Green Fintech

How Temenos Champions ESG in Banking Transformation

The financial sector is experiencing a transformative era where Environmental, Social, and Governance (ESG) principles are emerging as fundamental components of business strategy. This shift reflects a broader societal movement towards sustainability and ethical governance, fundamentally altering the landscape of

Read MoreGreen Fintech Picks up Steam in ASEAN Amid Growing Investor Interest, Business Adoption

In Southeast Asia and the broader Asia-Pacific (APAC) region, green fintech is picking up steam and growing on the back of increasing climate-related regulations, growing adoption of sustainable practices among Asian businesses, and rising investors’ interest, a new report by

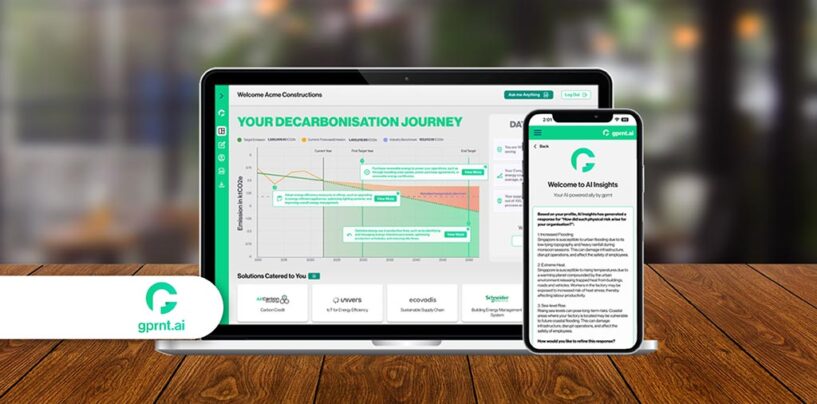

Read MoreRavi Menon Announces Project Greenprint’s Next Phase with Gprnt Launch

Ravi Menon, the Managing Director of the Monetary Authority of Singapore (MAS), unveiled the next phase of Project Greenprint, aimed at revolutionising the financial ecosystem with a new integrated platform named “Gprnt” at the Singapore Fintech Festival 2023. The Greenprint

Read MoreTemenos Joins Forces with MAS to Advance Sustainable Finance Through Gprnt

Temenos shared that it is the first core banking software vendor to collaborate with Gprnt, the newly launched integrated digital platform by the Monetary Authority of Singapore (MAS), aimed at advancing tech solutions and product development while exploring data integration within

Read MoreMAS Unveils AI-Powered Tool ‘MVP’ for Sustainability-Linked Loans

The Monetary Authority of Singapore (MAS) announced the launch of the Minimum Viable Product (MVP) to assist banks in issuing Sustainability-Linked Loans (SLLs) in the real estate sector. The tool will help banks to address key challenges such as inaccurate

Read MoreSTACS Responds to Regulatory Challenges by Upgrading ESGpedia Platform

STACS, an ESG data and technology solutions company, has announced upgrades to its ESGpedia platform. The upgrades offer digital tools to help businesses comply with the increasing ESG regulatory requirements across Europe and Asia. Starting in 2024, the European Sustainability

Read MoreUOB on Track to Achieve Net Zero by 2050

UOB today released its first net zero progress report, showing that the bank is on track to meet its 2050 net zero target. The report shows that the bank has reduced emissions intensities across all five of its focus sectors:

Read MoreMAS Seeks Input from Financial Institutions on Net Zero Transition Planning

The Monetary Authority of Singapore (MAS) has proposed guidelines for banks, insurers, and asset managers to transition to a net zero economy. The guidelines are expected to help financial institutions manage climate-related risks and support their customers and investee companies

Read MoreFunding Societies and STACS Bridge ESG Data Gap for Indonesian MSMEs

Southeast Asian SME digital finance platform Funding Societies, known as Modalku in Indonesia, has teamed up with ESG fintech firm STACS. Indonesian MSMEs will be introduced to STACS’ ESGpedia platform through Funding Societies for ESG reporting and sustainable financing solutions.

Read MoreDBS and SkillsFuture Singapore to Help SMEs Build Sustainability Skills

DBS Bank and SkillsFuture Singapore (SSG) have announced a new two-year partnership to help small and medium enterprises (SMEs) develop sustainability skills. The partnership will see DBS enhance its SME Skills Booster Programme to support SMEs on these skills. The

Read More