Reimagining Banking, DBS Launches World’s Largest Banking API Developer Platform

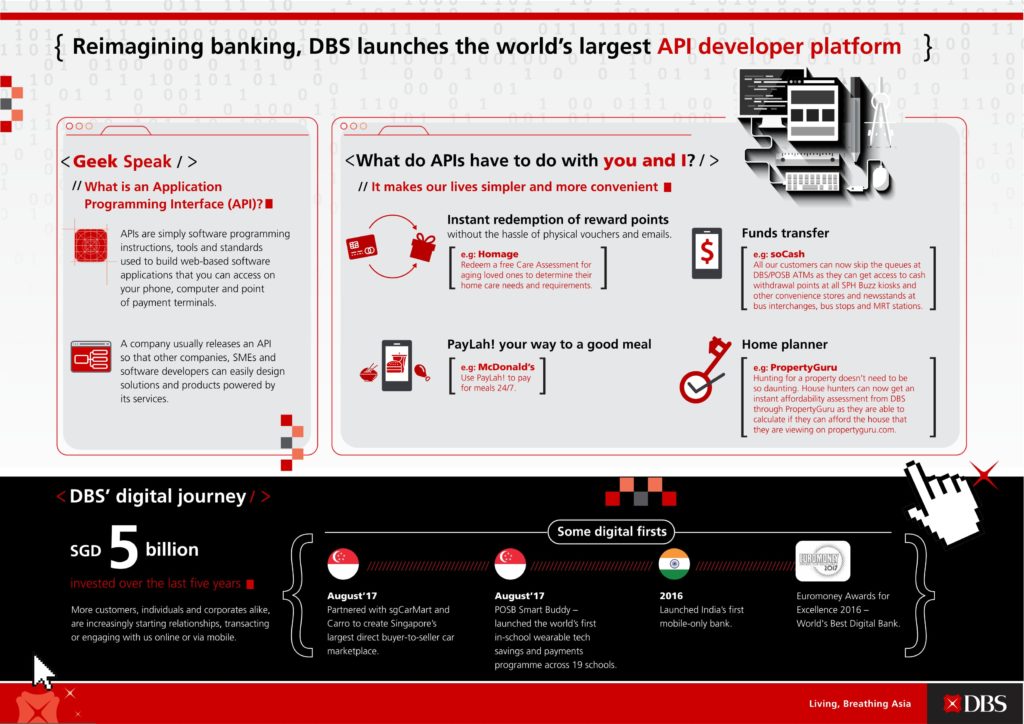

by Company Announcement November 4, 2017DBS Bank set yet another global milestone with the launch of a banking API developer platform that is the largest by a bank anywhere in the world.

The scale of the endeavour at launch underlines DBS’ commitment to reimagining banking for the benefit of customers. For its innovation efforts, last year, DBS was named “World’s Best Digital Bank” by financial publication Euromoney.

The API platform will boost the bank’s lead in creating innovative and customer-centric experiences by making available a wide array of APIs for other brands, corporates, fintechs and software developers to plug into. This has the potential to significantly accelerate the bank’s digital ambition and customer impact.

With 155 APIs at launch for Singapore across more than 20 categories such as funds transfers, rewards, PayLah! and real-time payments, the platform will offer the world’s largest number of and most relevant banking APIs for companies, whatever their focus, from fintech to lifestyle to build upon. More categories will be added in response to demand.

Notable too is that more than 50 companies including household names such as AIG, McDonald’s, MSIG, PropertyGuru, as well as start-ups like Activpass, FoodPanda, Homage, and soCash have already hopped onto the platform to develop solutions that will bring more convenience and value to customers.

For example, McDonald’s is the first fast food chain to offer round-the-clock food delivery services. By making use of DBS’ banking APIs under the PayLah! payments category, McDonald’s introduced the convenience of PayLah! to its McDelivery customer base this year, expanding their cashless payment options.

A McDonald’s spokesperson said,

“We serve more than 1.2 million customers a week in Singapore. The DBS API partnership has helped us to speed up the process of payments so that our customers can focus on enjoying their meals. Speed is essential in this process, and we’re delighted that banks such as DBS are exploring the use of digital capabilities to smoothen such experiences.”

Another example is social enterprise Homage, a one-stop, on-demand service that offers in-home caregiving services for seniors to help them maintain their independence, and live with dignity and grace in their old age.

By partnering with DBS, Homage’s customers, who are usually family members of the seniors who need care, are now able to instantly redeem their credit card reward points to arrange for a Care Assessment by a professional Homage Nurse and Care Specialist to determine the home care needs and requirements of their loved ones.

Gillian Tee, CEO and co-founder, Homage said,

Gillian Tee

“Families who engage Homage want the peace of mind and security that their loved ones are well taken care of. Therefore, it’s great to work with DBS to provide our care managers with a painless and hassle-free payment experience as they take the first steps in engaging care, keeping the administrative part of home care in the background and allowing our care to stand out.

