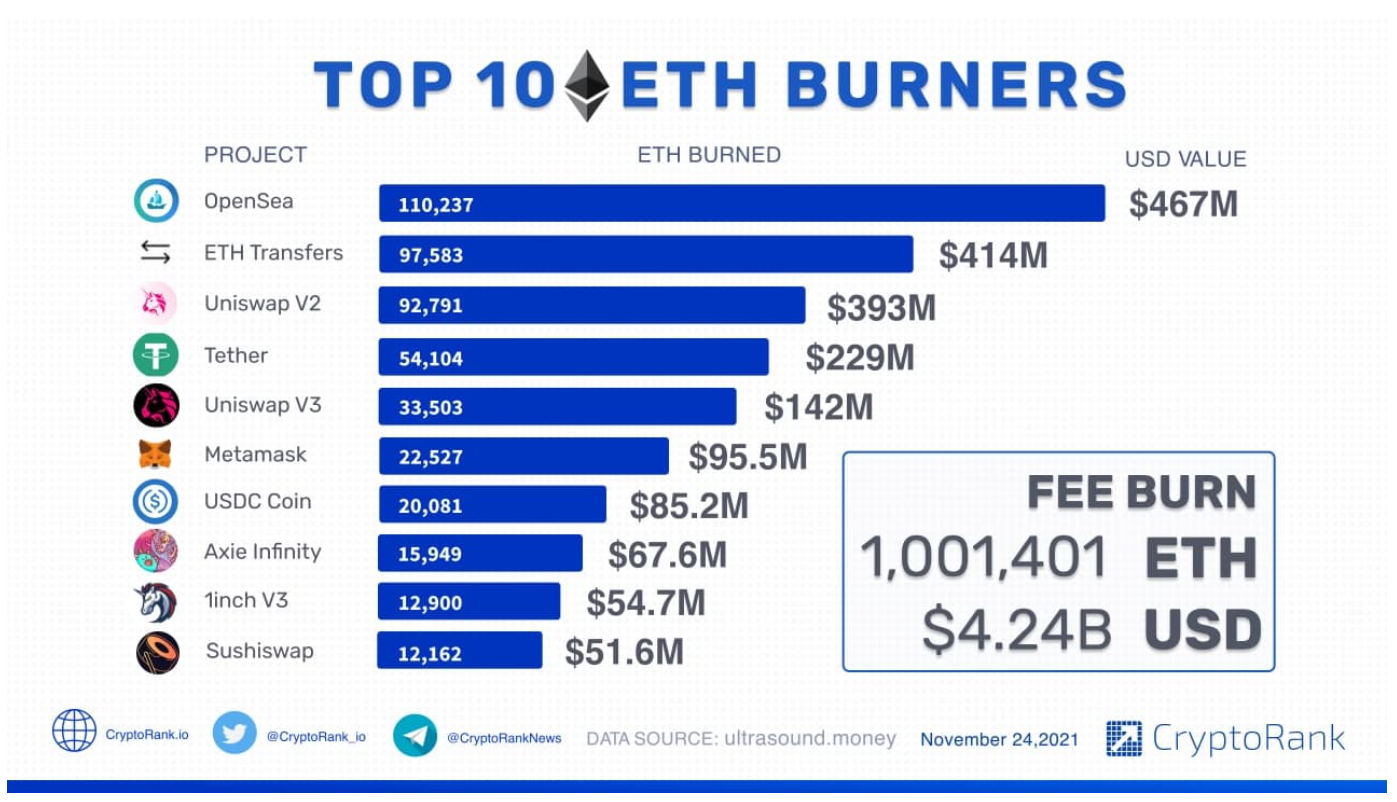

In a recent Twitter post by blockchain research firm CryptoRank, they revealed that over 1 million Ether (ETH), worth roughly around US$ 4 billion, had been “burned” since the EIP-1559 protocol (also called the London Hard Fork) was introduced in August 2021.

At first glance, you might wonder what the Twitter post meant by “burned” Ethereum, and what purpose did this fulfill.

In order to understand that we first need to take a step back and understand Ethereum a little better.

What Is Ethereum?

Source: Unsplash

Ethereum is described by its creators as the community-run technology powering the cryptocurrency Ether (ETH) and thousands of decentralised applications.

