Fintech Thailand is poised for significant growth and development in areas including digital banking, open finance, and startup support.

Digital banking is on the horizon, with the first digital banking licenses slated to be issued by mid-2025 and expected to bring about enhanced customer experiences, heightened competition and increased innovation.

With cashless payment becoming ubiquitous, the Bank of Thailand (BOT) is now paving the way for open finance, aiming to enhance consumer access to financial services.

Additionally, a new strategy announced by the National Innovation Agency (NIA) will be supporting local innovative startups, and help businesses integrate digital tools. At the time, freshly announced venture capital (VC) funds will revitalize startup growth in Thailand this year.

Next week, the Money 20/20 Asia event will make its debut in Bangkok, Thailand. The event is poised to provide a comprehensive platform for professionals across the Asia-Pacific (APAC) region to explore the latest advancements in fintech across a wide range of sectors, including payments, banking, regtech, insurtech, lending, and more.

Over 3,000 senior decision-makers and 200+ speakers, sponsors, and exhibitors, and address key industry themes such as financial inclusion, sustainability, cybersecurity, and regulatory frameworks at the event.

The advent of digital banking in Thailand

Thailand issued in March 2024 a notification from the Ministry of Finance that provides guidance on the process for applying for a digital banking license, as well as the relevant criteria, requirements and conditions. It has since attracted many big names to throw their hats into the ring/

Three licenses will be initially granted to ensure healthy competition, all the while guaranteeing financial stability and causing harm to depositors and the wider public. The BOT expects the advent of digital banking to heighten customer experiences, enhance financial services accessibility, and lower fees for consumers.

The central bank said that in its assessment, it will be taking into account the applicants’ qualifications, potential and capabilities to operate a virtual bank in accordance with their proposed business plans.

These criteria will include:

- experience, resources and capability in operating digital bank business, offering financial services with new value propositions to better serve the needs of each customer segment;

- governance and capability of the applicants and persons in key positions of the digital bank;

- expertise, experience and capability in operating a digital-driven business that offers services through digital channels;

- capability to use and manage IT system in an agile, secure, resilient and high-availability manner, so as to

- accommodate the development of financial services in response to changing situations or customers’ needs;

- experience and capability to acquire, manage, and utilize diverse types of data, as well as capability to develop data portability mechanisms to facilitate customers’ use of their own personal data in transacting with other financial service providers in accordance with their legal rights;

- capability to manage risks from financial business; and

- capability of major shareholders to provide financial support to ensure the continuity of the virtual bank’s business operations.

The capital requirement has been set at THB 5 billion (US$140 million) at the application process. Once the license is secured, the capital requirement increases to THB 10 billion (US$280 million), which can be reached in phases over a five-year period.

Interested applicants will be able to submit their application to the BOT from March 20, 2024 to September 19, 2024. The successful applicants are expected to be announced by the first half of 2025. The BOT hopes for these players to start operating by June 2026.

Cashless payments reach ubiquity

A 2023 report by Wing Vasiksiri and Ravenry highlights the rise of digital payments and the explosive growth of real-time transactions. These trends have set the foundation for fintech in Thailand to grow.

According to the report, cashless payments are now widespread in the country, reaching an adoption rate of 94% in 2021. Drivers of this trend include increased acceptance of digital payments, growing demand for convenient payment methods, and the establishment of the PromptPay real-time payment transfer system.

Launched in 2017, PromptPay is an interbank payment system that allows users to make and receive payments directly into their bank accounts or digital wallets linked to their national identification numbers, mobile phone numbers or email addresses.

The service, which has been adopted by all major payment players in the country, had some 67 million users in March 2023, according to the Nation. In 2021, it recorded 9.7 billion real-time transactions, making Thailand the fourth leading country in the world in instant payments, data from payment system company ACI Worldwide show. That year, real-time payments represented 24.7% of all payment volume, ranking second after paper-based payments.

PromptPay has pioneered and opened doors for digital wallet usage in the country, fueling the growth of digital payment platforms like ShopeePay, GrabPay, and TrueMoney. Today, the segment represents the most crowded vertical in the fintech Thailand scene.

