Seamless, Strong Identity Verification Is Key for BNPL Firms to Flourish

by Fintech News Indonesia October 27, 2021Buy Now, Pay Later (BNPL) may be a relatively new product in the financial services scene, but for those companies in the lending game who offer this option, they’re onto a winner.

To stay competitive, it is imperative that those in the digital payments and banking sector start offering this “instant credit” method immediately – and seamlessly.

But first, some context.

Exploring BNPL’s user base

Also known as point-of-sale (POS) lending or financing, BNPL has exploded in part due to COVID-19, but largely thanks to thin-file users.

These customers can be broken down into three distinct, at times overlapping, populations.

The first would be the underdeveloped credit markets as these customers lack access to traditional credit channels, in part, due to the systemic failure of these channels in markets like Malaysia where the credit industry is not as developed.

The second would be the mistrusting millennials and Gen Z population who represent a disproportionate percentage of BNPL users, especially in more developed credit markets such as Australia and the U.S.

Significantly, they don’t trust traditional credit channels and have no interest in paying credit card interest rates.

Also, BNPL users report lower income and higher financial volatility than those in households with credit cards.

Who are the BNPL players?

Major BNPL fintech companies like Affirm, Klarna, and AfterPay have gained much of the market share.

They have done so by partnering with e-commerce companies to provide POS financing to prime customers with good credit scores who may otherwise go the traditional credit route.

Second look financers are another group of BNPL fintechs who step in to provide financing to customers with lower credit scores.

They provide a different means of securing financing, such as tying to an existing credit card.

Due to the higher amount of regulatory scrutiny that traditional banks face when issuing credit, banks have been late adopters of BNPL programmes.

As they enter the space, it’s expected that they will avoid small loan amounts and customers with low credit.

Customer acquisition and fraud prevention

By virtue of the type of lending they’re engaged in, BNPL companies seeking to acquire and expand do need to take heed of the key pain points present if they wish to mitigate fraud risks.

Such pain points include decision speed which makes the BNPL process a natural target for fraudsters equipped with stolen IDs.

Additionally, the chargeback liabilities that BNPLs take on makes it an incentive for merchants to encourage customers to use this service.

The small margins should also be considered as companies must walk the thinnest of tight-ropes; providing a low-friction application process without making life too easy for fraudsters.

Fraud within the BNPL space

Speaking of fraudsters, here’s how they work when it comes to purchasing an item and paying it off later.

They do it through chargebacks and the two sources for it are stolen credit cards and opportunistic fraudsters who will make purchases with their own cards, but deny that they had ever approved the transactions.

Meanwhile, in the “never pay” fraud situation, a fraudster uses a combination of their personal identity data as well as stolen or fake data to pass through the credit checks with no intention of ever making repayments on the purchases.

In both these situations, many BNPLs take on the liability from the merchant, resulting in a write off every time fraud occurs.

Ekata’s BNPL Solution

Amongst a growing field of BNPL providers, the key to staying competitive is simple but this is easier said than done.

The trick is to implement strong identity verification during the authentication process without adding friction to the user experience.

The more a BNPL company can mitigate risk while maintaining a seamless authentication journey for a customer, the further ahead they will be.

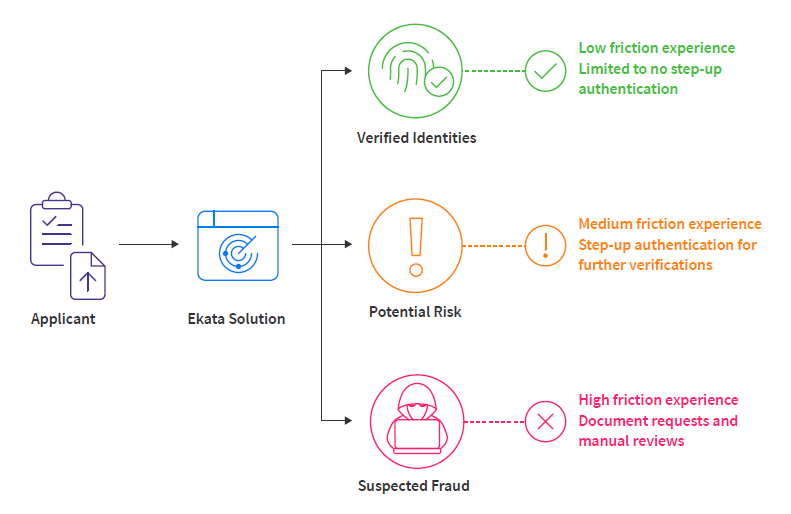

Ekata’s solutions provides rich visibility into applicants to passively authenticate identities whilst simultaneously assessing risks.

The company’s award-winning Account Opening API allows BNPL providers to optimise their onboarding workflow by separating customers into appropriate friction levels; ensuring a streamlined, hassle-free experience for low-risk buyers.

As a result, one of Ekata’s BNPL customer witnessed a 60% increase in passive verifications and a 50% reduction in account drop-offs.

To learn more about how you can lead the pack with your BNPL offering, here is Ekata’s latest e-book “Win More (Good) BNPL Customers”.

Featured image: Unsplash