Fintech Thailand Startup Map 2020 Showcases Growing Industry

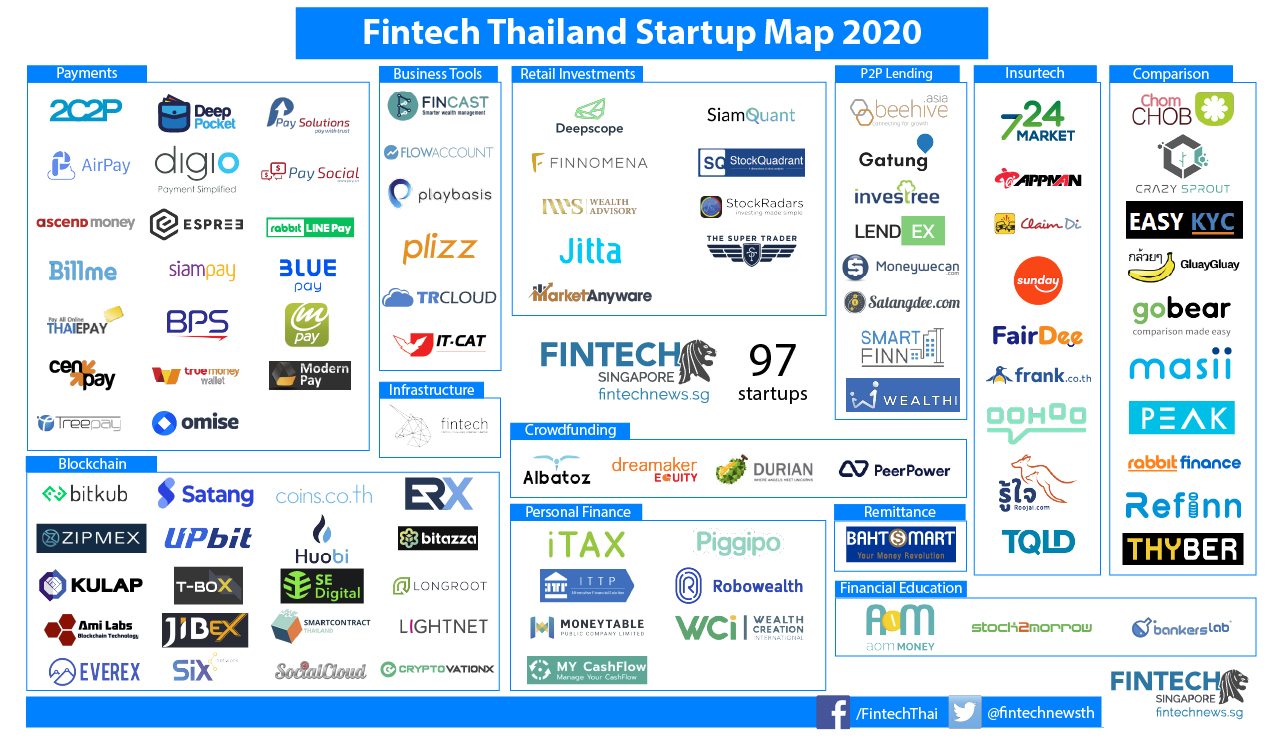

by Fintech News Singapore November 26, 2020Over the past years, the Thai fintech ecosystem has grown steadily, now boasting some 96 startups, according to Fintech News’ latest Fintech Thailand Startup Map draft.

The map showcases the domestic fintech startup ecosystem which includes startups operating in payments sector (20), blockchain (20), financial comparison (10), insurtech (9), retail investment (9), peer-to-peer (P2P) lending (8), personal finance (6), business tools (6), crowdfunding (4), financial education (3), remittances (1) and financial infrastructure (1).

As of July 2020, the Thailand Securities and Exchange Commission (SEC) had so far approved 13 crypto businesses the license to operate which includes cryptocurrency exchanges, brokers and dealers.

Notable homegrown fintech startups include AmiLabs, which uses blockchain to digitise securities, commodities and currencies, MoneyTable, a human resources and financial benefits platform for companies and their employees, FlowAccount, a bilingual accounting platform, and Masii, an online financial comparison platform.

Small but growing strong

Within ASEAN, the Thai fintech sector remains relatively small when compared with Singapore, Vietnam or Indonesia.

In 2019, Thai fintech startups represented just 8% of all of ASEAN’s fintech firms, according to a report by United Overseas Bank (UOB) produced in collaboration with PwC Singapore and the Singapore Fintech Association. Funding raised by Thai fintech ventures accounted for only 1.5% of all the money that was raised that year by ASEAN fintech startups.

2019 saw notable investors’ interest in the Thai insurtech and investment tech segments, with deals that included artificial intelligence (AI) insurtech startup Sunday’s US$10 million Series A, and financial intelligence platform Jitta’s US$6.5 million pre-Series A.

This year, investment is picking up, with notable rounds occurring in paytech and wealtech, among other segments.

Synqa, a Bangkok-based fintech startup formerly known as Omise, raised a whopping US$80 million Series C in June. Synqa provides a payment gateway that allows websites to complete transactions without sending shoppers elsewhere, and has developed a decentralized financial network that uses blockchain technology to allow for the transparent, fast and cheap transfer of digital assets.

In January, fintech startup Lightnet raised US$31.2 million in a Series A funding round to advance its blockchain platform. Founded in 2018 and based in Bangkok, Lightnet aims to become a “frictionless settlement hub for the East Asia region,” targeting underbanked migrant workers with remittances services.

Other deals this year include Finnomena’s US$10 million Series B in January, and Digio’s US$4 million Series B in May.

Finnomena offers investment products, financial advice, analysis tools, and investment content, and claims to have more than 120,000 subscribers with over US$270 million in assets under management (AUM), while Digio is a paytech startup that recently secured a payment facilitating services license from the Bank of Thailand (BOT).

Government push

The Thai fintech ecosystem has grown on the back of a broader push by the government to develop the sector.

Laws such as the Digital Economy and Society Council bill has supported the growth of fintech firms by enabling electronic identity verification, among other things, while investment promotion initiatives have been providing fintechs with corporate tax exemptions.

Regulators such as BOT, the Securities and Exchange Commission (SEC) and the Office of Insurance Commission have introduced regulatory sandboxes to support the development of innovative fintech and insurtech solutions, in addition to heading their own fintech initiatives.

BOT, for example, has been experimenting with blockchain and central bank digital currency (CBDC) through Project Inthanon. Most recently, it signed a Memorandum for Understanding (MoU) with the UK to accelerate fintech adoption and support sustainable finance.

Fintech Thailand Startup Map 2020

As this is the launch of our first Thailand fintech map, you may submit your name for consideration if you were not featured on our list.