Big Data

Data Science at the Heart of the Fintech Revolution

Data science, which involves developing methods of recording, storing and analyzing data to extract useful information and gain insights, has created a drastic change in the financial services industry. Considered as the core of fintech, data science and its allies

Read MoreUnlocking the Value in Payments Data With Technology and Partnerships

Over the years, banks have been creating exponentially growing mountains of data – much of it with huge potential value. However, despite their ability to create it, banks have not always been good at making the best use of it.

Read MoreCloud Computing, a Major Tech Trend in Finance This Year, Also in Singapore

Many financial institutions are already using cloud-based software-as-a-service (SaaS) applications for business processes, but 2020 is set to be the year that adoption accelerates, experts and industry participants say. Cloud computing: one of the biggest trends of 2020 Cloud computing

Read MoreOne Degree of Trust with My Data

Consumers may be willing to part with data and personal information but, like an increasing array of regulators, they are far more sensitive about how their details are used and by whom. As a result, companies need a coherent plan

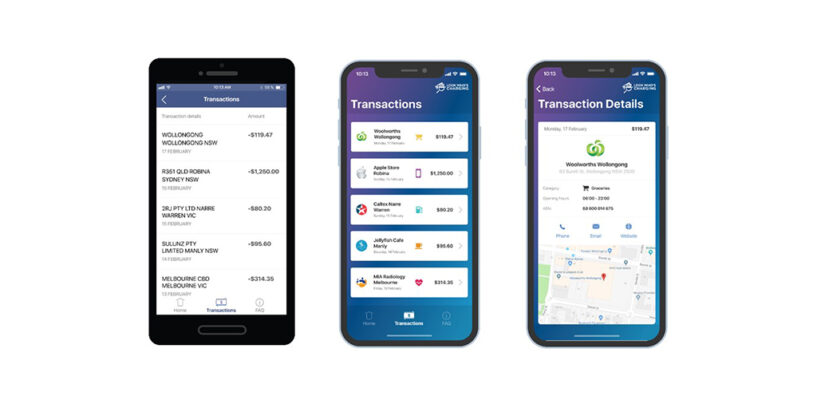

Read MoreExperian Invests in Yet Another Data Startup in Asia Pacific, Look Who’s Charging

Experian today announced its acquisition of Look Who’s Charging, the Australian fintech startup which has solved the everyday frustrating problem of unrecognised bank transactions by providing instant clarification on the merchant behind a transaction. Look Who’s Charging is integrated with

Read MoreRefinitiv Brings its Financial Data to the Cloud for Customers in Asia with AWS

Refinitiv has launched delivery of its financial data to Asia-based clients leveraging Amazon Web Services (AWS) as it continues to expand its global cloud capabilities to meet customers’ needs. Refinitiv’s Elektron real-time data is now available in the AWS Asia

Read MorePaying Attention To The Right Signals

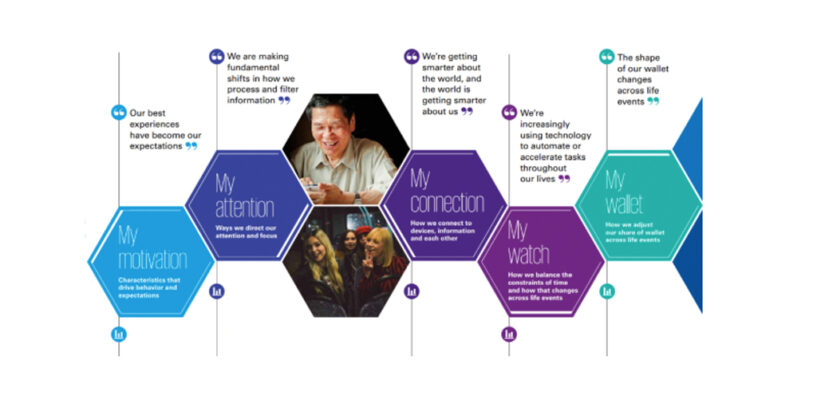

Around the world, from sector to sector, companies are locked in a battle for growth. Facing intensifying competition, many are struggling to understand the wide variety of trade-offs customers are willing to make and the forces impacting their decisions. And

Read MoreSingapore’s CredoLab to Power Digital Financial Inclusion in Sub-Saharan Africa

CredoLab, a developer of bank-grade digital scorecards based on smartphone metadata, announced its expansion into the Sub-Saharan African fintech market with the addition of three new clients – two banks and a leading airtime credit provider. According to its press

Read MoreHow Well Do You Understand Today’s Customer?

Power has shifted from companies to customers. Mobile phones have become central to our lives. Trust in institutions and traditional advertising has diminished. New entrants with radically different businesses are capturing our attention, and are reshaping the customer value chain. These

Read More5 Ways Banks in Singapore are Using Big Data

Pop quiz: What is big data? Actually, don’t answer that. Everyone can easily recite the same quote: “It’s the process of analysing huge amounts of data to draw actionable insights that are beneficial to your business.” In practice, this

Read More