Instapay Enables Indonesian SMEs to Accept Payment Using WhatsApp & Line

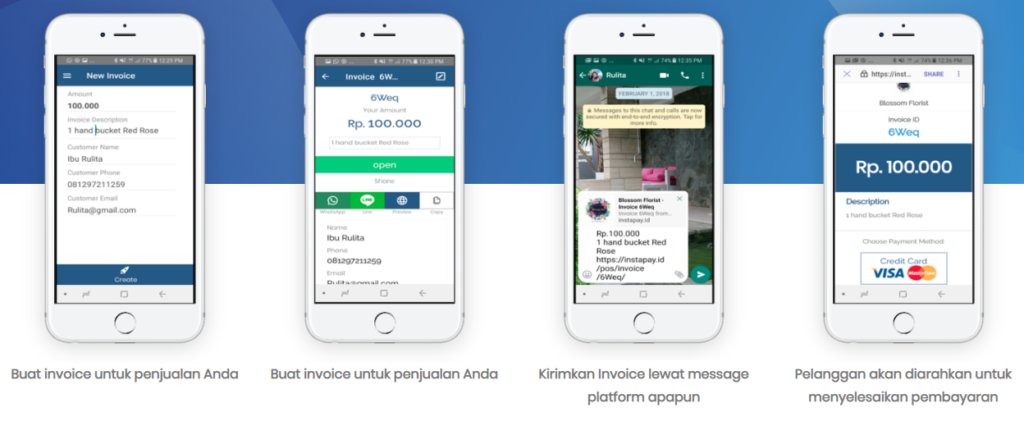

by Fintech News Indonesia September 13, 2018Homegrown fintech player MC Payment held a soft launch for Instapay, a new mobile B2C payment platform targeting Indonesian SMEs. Instapay would enable merchants to accept payment using social media messaging apps, like WhatsApp and Line.

Businesses would be able to use the to invoice their customers via social media, and accept various payment more quickly. Due to its portability, the company hopes that business owners could utilise the app to expand international markets and accept international credit cards. It can also accept credit card payments without website integration or EDC machine.

Approximately 1,000 merchants have signed up for and used the payment services to date.

PT MCP Indo Utama (MC Payment’s Indonesia division) country director, Valerino Wijaya said:

“MC Payment has identified pain points associated with payment processes in SMEs. This includes the inability to monitor and accept a wide range of payment channels. Instapay provides an easy mobile-based solution that directly solves these problems so businesses can focus on what they do best.”

MC Payment’s Instapay targets a few markets, such as sole-proprietor businesses like florists and tailors, small retailers selling online, as well as smaller hotels and villas. The company opines that their new service could enlarge the consumer market size for the aforementioned markets.

This is in tandem with Indonesia’s “Ayo UMKM Jualan Online” (Let SMEs Sell Online) campaign, which is aimed at attracting and persuading SMEs across Indonesia to sell products via online marketplaces. Several government bodies that have taken part in the campaign include the Communications and Information Ministry, the Cooperatives and Small and Medium Enterprises Ministry, and the Creative Economy Agency (Bekraf). Six online marketplaces involved in the campaign are Blibli.com, Tokopedia, Bukalapak, Shopee, Lazada, and Blanja.com.

The Indonesian government has a goal of getting 8 million SMEs online by 2020. As of 2017, there are a total of 59.26 million SMEs operating in Indonesia, but only 3.97 million SMEs were active online—translating to a little less than 7% of SMEs active online.

MC Payment’s CEO Anthony Koh, said,

Anthony Koh

“MC Payment is pleased to strengthen our market presence in Indonesia with Instapay. Approximately 1,000 Indonesia merchants signing with us is a testimony to the platform’s accessibility and stability. Instapay enables small merchants to save time without the hassle of going to a bank. At the same time, these small business owners will be able to manage their cash flows better.”

“MC Payment will be rolling out supporting services like mobile micro-financing and installments for SMEs in the coming months. SMEs can get small loans approved within 24 hours using their mobile phones. We will keep the public updated in due course.”

Featured image via Instapay