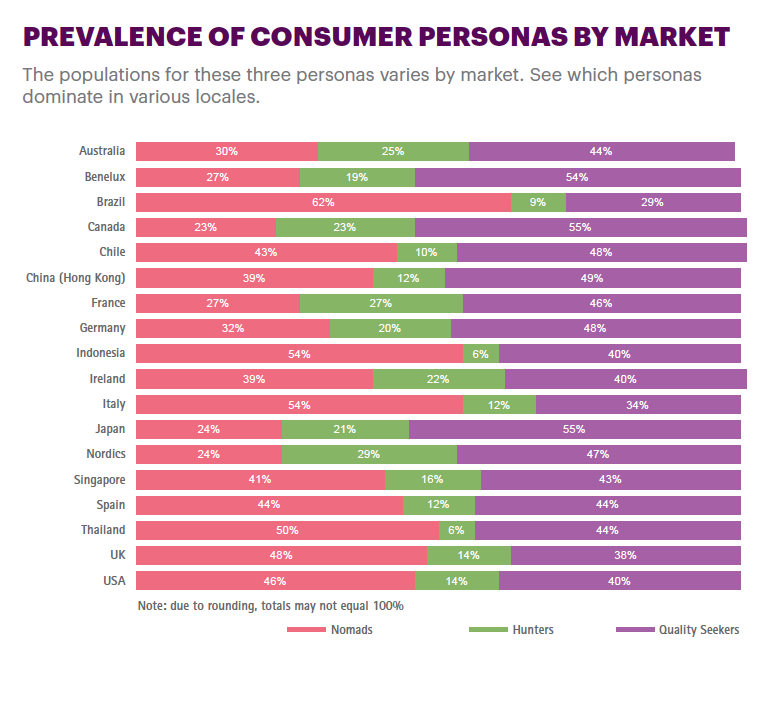

Three distinct consumer personas emerged within the research findings, each with specific characteristics linked to what they value most from their financial providers. The key drivers of loyalty are cost, customer service (defined by high quality and responsiveness), trust when it relates to protecting the customer’s best interest and to protecting data, and the appetite or willingness to consider new digital models.

The varying needs and priorities of these groups provide insight into how financial providers may need to reshape their proposition, both to secure the loyalty of existing customers and to reach out to new consumers, said the report.

These personas are nomads, a highly digitally active group, who are not tied to traditional financial services providers, and who constitute the 78 percent who would use a tech firm such as Google or Amazon for banking; hunters, who are searching for the best deal on price, and who would still prefer human advisors as they don’t feel they can get everything they need without these advisors; and quality seekers, who are looking for high quality, responsive service and data protection.

53 percent of respondents say these qualitities would keep them loyal to banks, while 40 percent and 39 percent said these qualities would keep them loyal too insurers and investment advisory firms respectively.

Financial service providers need to step up

The shifts in consumer behaviour that the study identifies send some stark messages to the financial services sector – that customers are in control, and financial service providers need to seek out new opportunities from customers’ personal data. They also need reconsider their platform approach.

Accenture warns that in a world where the customer is in control, providers need to show every day that they are committed to customers and passionate about delivering great service. However, they need to do this cost effectively, considering pressures on margins and shareholders’ desire for optimal returns.

This will entail developing new propositions, transforming the distribution network and creating models for sustainable growth.

With customers willing to share their personal data, they are expecting benefits in return. Using the latest techniques in information gathering, such as data analytics, financial services providers can reinforce relationships with customers.

For instance, insurers could send relevant information to help with house-hunting, which could open the door to selling mortgage or insurance products further down the line. Also they could offer other products such as Reverse Mortgage.

You might be asking yourself how does a reverse mortgage loan works? It works however you want it to. You can borrow a single large amount against your home’s equity, or you can request money to be paid to you each month to supplement your fixed retirement income. When you request your reverse mortgage you can select the payments you want based on your current needs at the time. The other advantage of a reverse loan like that is that there are no strict monthly repayment terms. The only repayment stipulation is that whatever balance there is must be paid back in the event of your death or if you choose to or are obligated to change residences at any point.

Similarly, auto insurers can position themselves as more than mere coverers of risk by sending notifications to car drivers about accident-prone areas.

Customers are spending increasing amounts of time on digital platforms such as those offered by GAFA (Google, Amazon, Facebook, Apple) companies. To remain relevant to customers, financial services providers need to reach them on these platforms with tailored products at the right time.

For example, providers may seek to integrate their services onto third-party platforms, embedding tailored products at “point of sale” during other shopping experiences. This means developing the ability to customize products—such as tailoring loan terms or insurance premiums— in response to consumers’ immediate financial needs.

Featured picture by PublicDomainPictures via Pixabay.com