Posts From Slava Solodkiy

Chinese POS Lending Startup Plans Fintech IPO

Fenqile is planning a U.S. initial public offering that could raise about $600 million. The Shenzhen-based startup, founded by former Tencent executive Xiao Wenjie, could list as soon as this year. Fenqile, which means “Happy Installment Payments” in Chinese, targets

Read MoreThe “Hen and Egg” Issue With all Online-Lending Startups in Asia

Online-lending service for students SoFi (Social Finance Inc.) is close to raising about $500 million in a funding round expected to be led by private equity firm SilverLake Partners to bolster the expansion of its online-lending businesses and personal financial

Read MoreTwo Online-Pawnshops: For Rich and for Poor

Pawnshops that moved online has also shown interesting business strategies. And it can be observed with two extremely different types of audiences. British Borro, who attracted £5,6M provides online secured loans through a customer’s luxury assets, targeting the top 10%

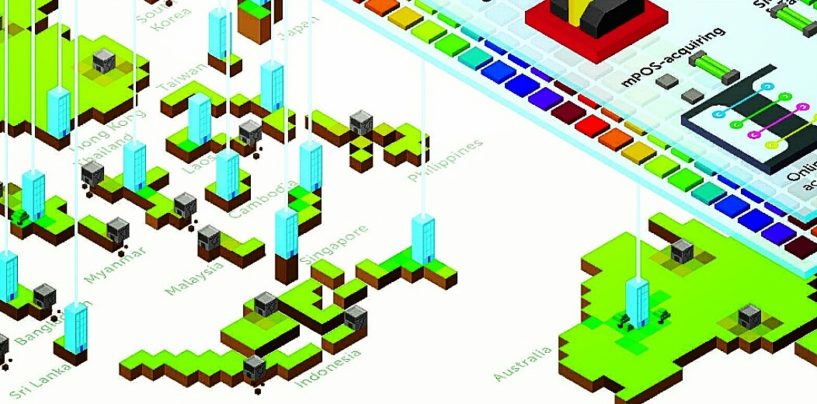

Read MoreWhat Asia Can Learn From Africa To Succeed in Fintech For Unbanked?

Facebook is currently considering acquiring mobile money giant M-Pesa in Kenya. One month ago Visa payments network introduced a mobile-phone application to enable cashless transactions in Kenya too. The mVisa app will initially facilitate transactions for people with accounts at

Read More