Launched in July 2015 by a group of blockchain enthusiasts, including Vitalik Buterin and Joe Lubin, Ethereum is a programmable network that serves as a marketplace for a variety of applications including financial services, games and more.

Developers can build on the Ethereum network by publishing smart contracts and decentralised applications (dApps).

It is for this reason that Ethereum is also called the world’s programmable blockchain by its creators.

This might sound quite complex, but a simple way to visualise Ethereum is to think of it as a bazaar.

Many different merchants and vendors build their businesses within the bazaar, and pay for the cost of being a part of it by using the native currency, ETH.

Ethereum is the blockchain, or network, and ETH is the currency used to operate within that network.

When users make transactions or use applications built on the Ethereum network, they have to pay “gas fees” to compensate for the computing energy used to process and validate each transaction.

This is an important part of understanding the concept of “burn”.

What Is “Burning”?

“Burning” cryptocurrencies simply mean the act of sending tokens to a wallet address that cannot be accessed by anyone.

Once tokens are sent to a burn address, this removes the coins from the circulating supply, where they cannot be accessed ever again.

With the recent EIP-1559 protocol introduced a couple of months back, a part of every Ethereum transaction will be burned and permanently removed from circulation.

The EIP-1559 protocol was implemented mainly to alleviate some of Ethereum’s network congestion by increasing block sizes to include more transactions.

With the new upgrade, this slows down the net growth of ETH in circulation, putting less strain on the blockchain over time.

With the large number of use cases that Ethereum currently has, this means that there will be a consistent stream of coins sent to inaccessible wallets.

According to CryptoRank, the largest ETH burner as of Nov 2021 was Opensea, the NFT (Non-Fungible Token) marketplace.

Since the majority of NFTs are created, bought and sold on the Ethereum network, it is no surprise that Opensea takes top spot on this list.

