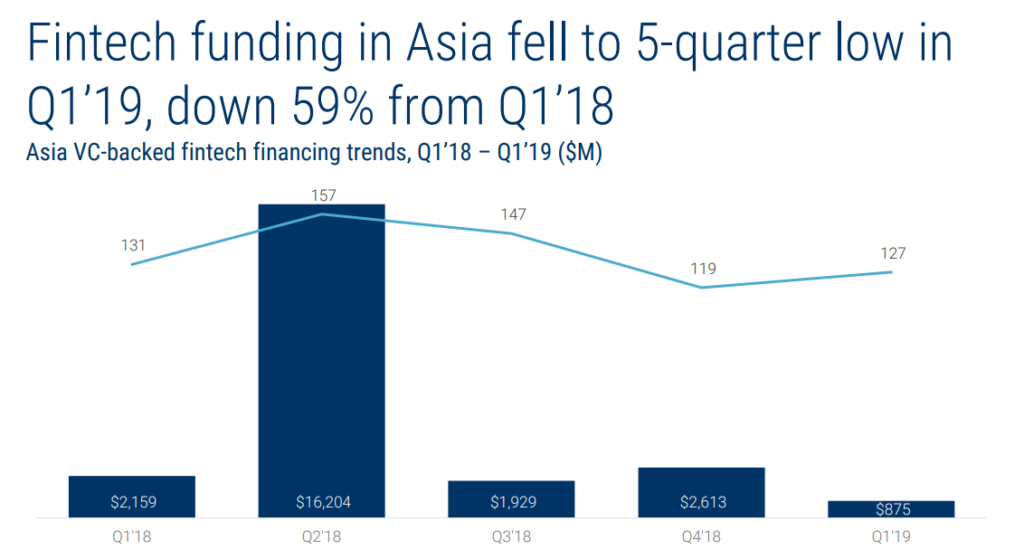

India’s Now the Top Fintech Funding Hub in Asia, but It’s Too Soon to Celebrate

by Fintech News Singapore May 3, 2019India, often considered Asia’s underdog tech advancements in Asia, is finally now the top fintech funding hub in the first quarter of 2019, beating longtime rival China. At Q1’s close, India’s fintechs raised US256.8 billion to China’s US$192.1 billion.

It is accurate to say that India overtook China in funding in that period. However, this is less because of anything special India did, but rather because China’s billion-dollar fundings simmered down following tighter regulations. China’s fintech funding too, has now hit a 5-quarter low which dragged Asia down with it, based on a recent CB Insights report.

China saw a 89% drop quarter on quarter. India and China both saw 29 deals.

CB Insights claims that this is due to tighter regulations, like China’s plan to wind down on small and medium P2P lending platforms nationwide, following concerning levels of defaults, fraud and investor anger.

The regulations came partly following a slew of collapsed P2P lending platforms that have led to suicides when savers lost significant amounts of funds.

It’s said that P2P lending led to one of the nation’s biggest Ponzi schemes, leading to losses in the thousands and massive protests. For example, Bloomberg reported that “4,000 people have lost as much as US$117 million as a result of the failure of PPMiao”.

The situation was a double-edged sword, as lack of regulation helped the industry grow, but also cannibalise on itself.

When the smoke clears on the China peer-to-peer (P2P) lending crackdown, we may see 70% of firms close down as crackdowns target riskier forms of financing.

Ant Financial’s Billion-Dollar Funding Deals Inflated 2018 Figures

Another CB Insights report reveals that the Alibaba-affiliate company, Ant Financial, raised US$14 billion in venture capital over 2018, just shy of the total US$15.9 billion raised by all fintech investments last year in the EU and USA.

By August last year, Ant Financial’s funding makes up 83.3% of all of fintech funding in Asia.

The fintech giant also raised billion in 2017 and 2016 as well of disclosed funds—US$3.5 billion and US4.5 billion respectively.

When you put the sheer value of Ant Financial’s funding against figured listed above, it is clear that at least, one cannot discount Ant Financial’s impact on China’s funding as a whole, and what the lack thereof in Q1 of 2019 did to the values.

Ant Financial’s efforts to grow its fintech business is a valid addition to consider about China’s growing tech industry, but it is worth noting that it is more of an exception rather than a rule.

Don’t Discount India’s Fintech Either

India’s fintech startups are now a gleam in investors’ eyes, with the country becoming a breeding ground for many fintech startups. For one thing, even Facebook’s got its eye on India as the social media giant develops its experimental crypto stablecoin targeting remittance in in the region.

Economic Times reported that fintech segments with a strong presence include payment, lending, insurance, and personal finance management, catering to the type of population that is often popular with fintech today—unbanked and underserved segments.

The same article states that there has been three-fold growth in the number of fintech startups between 2015 to 2018. Over 1,300 new startups were added to the base number of over 730 already in practice.

As one of the most regulated startup sectors, fintech can only grow with government advocacy, and luckily India has the Mumbai Fintech Hub run in Western India, and the Fintech Valley in Vizag in the Andhra Pradesh state, both run by state governments. One also cannot discount the impact of low-cost internet via the Unified Payments Interface (UPI) by the National Payments Corporation of India (NCPI).

In fact, it’s been said that the most exciting trends in the fintech ecosystem are unfolding in India, so we wouldn’t be surprised if India truly does grow its fintech funding numbers exponentially this year.

The way we see it, India right now seems to present fintech opportunities similar to China prior to its fintech boom, and if industry players are able to play the right cards, there is no reason why international eyes wouldn’t try to emulate India’s fintech successes sometime in the future instead of China.