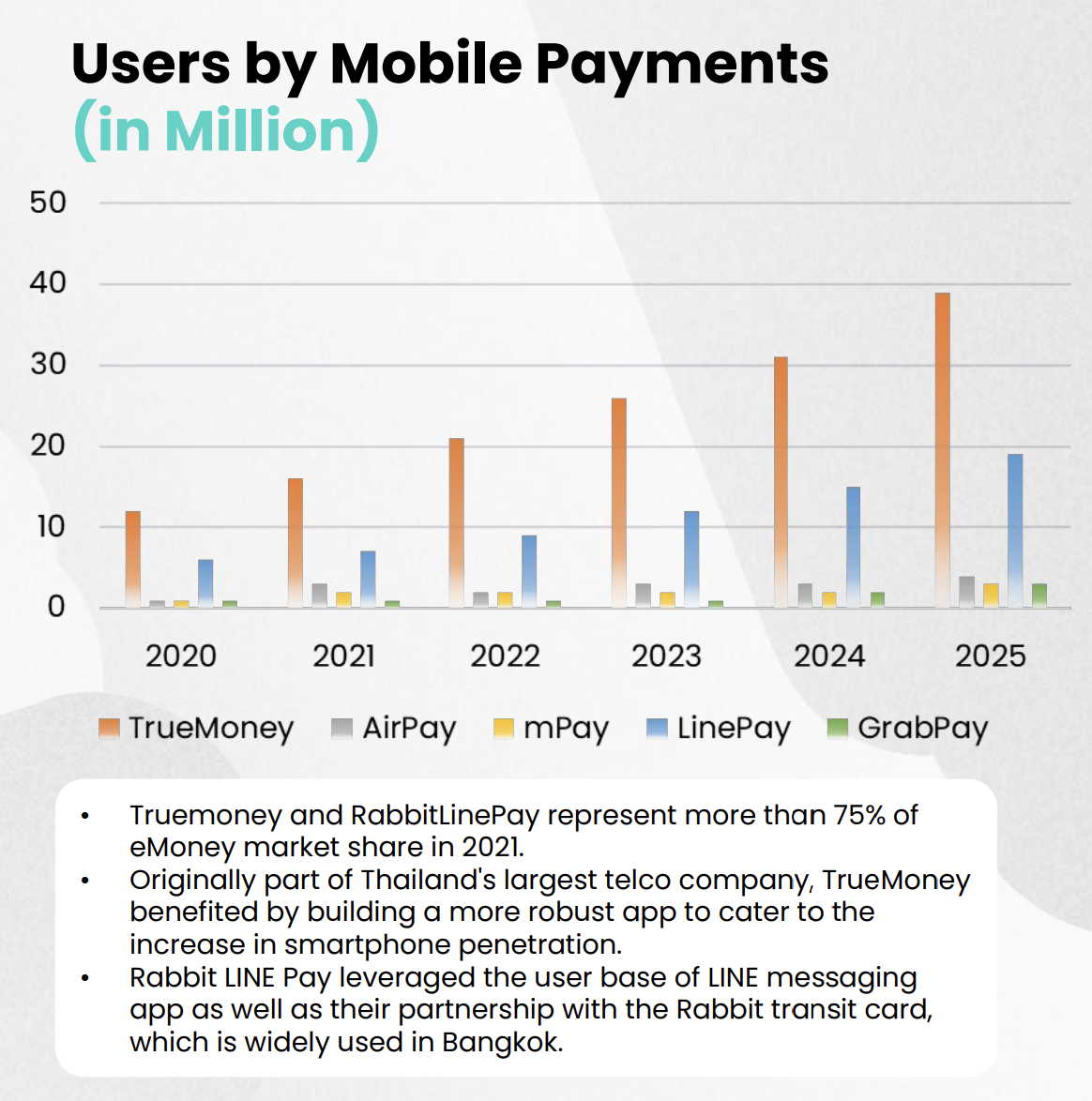

Data from the Wing Vasiksiri and Ravenry report show Ascend Money’s TrueMoney is currently leading the market, boasting more than 26 million users in 2022. By the end of this year, that number is projected to surge past 30 million.

Users of mobile payments per platform, Source- Revolutionizing Transactions: Exploring the Thai Fintech Landscape and the Evolution of its Payments Sector, Wing Vasiksiri and Ravenry, Sep 2023 (Fintech Thailand)

Setting the stage for open finance

The BOT is preparing to implement an open data policy, aiming to provide consumers with access to superior and more convenient financial services.

