The first Fintech Vietnam Startup Report with on overview of 28 Vietnamese Fintech Startups. Moreover this reports shows interesting information about the Vietnamese age populaton and shows exciting facts about internet, online banking and credit card usage. And there is one big market for Vietnam, the 14bio USD Remittance market.

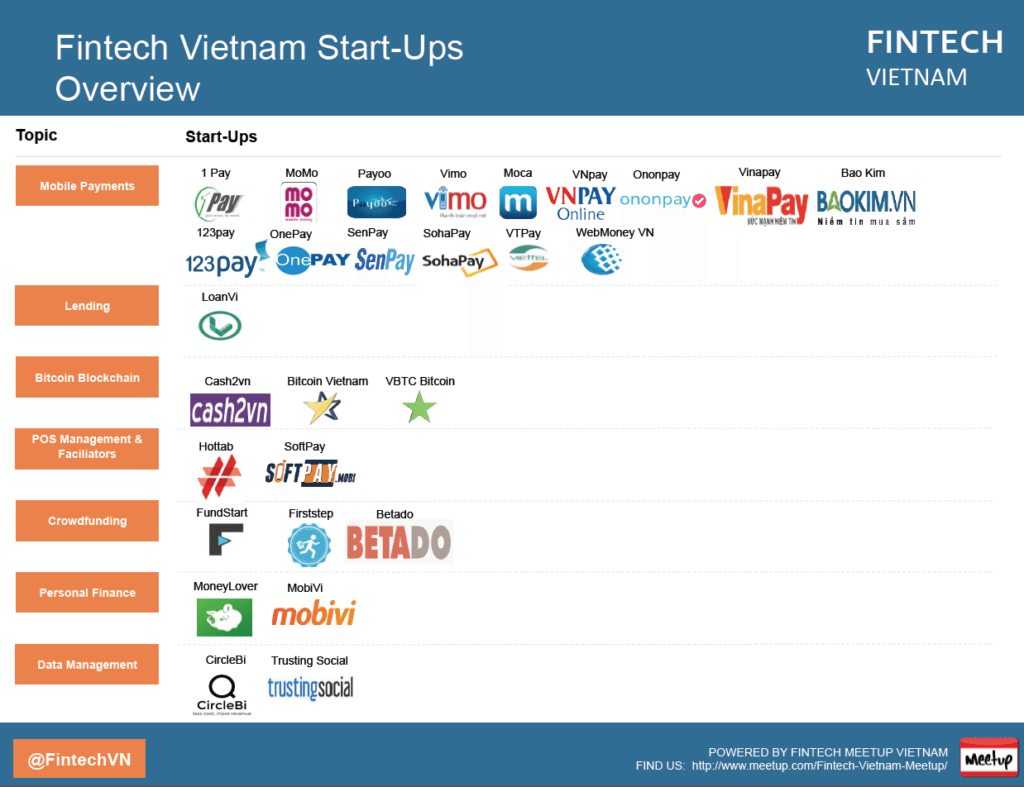

Fintech Vietnam Startups Overview

The current Fintech Startup System is dominated by Payment Solutions and there are no investment and insurance Fintech Startups. In total we counted 28 Fintech Startups. There are many more Fintechs in Vietnam, but they are not founded in Vietnam. For example Fastacash Vietnam which is expanding from Singapore to Vietnam.

