Sleek’s Foray into Singapore’s Dynamic SME Digital Finance Space

by Fintech News Singapore July 21, 2022Sleek, an online corporate services provider, is looking to expand its footprint in Singapore’s vibrant small and medium-sized enterprise (SME) digital banking space, announcing on June 13, 2022, the launch of an array of new products designed to complement its existing Business Account product in the city-state.

The new services are intended to ease the processes of bookkeeping, expense management as well as payments and collections for entrepreneurs and small business owners.

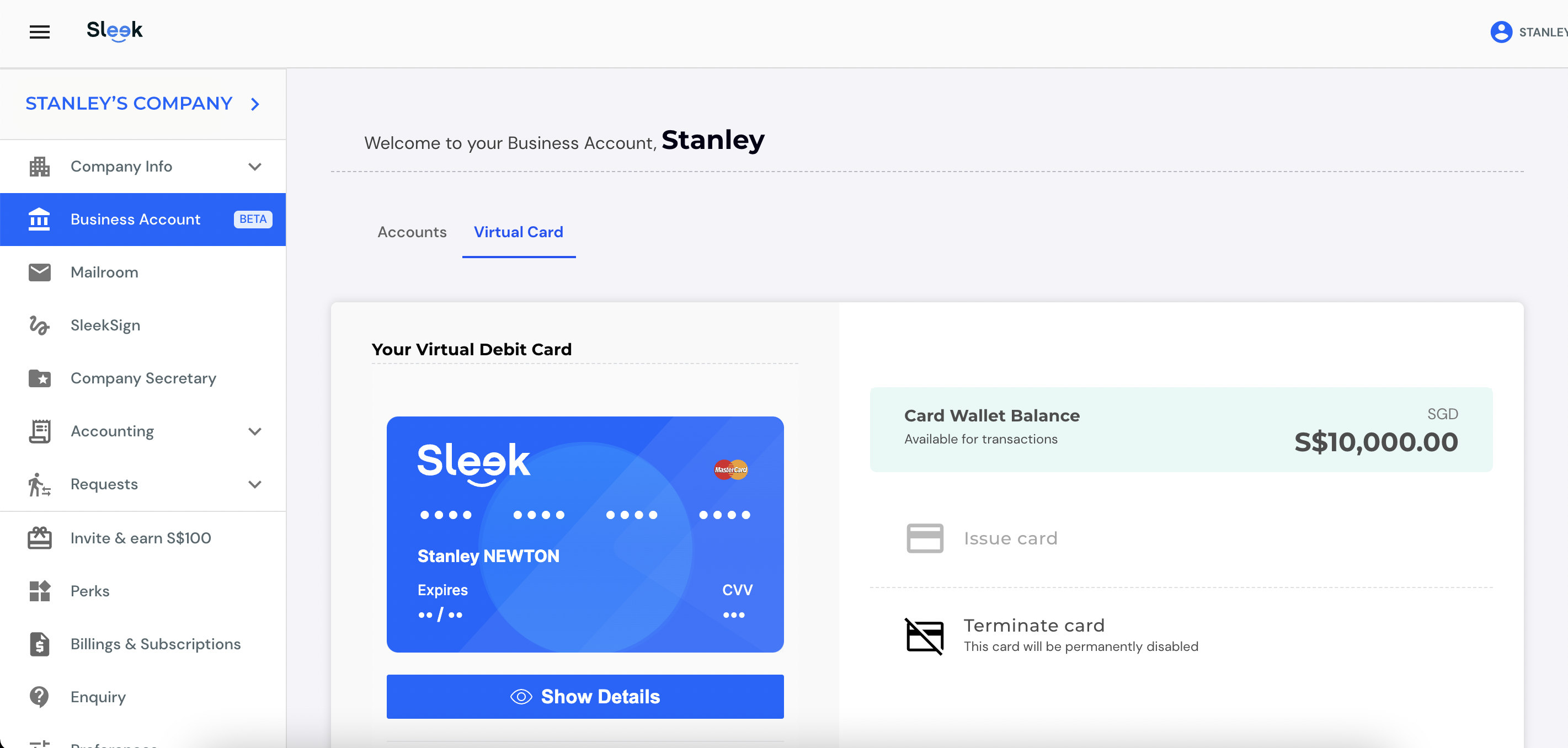

They include virtual corporate cards tied directly to its existing Business Account product; free unlimited access to transaction history and bank statements; and seamless domestic and international transfers with competitive foreign exchange rates and cheaper fees.

The Sleek Business Account and corporate cards are free of charge for Sleek’s clients, the company said, with no monthly fee, nor minimum balance. Multiple cards are available for company directors and administrators, available at one card per company director and administrator. This means that different cards can be allocated to more than one person, making processes simpler for all.

These virtual cards are managed through the Sleek Business Account, which comes with bookkeeping functionalities and easy tracking and management of business spendings.

Sleek Business Account dashboard, Source: Sleek

Sleek’s foray into fintech

Julien Labruyere, CEO and co-founder of Sleek, said in a statement that the new banking updates aim to expand Sleek’s offerings and enhance its versatility and user experience as the company strives to become “the leading service to help entrepreneurs start and manage a business easily.”

The release follows the launch of Sleek’s Business Account in October 2021, marking the startup’s first dip into the fintech business. The Sleek Business Account is a SGD deposit account which allows small and medium-sized enterprises (SMEs) to collect and process payments, while handling the bookkeeping in an automated fashion.

More products are expected to hit the market soon as the startup received earlier this month a Major Payment Institution Licence (MPI) granted by the Monetary Authority of Singapore (MAS), Pauline Sim, head of fintech and partnerships at Sleek, said in a separate statement. New fintech products in the pipeline include multi-currency accounts, better cross border transfers experience, and more debit card enablement.

