Tag "OCBC"

Financial Sector Dominates LinkedIn’s ‘Best Workplaces’ in Singapore

LinkedIn has released its Top Companies list for 2024, identifying the 15 best workplaces for career growth in Singapore. Financial institutions dominate this year’s rankings, emphasizing the sector’s focus on employee experience and adaptability in integrating artificial intelligence. The analysis,

Read MoreOCBC Reports Sixfold Increase in Eco-Care Car Loans Amid Rising EV Popularity

OCBC has reported a major increase in its Eco-Care Car Loans, with numbers surging over sixfold in 2023 compared to their launch year in 2021. This rise coincides with a growing environmental consciousness among Singaporeans and a governmental push towards

Read MoreMoney Lock Safeguarded S$6.6B Across Over 78,000 Singapore Accounts

Since the launch of the Money Lock feature by three local banks – OCBC, DBS, and UOB – in November, over 78,000 accounts have been established with more than S$6.6 billion of savings securely set aside as of March 2024.

Read MoreCOSMIC Platform Goes Live in Singapore to Combat Financial Crime

The Monetary Authority of Singapore (MAS) has officially rolled out the COSMIC platform, a digital initiative aimed at bolstering the defense against money laundering, terrorism financing, and the proliferation of weapons of mass destruction. The system, which became operational today

Read MoreOCBC Supports Women-Led Startups with Up to S$100,000 Financing

OCBC Bank has unveiled a SME programme set to launch in April 2024, aimed specifically at supporting women entrepreneurs in Singapore. The OCBC Women Entrepreneurs Programme offers a targeted approach to financing, enabling female-owned SMEs to expedite their business goals.

Read MoreElaine Heng to Lead OCBC’s Newly Formed Strategy and Sustainability Division

OCBC Bank has established a new division named Group Strategy, Innovation, and Sustainability. The division aims to anchor the bank’s strategic direction, fostering innovation and sustainability efforts. The new division, set to commence on 22 April 2024, will play a

Read MoreThree Singapore Banks Step Up to Combat Rising Cost of Living for Junior Staff

Three of Singapore’s leading banks have announced substantial financial aid packages in a move to support junior employees during times of economic inflation. This initiative, kick-started by DBS, followed by OCBC, and then UOB, is in response to the latest

Read MoreOCBC to Offer S$9M Financial Aid to Junior Staff Worldwide Amid Rising Living Costs

OCBC Bank plans to distribute a one-time financial aid package totaling nearly S$9 million to its junior employees worldwide, aimed at alleviating the impact of escalating living costs. The disbursements are scheduled between February and March 2024. This initiative is

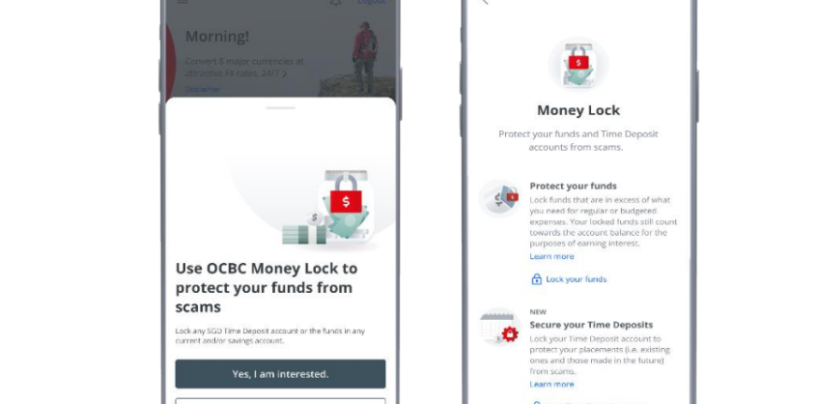

Read MoreOCBC Enhances Digital Security, Extends OCBC Money Lock to Time Deposits

From January 31, OCBC Singapore is set to expand its OCBC Money Lock ‘kill switch’ service to time deposits. This follows its successful implementation for current and savings accounts in November 2023. The enhancement is a response to growing concerns

Read More5 Use Cases Of Generative AI (Gen AI) in Banking, Insurance Within Asia

The emergence of generative artificial intelligence (Gen AI) represents a pivotal moment in the technological evolution, significantly altering the digital financial services landscape in the Asia Pacific region where we are seeing a rise of use cases for generative AI

Read More