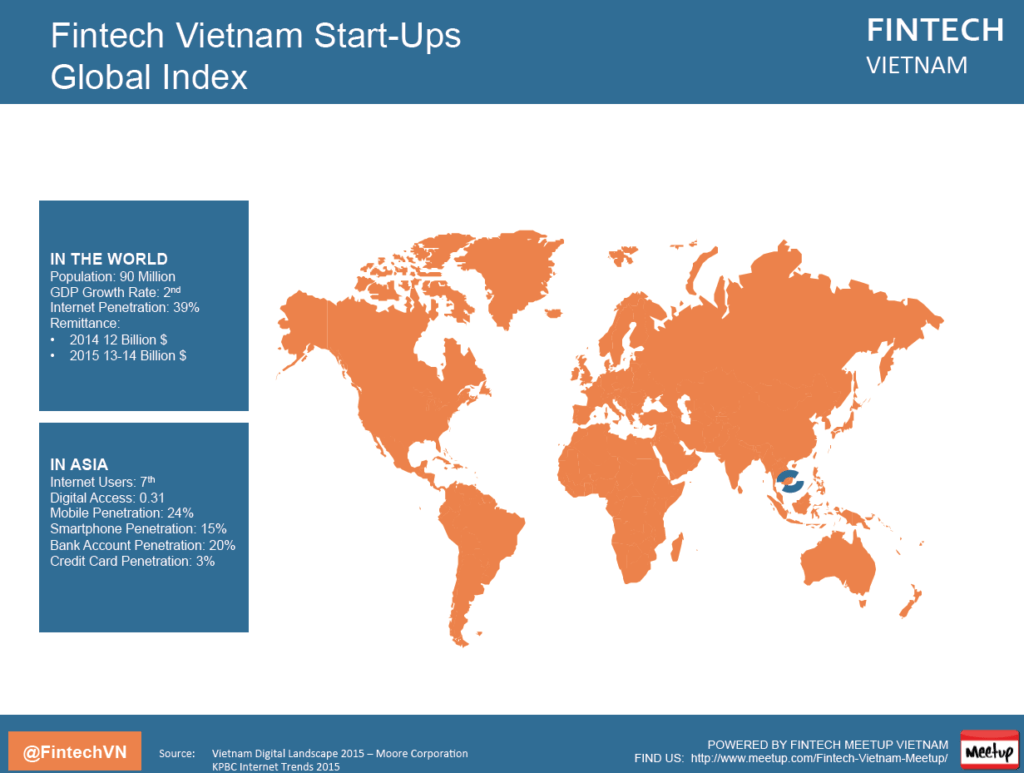

Remittance Market / Credit Card Penetration Vietnam

Especially the Remittance market (around 14bio USD every year!) and the young tech-savvy population can boost Fintech in Vietnam. However, Credit Card use is still only around 3 to 4 percent. USA to Vietnam is one of the top 3 remittance bridges in south east asia. This give opportunities for Fintech Startups to disrupt traditional money transfer players such as Moneygram. If they will be able to cut the money transfer fees to Vietnam, Vietnam’s GDP growth could growth even more.

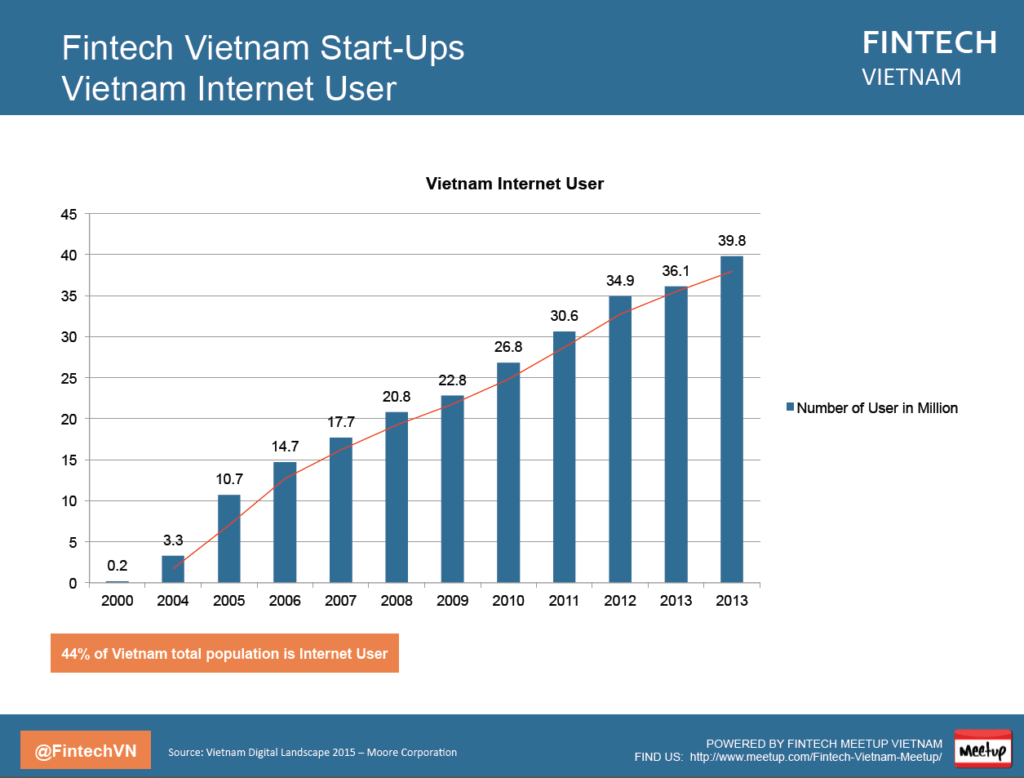

Internet Users in Vietnam

around 40 Mio Vietnamese have now access to internet which is about 44% of the population. If you walk around the streets in Hanoi or Saigon you will see also many people using smartphones. Apple recently even announced that Vietnam is one of the fastest growing markets market for iPhone sales. 52% of the mobile users are already using Smartphones.

