For corporate executives and decision makers this is where the journey starts, they ask themselves:

How much of my investment budget do I have to allocate to “Innovation”?

And luckily many firms in the Financial Services industry have already found their answers and kickstarted their journeys. But many have not. So I thought we’d put together a few lines on a way to approach this question.

Why do many struggle first of all? Because of the high levels of uncertainty. Because interest rates are low in 2016. Because yield is hard to find. Because ROE is already low – industry wide. Because the Cost-Income-Ratio is not going where we all want it to go. Sometimes mistakes are made under pressure and Innovation efforts are simply cut.

How are you going to calculate a reasonable ROI on something that is highly exploratory anyway?

Yes, there is a high likelihood that individual Innovation efforts may fail. There is, however a bigger risk in not engaging in any Innovation activities at all. A pretty fatal one, actually. With the decision to invest zero in Innovation one may kill the very firm one is trying to manage through difficult times now and hopefully to new highs shortly.

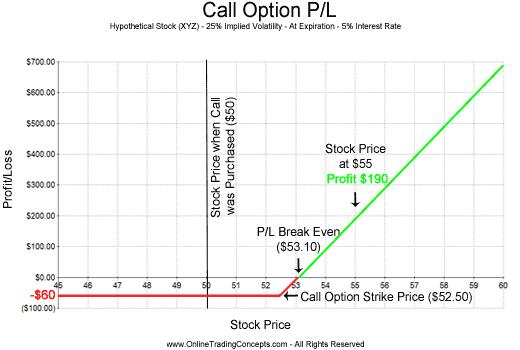

To help think about Innovation investments we like to compare them with Call options. Do you remember this graph:

What we mean:

– One pays a (relatively small) premium for something that one hopes has the potential for rapid and fast growth. This might be your Innovation initiative.

– If the Option expires below the strike price the premium is gone. This is equivalent to an Innovation initiative failing and creating no value for the firm.

– If things go well however, there is unlimited upside. The price of the option increases rapidly. This is the scenario of an Innovation initiative taking off well and generating sharply rising returns for the company.

– So what is the right premium to pay?

There is no single answer to this I am afraid. As with taking market risk it depends on the risk appetite and financial position of the institution. One, back of the envelope, calculation that has been considered by a client was 1% of the yearly investment budget for a business line in the bank.

What is the right maturity?

Again, no company is the same. But since we recommend to keep premiums relatively small compared to the annual investment budget, why not make your “Innovation call option” an open ended one. In the following post we will discuss more about how to deploy the allocated capital.

We encourage every Financial Services company to consider Innovation investments essential and on a continuous basis.

In our view it is much better losing a relatively small premium, even repeatedly, rather than being put out of business completely because the opportunity to embark on a new exploratory / high profit opportunity was never even considered.

Watch this space – we’ll follow up on Innovation opportunities and real options as well as the VC way to deploy funds to your internal Innovation efforts.

This article first appeared on LinkedIn Pulse