Source: CryptoRank

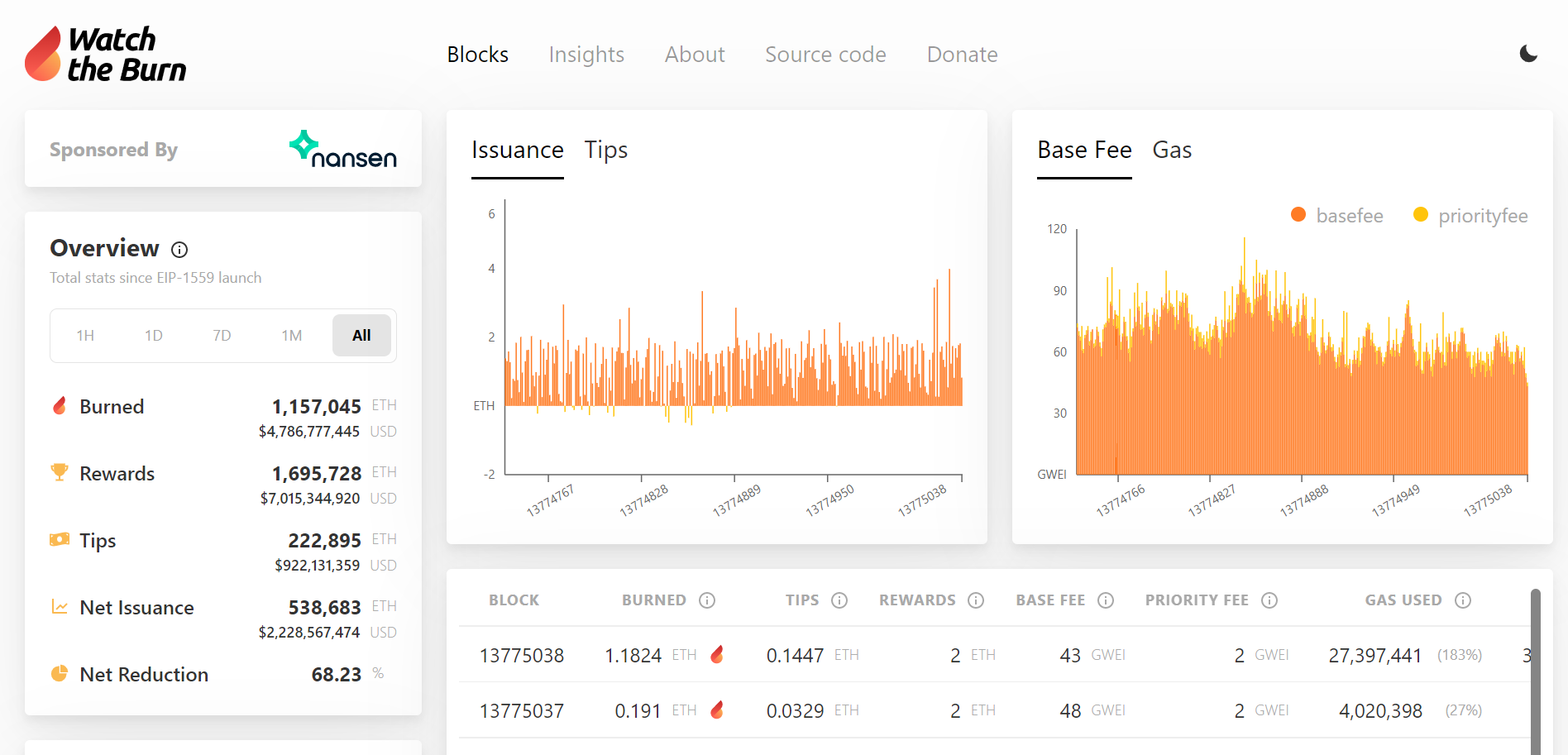

If you’d like to see a visualisation of how much ETH is being burned, do pay a visit to Watch The Burn.

This site displays a view of a new block generated on the Ethereum blockchain and in particular lets you visualise the burning of ETH from new transactions in real-time.

Source: Screengrab from Watch The Burn

How Does “Burning” Affect the Price of Ethereum?

With the introduction of EIP-1559, a certain amount of ETH will be burned with each transaction and permanently removed from the circulating supply.

Based on the basic principles of supply and demand, assuming demand remains constant while the supply of Ethereum decreases as they are burned, the price would be driven up.

However, since there are many other factors that can affect the price of Ethereum, it is not as directly predictable as this.

Many investors consider the implementation of the EIP-1559 to be a bullish sign for Ethereum, especially since it is a precursor to the highly anticipated Ethereum 2.0 upgrade, which will bring even more significant changes to the network.

If you are bullish on the plans for Ethereum in the future, perhaps you’d like to buy some ETH for yourself. If so, let us take you through how you can buy your first slice of ETH.

How to Buy Ethereum?

One of the best and easiest ways to buy Ethereum (ETH) and a bunch of other cryptocurrencies is by using Luno.

Luno has a user-friendly interface, extremely convenient methods of depositing fiat and even crypto education content.

Using the Luno app, you can buy cryptocurrencies such as Bitcoin and Ethereum from as little as SGD 1, at a low fee of 0.75%.

Let us take you through the process of buying your first ETH.

As a little added bonus, we’ll show you how you can earn interest just by keeping ETH in your wallet which is as easy as 1, 2, 3.

