Digital Bank CEOs Share Top 5 Trends Shaping the Future of the Industry

by Fintech News Singapore April 25, 2023In Asia, digital banking has been a growing industry over the past couple of years, owing to soaring demand for online and mobile alternatives, and positively evolving regulation.

However, the current macroeconomic environment, marked by rising inflation and a looming global recession, is driving up the cost of capital, making venture capitalists (VCs) more reserved on their investment decisions.

With VC funding drying up and economic uncertainty on the rise, Asian digital bank CEOs and business leaders are shifting their focus from growth at all costs to reaching profitability, industry stakeholders said during a discussion.

At the Elevandi Insights Forum during the 2022 Singapore Fintech Festival, the Asian digital bank CEO strategic roundtable brought together CEOs from leading digital banks across Asia as well as experts from American management consulting firm Oliver Wyman to discuss the state of the region’s digital banking sector, exploring existing growth opportunities as well as the risks shaping the future of the industry.

Forum participants discussed how industry players can navigate these turbulent times and manage these challenges, all the while maintaining profitability. Though many topics were tackled, five key themes emerged from the discussion.

Lending becomes central to digital banks’ profitability

The first theme outlined during the roundtable is the need for digital banks to focus on profitability.

Startups are experiencing an unprecedented and challenging environment with rising inflation and political instability. Investors are more cautious about deploying funding, spooked by an uncertain economic picture, plunging tech industry stock prices, and growing recession fears.

Against this backdrop, founders across the board are switching their focus from high growth to profitability.

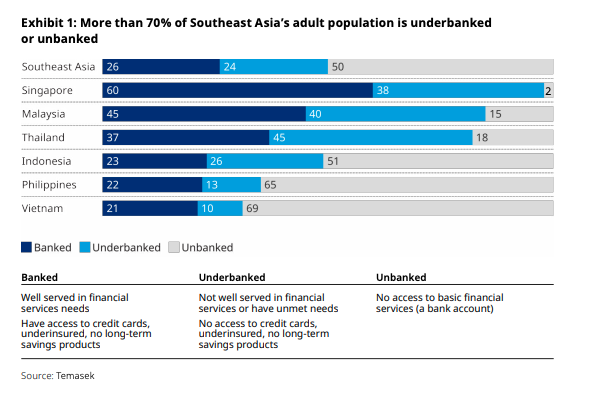

In Asia’s digital banking space, though reaching the unbanked and underbanked has been a key driver to gain traction, lending has proven to be the secret sauce to a winning and profitable strategy, the participants said.

The experts warned however that in order to unlock the full potential of lending, digital banks will have to overcome the challenges relating to servicing the unbanked and underbanked population, which, oftentimes, lacks the traditional data points required to underwrite lending decisions.

Hence, some providers have resorted to incorporating alternative data sources from ecosystem partners such as telecommunications companies to underwrite loans. Combining this alternative data with a customer’s particulars allows digital banks to better price the risk associated with lending to them, helping lenders make better informed underwriting decisions.

A modular, open technology architecture

The second theme outlined during the roundtable is the need for a modular, open technology architecture. This architecture must allow for rapid testing and launching of new products, as well as secure data sharing with ecosystem players, the participants said.

With the right foundational architecture in place, digital banks will be able to reap various benefits, they said. Banks will be able to consume data from ecosystem partners, such as telcos and e-wallets, to develop hyper-personalize products and services, as well as to underwrite loans.

Additionally, an open architecture allows digital banks to expand their distribution channels for banking services by enabling models such as embedded finance and banking-as-a-service (BaaS). For example, a digital bank could embed its APIs into an ecosystem partner’s customer journey to offer products such as loans and buy now pay later (BNPL) arrangements.

Open and trusted data

The third trend highlighted by forum participants is the need for digital banks to leverage open and trusted utilities such as national identity databases.

These digital utilities provide accessibility, affordability, and trust of banking services, allowing digital banks to simplify banking processes like onboarding and loan underwriting, the experts said.

Digital identity schemes like Singapore’s Singpass support electronic know-your-customer (eKYC), enabling digital banks to confirm the identity of a person remotely. Digital utilities also allow banks to make use of outside data from other financial bodies, such as credit agencies and other banks, to evaluate the risk of lending to an individual customer, streamlining the underwriting process.

Ultimately, this helps improve risk management and introduces efficiencies, leading to reduced cost to serve and enabling greater accessibility to banking services among the unbanked and underbanked.

Talent as a key driver of success

Forum participants were unanimous on the fact that attracting talent is currently one of the biggest challenges faced by Asian banks. Against this backdrop, business leaders agreed that they must focus on several key areas going forward.

First, teams must build and maintain the right work culture, and ensure that new hires are truly a fit for their culture. Developing and retaining this culture will be critical to attract and retain the right talent, the experts said.

Banks should also ditch traditional base compensation schemes and adopt schemes that are linked to performance, such as providing stock options. This will not only drive performance but also attract the candidates that are most confident in their ability to build a next-generation organization.

Finally, business leaders must provide the right environment for employees to learn, grow and feel empowered. This will be done by developing a core employer proposition that is compelling to their target talent pool with flexibility based on the employees’ preferences.

A conducive regulatory environment

Last but not least, forum participants said regulators will continue to play a critical role in the development of the digital banking industry, noting that although efforts have been made to facilitate the growth of the sector in Asia, more needed to be done.

Industry participants praised initiatives such as the switch from rules-based to risk-based approaches for KYC, as well as the numerous digital banking frameworks that have been launched across the region.

They also shared a wish list of regulations they wanted to see being introduced in the future. Key areas include the use of sandbox environments for testing new types of innovation alongside regulators, the expansion of infrastructure and collaboration efforts across borders, and initiatives to facilitate a level playing field between digital and incumbent banks.