Fintech (Startup) Of The Month: TransferTo, A Cross-Border Mobile Payments Network

by Fintech News Singapore November 3, 2016TransferTo is a leading B2B mobile payment network and airtime hub serving the likes of Western Union, PayPal, Xoom, 7 Eleven, WorldRemit, Tigo mobile money and MoneyGram.

![]() TransferTo interconnects financial institutions and mobile operators globally, linking over 4.5 billion mobile users through partnerships with more than 400 mobile operators including Safaricom, Orange and Vodafone.

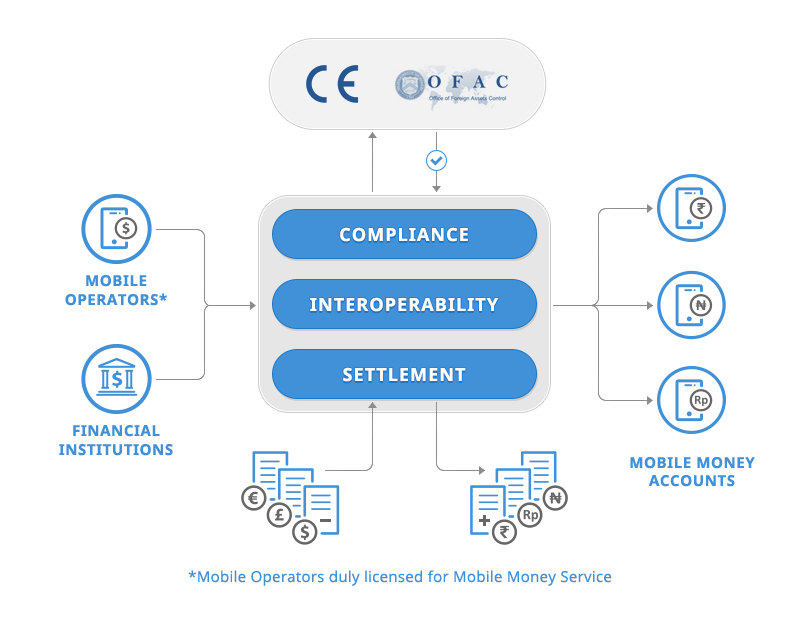

TransferTo interconnects financial institutions and mobile operators globally, linking over 4.5 billion mobile users through partnerships with more than 400 mobile operators including Safaricom, Orange and Vodafone.

Regulated by the UK’s Financial Conduct Authority, the company provides its partners with a global compliance framework for all relevant regulatory requirements and enables thousands of businesses in more than 100 countries to offer real-time mobile money and airtime transfer services to their customers.

TransferTo’s portfolio includes:

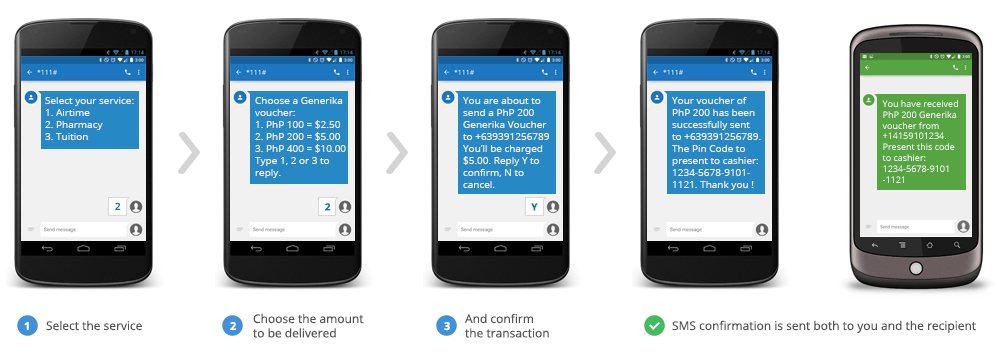

Mobile airtime: solutions enabling the real-time transfer of small amounts of prepaid mobile credits, across borders, conveniently, without the need of registration. TransferTo’s phone-to-phone transfer services use several channels including SMS/USSD, mobile applications, websites, web points of sale and APIs.

Goods and services: TransferTo’s global network of merchants and utility providers gives customers the ability to send goods and services across borders with real-time delivery and instant confirmation directly to any mobile phone. Using a peer-to-peer concept similar to airtime, Transfer To has extended its portfolio to include real-time goods and services transfers.

Mobile money: TransferTo’s Hub for Mobile Money allows financial institutions and mobile operators to provide their end-users with peer-to-peer mobile payment transfers that is fully compliant with the UK’s financial regulator. TransferTo’s Hub for Mobile Money allows for real-time transactions and convenience when sending small amounts. It supports over 80+ currencies.

In 2015, TransferTo’s Mobile Money and Airtime Hub processed more than 50 million transactions.

TransferTo was founded in 2005 with the aim of providing safer, more efficient and more reliable remittance services, eyeing the 250 million migrants worldwide that are moving from one developing country to another.

Today, more than 400 million people have access to financial services via their phone, with mobile money service available in over 90 countries, according to GSMA’s 2016 Mobile Industry Impact Report.

The mobile industry has been a major contributor to the world’s economy, adding US$3.1 trillion in economic value to the global economy in 2015, equivalent to 4.2% of GDP. The figure is expected to rise to US$3.7 trillion by 2020.

TransferTo has raised US$6.5 million in funding so far. The company has offices in Singapore, London, San Francisco, Dubai, Miami, San Salvador and Barcelona.

Notable remittance services in Asia include Dash, a service by Singaporean telecommunications company Singtel. The Singtel Dash app lets users pay for goods and services, send money, remit money overseas as well as top up their mobile phone on-the-go.

Hong Kong’s Toast leverages the Bitcoin blockchain to allow users in Hong Kong to remit money to the Philippines and pay bills through a peer-to-peer money transfer application.

Other bitcoin remittance services in the region include Satoshi Citadel Industries’ Rebit, Bitspark and Bitcoin Vietnam’s Cash2VN.

Featured image: Modern communication technology by ESB Professional, via Shutterstock.com.