Families across Singapore can now directly pay for an in-home care assessment and get a custom care plan through their credit card reward points. I’m impressed that they took time to understand Homage’s on-the-ground challenges and were able to work with us to integrate financial relief schemes and payments within our app so that caregivers could have a one-stop-shop to book and pay for the care that their loved ones need.”

Customers searching for their dream home on PropertyGuru, Asia’s leading online property group, can also get an instant affordability assessment. Vivek Kumar, Director, Product (Consumer) Technology, PropertyGuru Group said,

Vivek Kumar

“In Singapore, PropertyGuru helps more than five million people every month to find a home. We constantly deliver on our mission to empower property seekers to make confident property decisions and are very excited to partner with DBS and launch Singapore’s first home loan affordability check.

Property seekers, while browsing for property options, now have real-time access to their home loan affordability making their search process extremely effective.”

Shee Tse Koon, Group Head of Strategy and Planning, and Head of Ecosystems, said,

Shee Tse Koon

“The digital momentum that we see today is just the tip of the iceberg. By creating ecosystem partnerships – collaborating, creating and innovating together with partners – we believe that we can provide the best products, solutions and experiences. Today’s launch is a bold move in the direction of shaping the future of banking, with the customer at the heart of the banking experience.”

David Gledhill, Group Chief Information Officer, DBS Bank said,

David Gledhill

“DBS embarked on a journey to transform our tech infrastructure nine years ago. With that early start, we are now ahead of many others in being digital to the core. This has given us an edge – enabling us to operate with fintech-like agility and nimbleness, and also platform-like inclusiveness. This will be transformative in ways not imagined previously, both for the customer and the bank.”

In recent years, DBS has been stepping up collaboration with governments, partners, fintechs, start-ups and other members of the ecosystem to make banking simpler and more seamless for customers through the use of partner APIs. They include DBS digibank in India, a complete bank in a phone, which has acquired 1.6 million customers since its launch in April last year; as well as DBS PayLah!, Singapore’s most popular mobile wallet.

The platform, DBS Developers, was officially launched today. Interested parties are invited to register their interest at www.dbs.com/dbsdevelopers where they will be given tools to connect in a development sandbox, enabling them to test their ideas.

Partner quotes - DBS launches world’s largest banking API developer platform

| Activpass | “With one of the largest network of fitness, beauty and wellness services in Singapore, we want to make it easier for our customers to pamper and reward themselves. Using DBS’ APIs, we’re enabling customers to instantly redeem their DBS Points on the mobile app, a first in Singapore. This gives them the incentive to enjoy the lifestyle they deserve on-the-go, without the hassle of traditional voucher redemptions.” Peter Seow, CEO and Founder |

| Homage | “We started Homage to enable our community to provide quality home care for their loved ones using technology. Through our apps, Homage CarePros work with hundreds of families to allow Homage to deliver thousands of hours of caregiving every month, including nursing procedures and home physiotherapy services. With the new DBS API, we are now able to provide a painless, scalable and hassle-free payment experience, keeping the administrative part of home care in the background and allowing our care to stand out.” Gillian Tee, CEO and Co-founder |

| McDonald’s | "We serve more than 1.2 million customers a week in Singapore. Through DBS’ PayLah! API partnership, we have been able to speed up the process of payments, helping our customers focus on enjoying their meals. Speed is essential in this journey, and we’re delighted that banks such as DBS are exploring the use of digital capabilities to enhance such experiences." McDonald’s spokesperson |

| PropertyGuru | “In Singapore, PropertyGuru helps more than 5 million people every month to find a home. We constantly deliver on our mission to empower property seekers make confident property decisions and are very excited to partner with DBS and launch Singapore’s first home loan affordability check. Property seekers, while browsing for property options now have real-time access to their home loan affordability making their search process extremely effective.” Vivek Kumar, Director – Product (Consumer) Technology, PropertyGuru Group |

| Red Dot Payment | "We aim to provide the best ways for our clients to accept payment from their customers. When McDonald’s approached us to extend their digital payments profile to include DBS PayLah! we gladly took on the challenge to learn, adapt and add new capabilities to our existing solutions set. The DBS PayLah! integration team have been, and continue to be, great partners to work with." Randy Tan, Co-founder & Managing Director of Red Dot Payment Pte Ltd |

| soCash | "soCash is a digital cash circulation platform that matches the consumers' demand for cash with the retailers' need to make deposits. People need cash, but it can be a hassle when you are unaware of the location(s) of nearby ATM(s) or when there are long queues. Working in conjunction with DBS, soCash enables instant withdrawal to all DBS and POSB customers via our mobile app and islandwide network of participating merchants. This ensures that cash is always around the corner for consumers while also saving retailers the effort of travelling to the bank to make deposits.” Hari Sivan, CEO, soCash |

This article first appeared on dbs.com