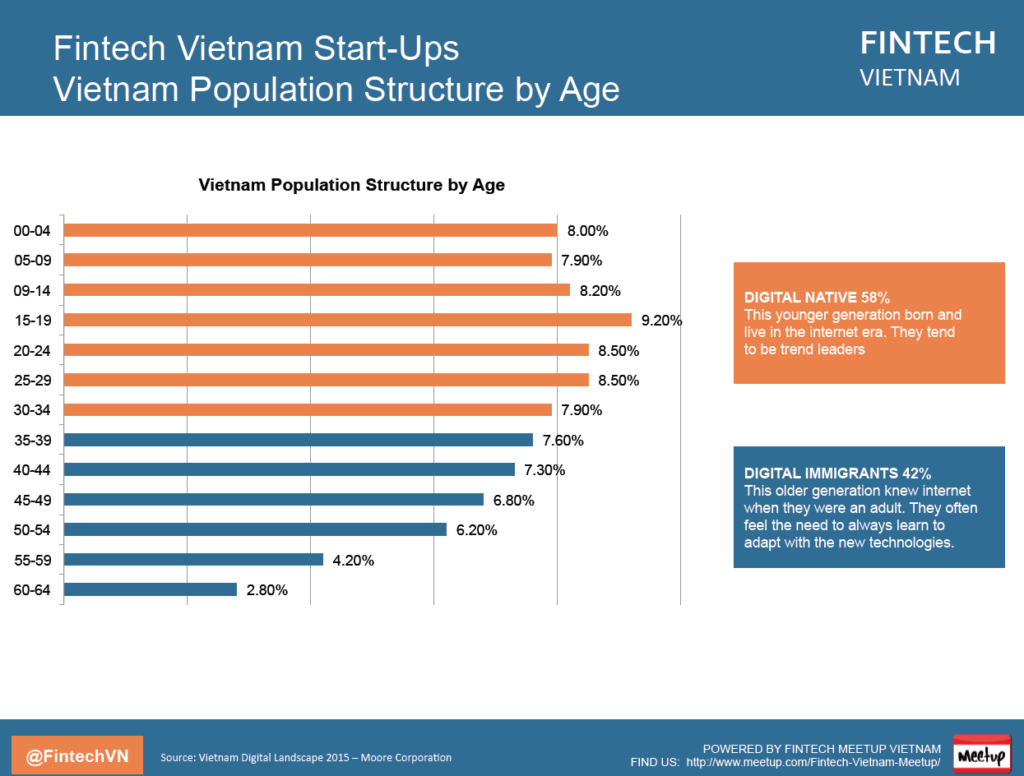

Age Structure in Vietnam

Vietnam has many Digital natives which can give room for a full digital bank. See for example Go Bank in the US. Most Vietnamese are between 15 and 35 years old.

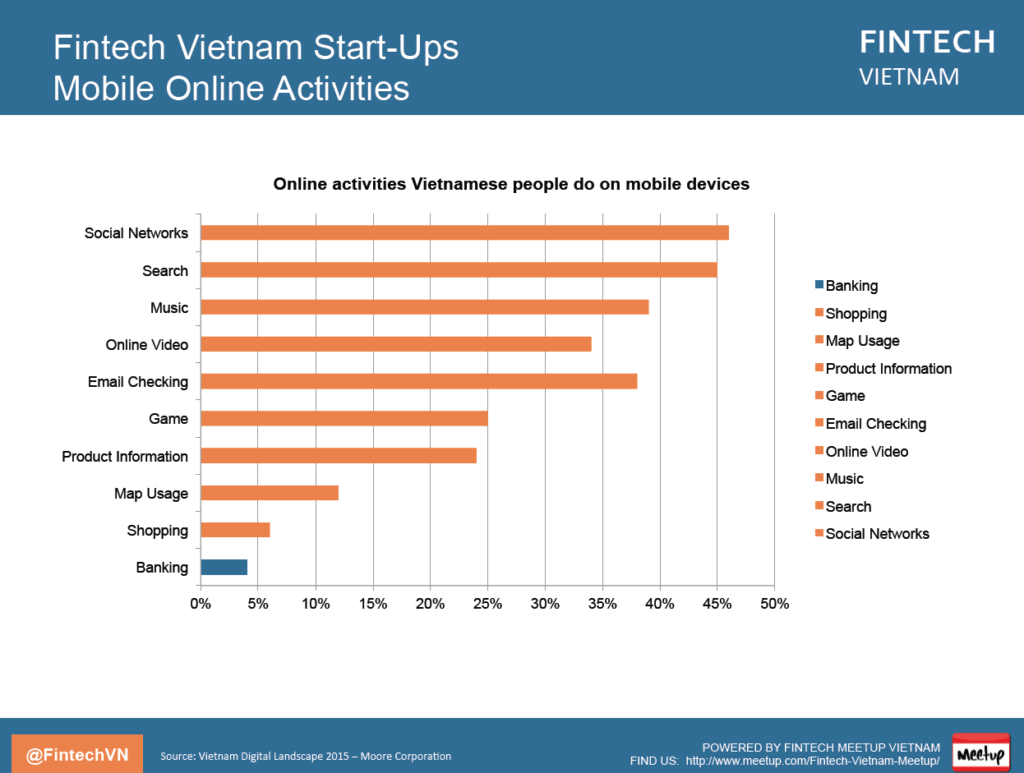

Online Banking in Vietnam

Online Banking usage in Vietnam is still very low. However, the use of Social Networks is huge. This gives room for Social Media Payment Solutions.

In an other survey called ‘E- and M-Commerce and Payment Sector Development in Vietnam,’ a world bank report found that the e- and m-commerce industry is growing faster than the infrastructure, which will generate a big demand for fintech and payments solutions for end-users and merchants/online-sellers.

(see also the Top Vietnamese Mobile Payment Providers)

Vietnam Fintech Startup Report

The full Vietnam Fintech Startup report can be seen here: (incl. Description of the Vietnamese Fintech Startups)

Check also the article “6 Vietnamese Fintech Startups to watch”