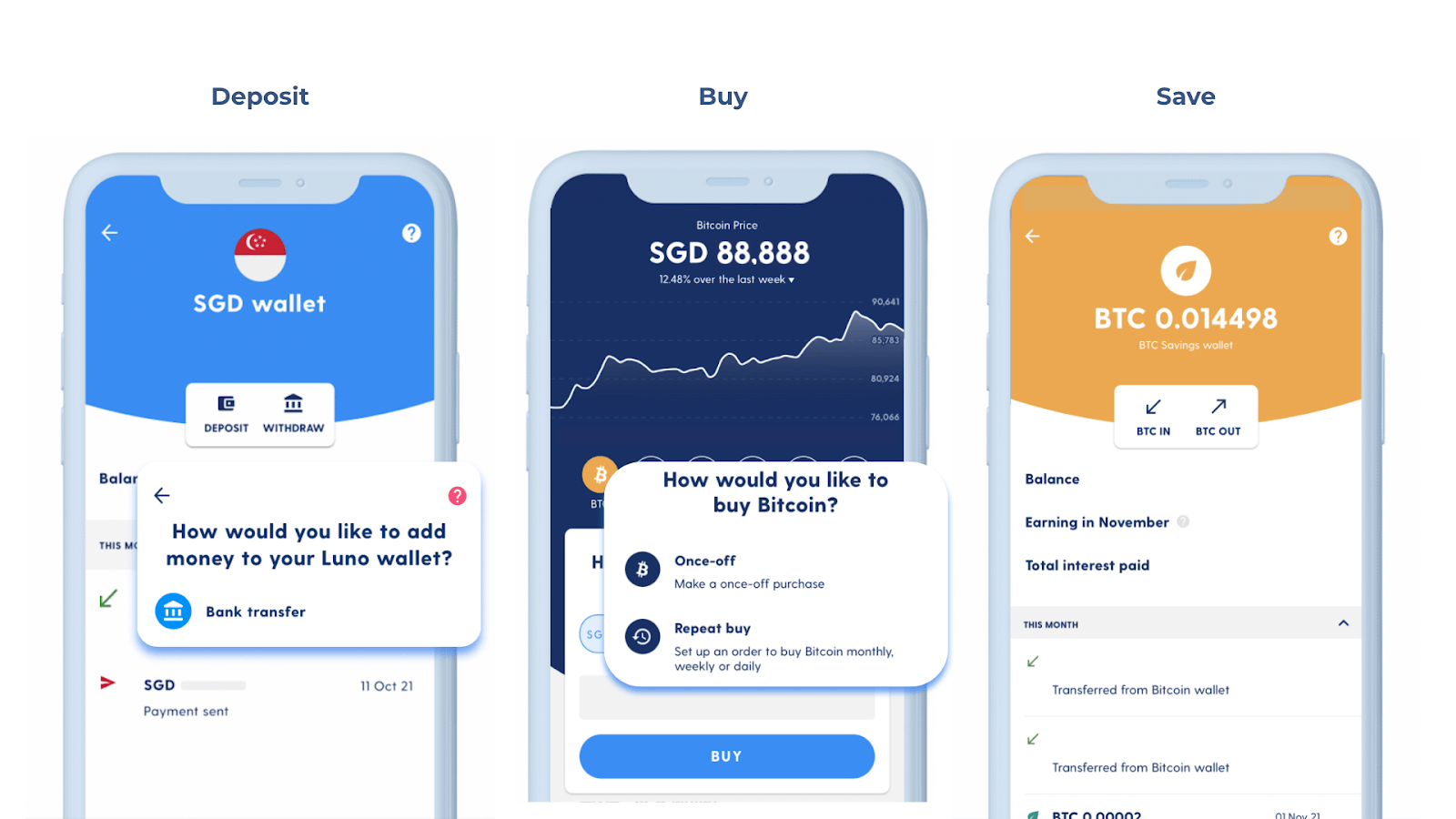

1. Deposit SGD – Bank transfer / StraitsX

You can deposit your SGD into your Luno account in a breeze. Just sign into the platform, click “deposit” and the platform will guide you on how to securely transfer your SGD.

Luno allows you to deposit your money quickly by doing a direct bank transfer using any SGD bank account or a digital wallet like StraitsX.

2. Buy ETH on the main page

Now that you have some SGD in your account, it’s time to buy some ETH.

On the main page, you can view the different types of cryptocurrencies available via Luno.

Besides Ethereum, you can also choose from Bitcoin (BTC), Ripple (XRP), Litecoin (LTC), Bitcoin Cash (BCH) or USD Coin (USDC).

In addition to a once-off purchase, you can even set up recurring cryptocurrency purchases on a daily, weekly or monthly basis.

3. Create a savings wallets to earn interest on your ETH

Luno’s Savings wallet is a feature that lets you earn up to 4% interest on any ETH (or BTC) stored in it.

Your earnings are then paid in the selected cryptocurrency (ETH or BTC) directly into your Savings Wallet at the beginning of every month.

Then, the choice is yours, whether to withdraw your earnings or leave them in your Savings Wallet to compound, allowing it to grow exponentially.

Congratulations, you now have some of your first ETH. If you ever feel you need a refresher on Ethereum or any of the other cryptocurrencies, check out Luno’s Learn Page.

Disclaimer:

This is an article written by Luno. Fintech News Singapore does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any actions related to the company. Fintech News is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release. Please note this is no investment advice.