Hyperpersonalisation Experiences Among Southeast Asian Banks’ Top Priorities

by Fintech News Singapore February 28, 2023In Southeast Asia, banks are embarking on the next phase of their digital transformation, focusing heavily on improving customer experiences, leveraging data and analytics, and investing in cloud-based core banking systems as well as intelligent technologies, a new study by digital transformation consultancy Publicis Sapient found.

This year’s Global Banking Benchmark Study, which polled over 1,000 senior executives at banks from around the world, revealed that financial institutions across Southeast Asia are moving forward in their digital transformation journey.

While COVID-19 pushed incumbents to focus on business continuity, establish remote operations and enable digital customer interactions, they’ve now moved into the next step of their digital agenda, shifting the focus to enhancing their use of data and better understanding their customers’ needs.

Of the Southeast Asian bank leaders surveyed, more than a quarter (29%) said their organizations are currently prioritizing customer experience improvement as their main digital transformation goal. For bank leaders in Singapore, that figure stands at 24%, the research found.

To achieve this, banks believe utilizing data from a multitude of different sources will be critical in enabling them to get a deeper understanding of their customers. In Singapore, 33% of bank leaders indicated wanting to make use of customer data across different systems.

Banks also believe data can help them build new offerings that are more in-tune with their customers’ preferences and needs. Of the Southeast Asian bank leaders polled, about 26% said they are seeking revenue growth from new innovative products and services.

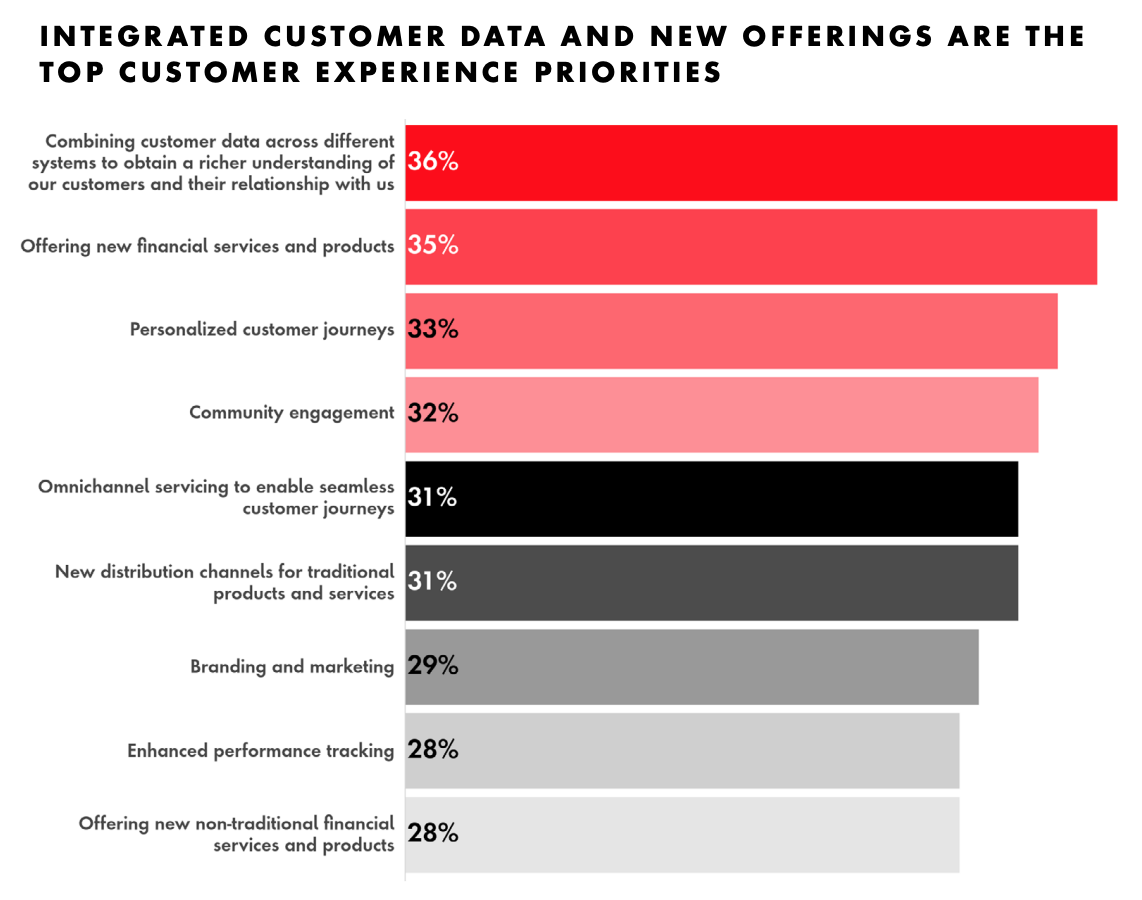

Results found in Southeast Asia are consistent with those observed globally, with bank leaders naming integrated customer data (36%), the introduction of new financial services and products (35%), and providing personalized customer journeys (33%) as the top three customer experience priorities in their organizations.