Wipawin Promboon, BOT’s senior director for the financial institutions strategy department told the Bangkok Post earlier this month that the central bank is scheduled to issue guidelines for open data service in April 2024 , then set up an open banking data committee in the first half of the year.

These developments will build on an earlier public hearing on a consultation paper titled “Open Data for Consumer Empowerment” to which consumers, the private sector and the public sector all agreed upon and supported, she said.

The BOT expects initial use cases under the new policy to be implemented in 2025. In the initial stage, the open data service will be offered in the financial sector, starting with deposit account data and moving on to lending services, Wipawin told the Bangkok Post in November 2023.

The central bank plans to collaborate with other authorities and the private sector to expand the scope of data exchanges, including payments of insurance premiums and utility bills to non-bank financial institutions to strengthen the open data ecosystem, she said.

For the next phase, the central bank wants to allow other business sectors to offer open data service, including so-called data consolidators.

Wipawin said the open data policy is part of the central bank’s new financial strategy that aims to drive responsible innovation through three main principles: the establishment of an open financial infrastructure to provide consumers with a wider range of products and services, the enablement data portability, and an increase in competition in the financial sector to boost innovation.

New innovation strategy to support local startups

Thailand’s National Innovation Agency (NIA) unveiled in February 2024 a new strategy designed to support local startups, facilitate their development and enable them to keep pace with innovation demand in global markets, the Bangkok Post reported on February 26.

Called “Create the Dot — Connect the Dot — Value Creation”, the new strategy aims to promote the transformation of entrepreneurs into innovation-based enterprises (IBEs) and ensure they have access to the knowledge sources, capital and infrastructure necessary to create innovations, NIA executive director Krithpaka Boonfueng told the publication.

The agency’s goals are to increase the number of IBEs and turn Thailand into a top 30 leading innovation nation by 2030. The approach aims to improve three areas in particular: opportunities to access funding sources, the number of innovators and IBEs offering jobs, and IBEs’ capability to create innovative local brands and could play a vital role in the growth of fintech in Thailand

There are 2,100 startups in Thailand, of which 700 are in the pre-seed funding stage and 1,400 are in the go-to market and growth stage, according to NIA. These ventures faced challenges in 2023, amid global uncertainties and a stagnant economy. But in 2024, VC activity is expected to rebound across the region, with Thailand holding high investment potential, said the NIA. The Thai Venture Capital Association estimates that roughly THB 20-30 billion (US$562-842 million) will be injected into Thai startups this year.

New investment funds to accelerate fintech Thailand growth

Several investment funds are poised to revitalize startup growth in Thailand this year, following a slowdown in VC investment in 2022 and 2023.

These new funds include the Finno Efra Fund, worth THB 1.3 billion (US$36.5 million), and an investment vehicle set up by True Incube, the Bangkok Post reported in February 2024.

The Finno Efra Fund is slated to start operating some time this month in a partnership with EfraStructure and Krungsri Finnovate. EfraStructure was founded by tech pioneer and angel investor Pawoot Pongvitayapanu to invest in startups, while Krungsri Finnovate is the investment arm of Krungsri.

Pawoot has invested in 48 startups, but this year, he plans to switch his role from angel investor to invest via EfraStructure and aims to increase the number of startups in the pre-series and series A funding rounds.

“Finno Efra will groom ten startup teams for four months, with funds of US$200,000 to US$2 million per startup,” Pawoot said. The new fund will focus on impactful businesses and digital transformation in fintech, edutech, healthtech, agritech and mobility tech, he stated.

Meanwhile, True Incube is a startup incubator under True Corporation.

Earlier Suphachai Chearavanont, chairman of True Corporation, told the Bangkok Post that the firm might use True Incube as a mechanism to establish a VC fund worth US$200-300 million. The company will also seek more strategic partnerships to increase the fund size to US$500 million.

Areas of investment will cover the digital economy, quantum computing, robotics, artificial intelligence (AI), electric vehicles and battery storage, green and alternative energy, nuclear microreactors, ageing and health tech.

True Incube has invested US$100 million in the past seven to eight years.

The Fintech News Thailand team has handpicked 10 must-attend sessions at the upcoming Money 20/20 Asia event. Visitors who wish to purchase their tickets may use the discount code ‘FNN300‘ to enjoy USD300 off their Money 20/20 entrance tickets.

Featured image credit: Edited from freepik