It is no secret that trading activity blossomed over the last couple of years, as an army of small investors entered the financial markets.

With everyone stuck at home during the pandemic while market volatility exploded thanks to unprecedented stimulus measures, many people started to trade on a regular basis, familiarising themselves with the dynamics governing currency, equity, commodity, and even crypto assets.

There were some long-term drivers behind this trend too. After a decade of zero interest rates on savings but astonishing returns in the markets, there was a paradigm shift with people gravitating towards investing.

Fast forward to today, and while interest rates are moving higher across the world, that hasn’t really reduced the allure of trading. Inflation is high and holding cash in the bank is almost guaranteed to make one lose money in real terms, forcing people to search for alternatives.

By extension, financial education has turned into an important cornerstone as these online traders attempt to close the knowledge gap.

What should traders focus on?

What elements influence each asset class, the volatility of an instrument, and how a popular narrative can change are all crucial variables to comprehend.

Others prefer to focus on the charts, analysing the markets purely through the lens of buying and selling forces, either to ride established trends or to catch their reversal.

Of course some rules are universal, no matter what the preferred trading style may be.

How to manage risk, sticking to a strategy, avoiding over-trading, and understanding when a view has been proven wrong are all essential skills for any trader.

Even the most accomplished investors make tonnes of mistakes – the secret to success is how they deal with them.

As trading gained in popularity in recent years, the market has been flooded with a plethora of companies offering online brokerage services.

The problem is that not every broker is reputable or even regulated for that matter. As such, who a trader chooses to do business with can impact their educational journey and ultimately, their potential returns.

Trading with XM

XM provides a unique combination, being an education powerhouse that also offers a fantastic trading experience.

Customers can gain access to its live education streams, where experts with decades of experience trade in real time, answer questions, and provide market insights on a daily basis.

Traders can also enjoy news from Reuters free of charge, alongside a variety of technical tools.

Meanwhile, there is a dedicated team of analysts who cover market developments and provide a wide range of fundamental and technical analysis reports.

Daily market updates, previews of upcoming events and how those can affect the forex arena, stock market news, and crypto articles are featured constantly.

Most of these reports are done in video form too, allowing clients to stay informed even without reading much.

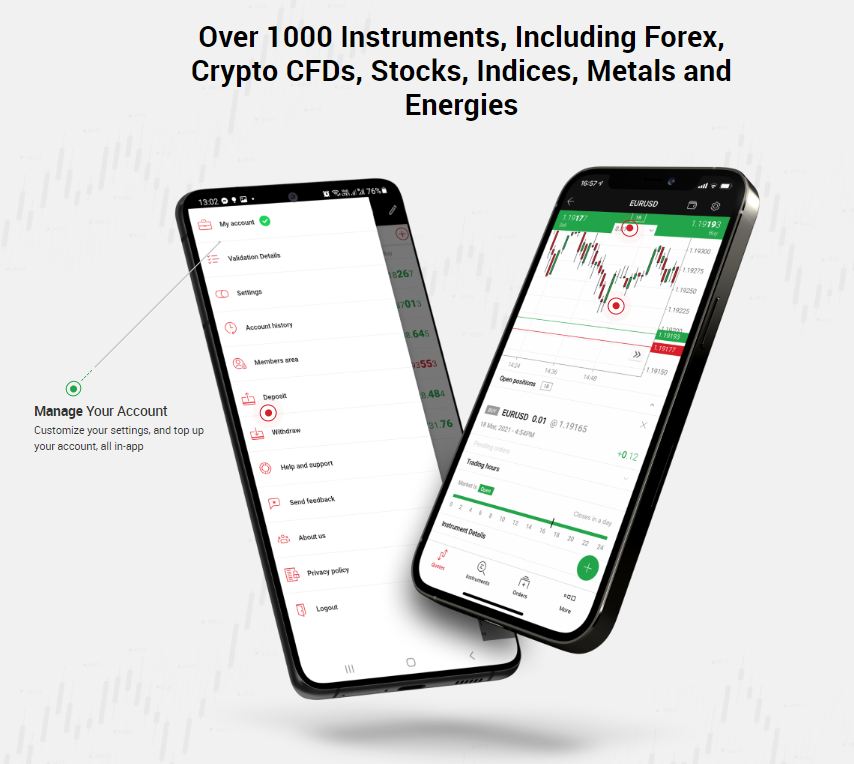

In addition, XM offers a broad collection of financial instruments to trade, which include forex products, contracts for difference on stock market indices and individual stocks, commodities, and cryptocurrencies.

Execution services are flawless, with no rejection of orders or re-quotes, and very tight spreads for every account type. Most importantly, the culture is entirely based on the customer.

There are no hidden fees, depositing and withdrawing funds is a smooth process, and the customer support center is world class with professionals that speak more than 25 languages there to help with any questions and enhance user experience.

XM allows its clients to take fate into their own hands, equipping them with invaluable knowledge to help them succeed throughout their trading career.

It also ensures that the playing field is level for everyone, offering a home both to newcomers and sophisticated traders.

The meteoric rise of small investors might be just beginning, and choosing the correct trading platform is as important as ever.

Find out more about XM’s offerings here.