Integrated customer data and new offerings are the top customer experience priorities, Source: Global Banking Benchmark Study 2022, Publicis Sapient

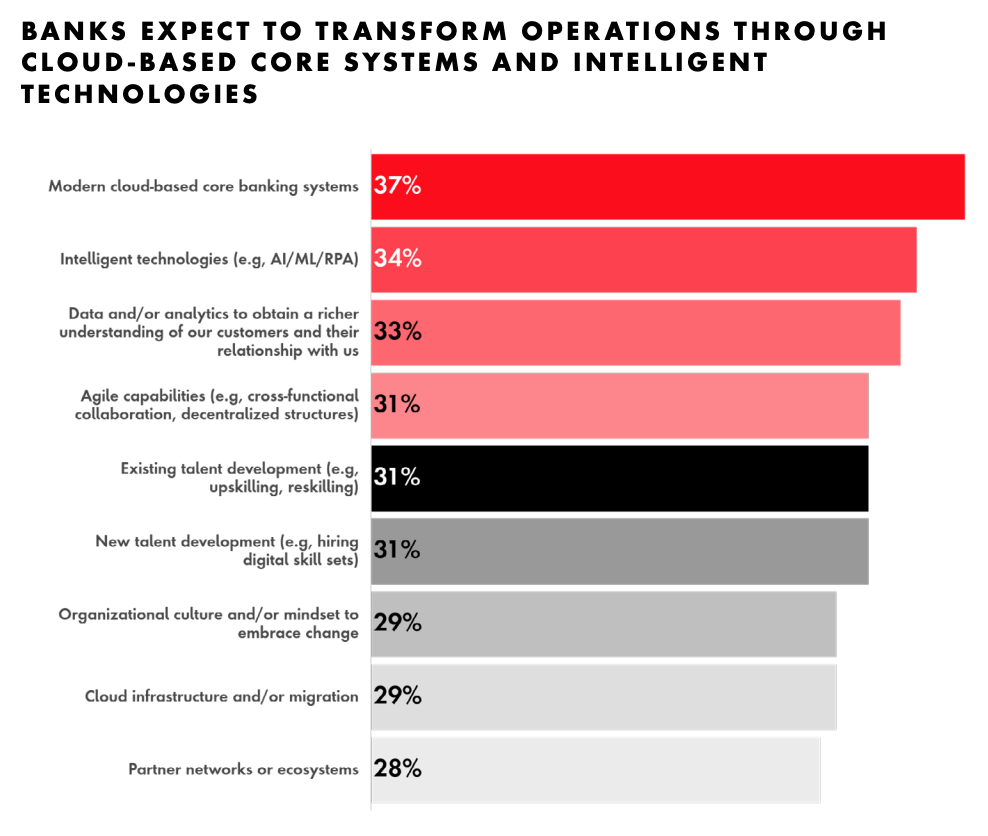

To reach their goals and provide superior customer experiences, banks believe they must modernize their internal operations by embracing cloud computing and adopting cutting-edge technology.

For the next three years, 37% of respondents globally identified modern cloud-based banking systems as a top investment priority, followed by intelligent technologies like artificial intelligence, machine learning (AI/ML) and robotic process automation (RPA) (34%), as well as data and/or analytics (33%).

Banks expect to transform operations through cloud-based core systems and intelligent technologies, Source: Global Banking Benchmark Study 2022, Publicis Sapient

Those figures are even higher in Southeast Asia, where four out of ten banks named investing in intelligent technologies among their top operation transformation priorities, while 44% identified adaptive, cloud-based architecture as a critical element for them to become digitally innovative.

These findings suggest that banks have become frustrated with their legacy core banking systems. These systems are complex, rigid, and lack the flexibility and agility to respond to changing customer and business needs, thus preventing meaningful improvements in customer experience and slowing the pace of transformation.

Similarly in a recent interview conducted by Fintech News Network, banking leaders shared why hypersonalisation is crucial to their organisation and how they are leveraging it to win over customers.

Barriers hindering digital transformation

Despite bold ambitions for digital transformation, the study also revealed several challenges hindering banks from making significant progress on executing their plans.

The COVID-19 pandemic, regulatory obstacles, legacy technologies and core systems, as well as the lack of operational agility were identified as the top barriers for Southeast Asian banks, named by 43%, 43%, 37% and 34% of respondents across the region, respectively.

Results in Southeast Asia are consistent with global findings where 36% of respondents cited COVID-19 as the main digital transformation barrier, followed by the lack of operational agility (31%) and regulatory challenges (31%).

COVID-19 cited as the main digital transformation barrier, Source: Global Banking Benchmark Study 2022, Publicis Sapient

The need for digitalization has gained urgency in Southeast Asia’s traditional banking sector as new digital challengers are beginning to enter the market.

Across the region, regulators have amended rules and introduced regulatory frameworks to allow and/or facilitate the entry of digital-first competitors.

Singapore has granted four digital banking licenses, and so far three digital banks have launched: GXS, the digital bank backed by super app Grab and incumbent telco Singtel, introduced its first product, a savings account, in August; and Ant Group-backed Anext Bank and Greenland Group-backed Green Link Digital Bank, both commenced operations in June, serving small and medium-sized enterprises (SMEs).

In Malaysia, the central bank granted five licenses in April but industry observers have warned that it would likely take these challengers at least a year before they’re able to commence operations.

And in the Philippines, all of the six entities that were granted a digital banking license in 2020 and 2021 are operational. These are Tonik, Overseas Filipino Bank, UnionDigital of UnionBank Corp., GoTyme Bank, UNOBank and Maya Bank.