Rely Nets 7-Figure Funding for Enabling Online Payments in Installments

by Fintech News Singapore February 27, 2019Rely just announced a seven-figure Pre-Series A funding led by Goldbell Financial Services. Additional funding comes from Octava, a family office based in Singapore among other strategic investors.The exact figure was not disclosed.

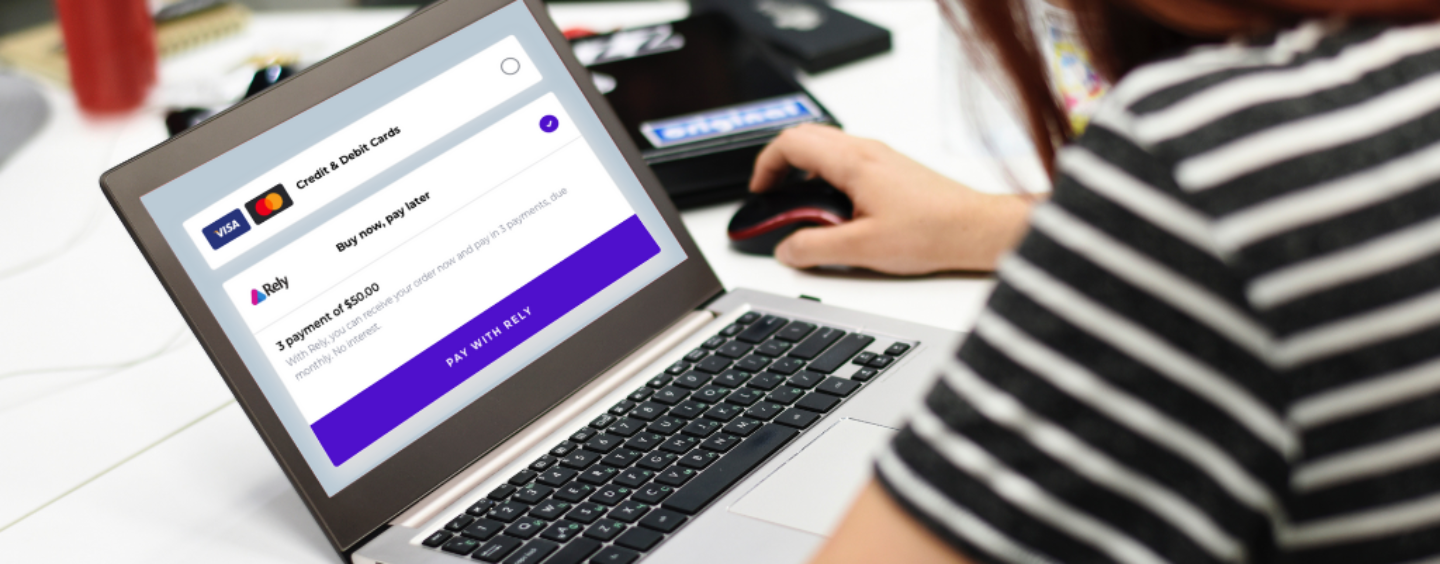

Rely is a local fintech company that provides shoppers with an interest-free option for payment installments during online shopping.

The home grown will use the fresh funding for regional expansion, scale up their team, and to support more partnerships across the region. The payments platform has established partnerships with e-commerce retailers such as Zalora, Zilingo and Fitlion.

CEO and Founder, Hizam Ismail, said:

“With the rapid expansion of the e-commerce industry in Southeast Asia and Singapore, we at Rely want to continue to stay at the forefront where the ‘Buy Now, Pay Later’ concept is being touted as the perfect fit for the way consumers shop online.”

“The e-commerce market in Southeast Asia makes for an exciting new world and we are ready for the new era.”

According to a study conducted by Google and Temasek, the Southeast Asian e-commerce industry is expected to exceed US$100 billion over the next couple of years. Singapore, one of the fastest growing players in the e-commerce industry, is predicted to grow to US$5 billion by 2025.

How Does Rely Work?

Rely claims to use an artificial intelligence engine to help determine shoppers’ repayment capabilities. The engine determines spending limits for each consumer, and safeguards are also in place to ensure that shoppers repay on time. Further purchases cannot be made via Rely if payments are not made on time.

The ‘Buy Now, Pay Later’ service can be used upon checkout, and only requires a user to link their debit card to their Rely account. Payments for purchases can be split into three equal monthly payments with the initial payment collected during checkout.

Meanwhile, online retailers can garner more purchases from more customers who may not otherwise have the means to afford their products. According to Rely, retailers typically experience between 20% to 40% increases in conversion rate, with a particularly strong uptake from millennials.

Similar business models have flourished in other Southeast Asian countries, particularly in Indonesia. In fact, the top funded fintech in Indonesia is AkuLaku, which also offers installment-based credit financing with no need for credit card ownership. As a more mature player operating in a region with higher population numbers, AkuLaku has raised US$220 million, and diversified their business into operating an e-commerce platform.

If Rely aims to launch their services into other Southeast Asian countries, then they will have competitors to contend with. Nevertheless, credit financing is still an area with a lot of potential in the region and at worst they at least still have first-mover advantage in Singapore on their side.