Sleek, which serves a total of four markets, is looking to launch similar fintech products in the other countries it currently operates in, starting with the UK and Australia scheduled for later this year.

Founded in 2017 and headquartered in Singapore, Sleek specializes in online corporate services intended to ease the process of company governance for entrepreneurs. The company’s services include handling everything from incorporation, government, accounting, and taxes, to visas and regulatory compliance, enabling clients to manage their company 100% digitally.

The startup, which has raised a total of US$35 million in funding according to Techcrunch estimates, claims to have served more than 450,000 entrepreneurs get their business registered with the relevant company registry and tax authorities.

Singapore’s new SME banking players

Sleek’s foray into business banking comes at a time when Singapore is seeing the entry of a slew of new tech-enabled players in the space. These companies are leveraging advanced technologies and digital platforms to provide the country’s SMEs and small business owners with convenient and affordable financial services.

On June 03, 2022, Green Link Digital Bank (GLDB) became the first digital bank to launch in Singapore. Owned by a consortium comprising Greenland Financial and Linklogis Hong Kong, GLBD serves micro, small and medium-sized enterprises (MSMEs) with banking and financial services, and aims to expand its service coverage and create more supply chain financing products.

At around the same time, Chinese fintech giant Ant Group soft launched its digital wholesale bank in Singapore. Called ANEXT Bank, the digital bank will initially provide a dual-currency deposit account with features such as remote onboarding and daily interest. ANEXT Bank will focus on serving regional MSMEs, especially those with cross-border operations.

GLDB and ANEXT Bank were granted digital wholesale bank licenses by MAS back in December 2020, allowing them to serve non-retail customers only. The Grab-Singtel consortium, known as GXS Bank, and Sea Group, meanwhile, were awarded full digital bank licenses, permitting them to serve both retail and corporate customers.

These developments come on the back of a banking liberalization push by the Singapore government with hopes for enhanced competition, greater innovation and better servicing of both SMEs and consumers.

Featured image credit: Edited from Unsplash