Advance.AI’s Atome Launches “Buy Now, Pay Later” Solution in Singapore

by Fintech News Singapore July 1, 2020Atome, a Singapore based startup, has launched a “buy now, pay later” solution, which they said is intended to support the recovery of Singapore’s retail sector during COVID-19.

The company is founded in 2016 and it is a subsidiary of ADVANCE.AI a Series-C big data and AI company headquartered in Singapore which is part of a consortium applying for Singapore’s digital wholesale banking license.

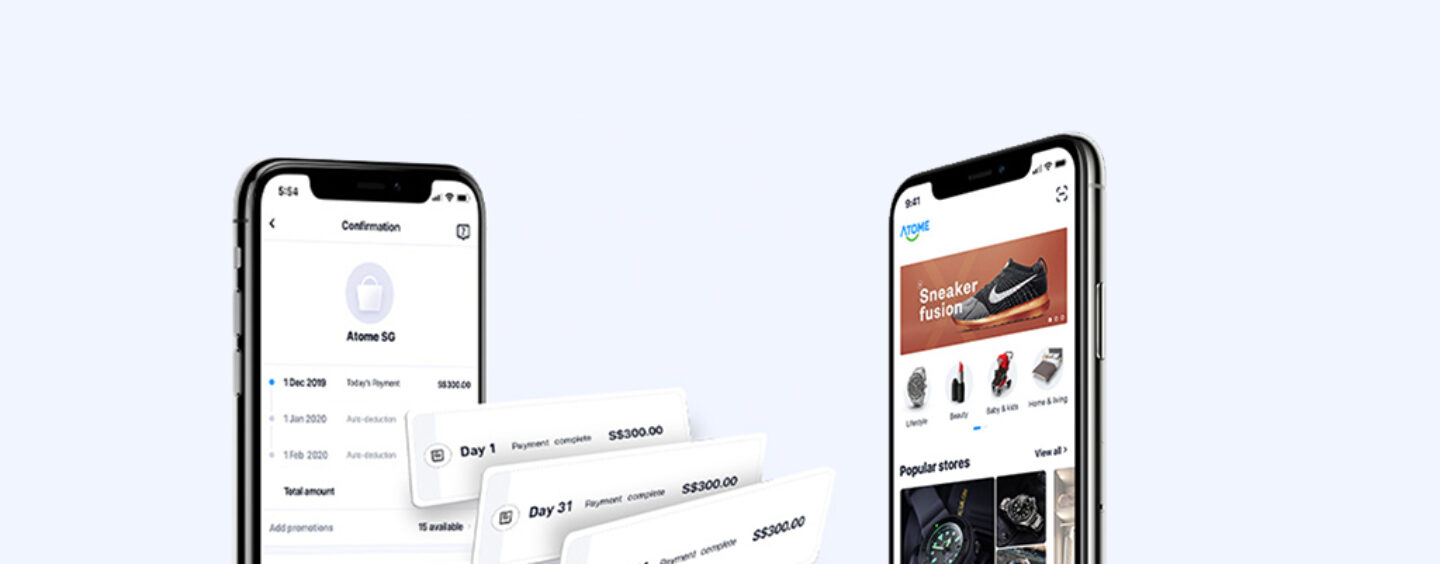

According to their media statement, Atome works by splitting bills into three equal zero interest installments over time, which is done by either scanning a QR code at a physical shop or choosing Atome during checkout on partner merchants’ websites. Atome’s competitors in “buy now, pay later” space include hoolah and Rely.

At launch, Atome claims to already have 500 partners, including marquee brands in popular verticals like fashion (Playdress, Lovet, Melissa shoes, Hush Puppies), beauty (Spa Esprit Group, Beauty Emporium, Kimage Salon), home decor (Star Living, Houze), lifestyle (Herschel, Bynd Artisan, Cocomi) and electronics (iStudio, Epic Gear).

In the first three months since its soft launch, Atome said that has seen an 11X growth in gross transaction volume on its platform. 70% of Atome’s customers are millennials aged between 20-40 years old.

David Chen

David Chen, CEO of Atome, said:

“The way people shop has irreversibly changed. Retail has irreversibly changed. The shift towards online began before COVID–19 but this has now accelerated. Businesses have to adapt quickly and find new sources of revenue and new ways to serve existing as well as new customers. As we’ve seen, having Atome as a checkout option in merchants’ online — as well as physical — stores makes a big difference, especially among digital savvy millennials. It’s a win-win for both retailers and their customers.”