Two Vietnamese Payments Startups are Merging and Raising US$30 Mil in Funding

by Fintech News Singapore June 11, 2019Two Vietnamese payments startups, Vimo Technology and Vietnam MPOS Technology have merged to form a brand new entity NextPay according to Bloomberg.

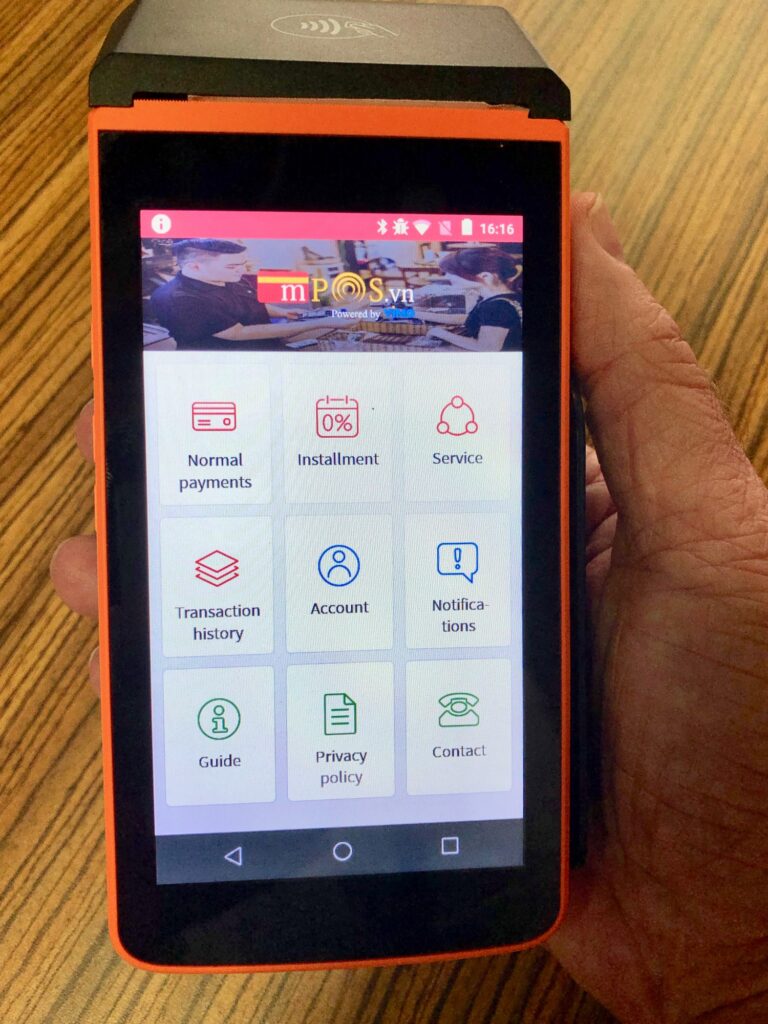

Vimo Technology operates a mobile wallet provider, while Vietnam mPOS Technology, as the name suggests, operates a portable point-of-sale solution.

The name NextPay seems to stem from NextTech, a group of companies of which both Viko and mPOS are members. To that end, the merger exercise seems to be more of a streamlining process as they were both founded by Nguyen Huu Tuat, CEO of mPOS, who will now head the combined entity moving forward.

As reported by Vietnambiz, MPOS has already made public to its customers that NextTech intends to merge the MPOS swipe payment gateway and Vimo’s mobile wallet, in a bid to combine offline and online solutions into one—mPOS representing the offline front, and Vimo representing the online front. As Vietnam makes its way towards a cashless society, it may be a fruitful strategy to ingratiate themselves into both, as currently offline Vietnamese may become loyal to a familiar name even later when they shift to more online payment methods.

NextPay is now looking to raise US$30 million to fund its planned expansion into Myanmar and Indonesia in 2020.

Vietnam Bank Card Association said that in 2018, Vietnam had 27,500 places accepting mobile point-of-sale (mPOS) in 2019, posting a 99% year-on-year increase. This is a sign that cashless payments are booming in Vietnam. The movement is in parts, thanks to a 2017 policy announced by deputy prime minister Vuong Dinh Hue aimed at dramatically reducing cash transactions by 2020. More than offering infrastructure and equipment, the policy intends to fundamentally change the cash-reliant habits of the Vietnamese.