Citi to Pilot Digital Platform for Commercial Banking Clients in Singapore, India, HK

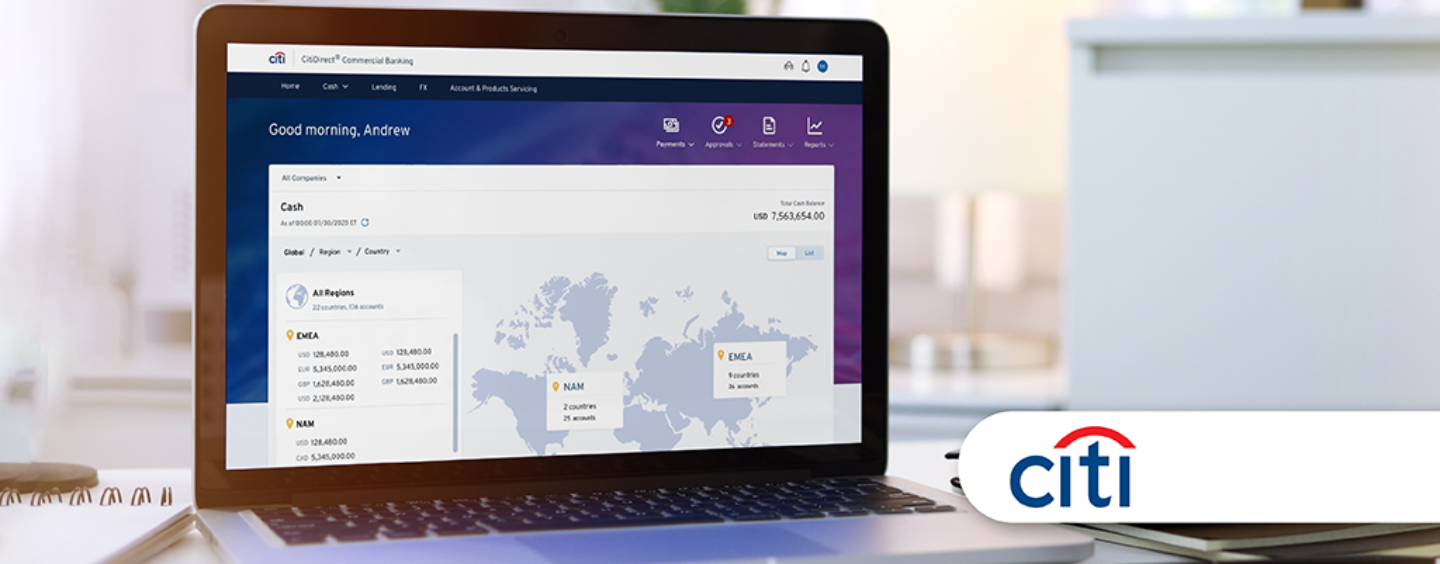

by Fintech News Singapore July 11, 2023Citi announced that it will pilot its new platform in the second half of 2023 across Singapore, India, Hong Kong, and the U.K. This is part of Citi’s significant strategic investment plan to meet the growing global needs of these clients by delivering a single-entry point digital platform.

It has been created in close collaboration with Citi Commercial Bank’s (CCB) clients, and as a result offers an intuitive and seamless digital experience.

Key features include access to data driven insights necessary to help inform decision making, efficient management of day-to-day banking interactions with Citi in one place.

Clients can also digitally open accounts and request new products and services, extending our self-service features, which significantly enhances the experience for clients as they grow, and their needs evolve.

The CitiDirect Commercial Banking platform is currently live in the U.S., with over two thirds of our U.S. client base actively using the platform.

Tasnim Ghiawadwala

Tasnim Ghiawadwala, Global Head of CCB commented,

“This is an important milestone in delivering on our commitments set out during Citi’s 2022 Investor Day. At the time, we spoke about our intention to deliver on a differentiated client experience through a single digital platform, that will empower clients and save them time, while offering them complete visibility and control. We anticipate that CitiDirect Commercial Banking will continue to evolve to support our clients as they grow their businesses globally.”

Shahmir Khaliq

Shahmir Khaliq, Global Head of Treasury and Trade Solutions added,

“The launch of CitiDirect Commercial Banking demonstrates how our Institutional Clients Group ecosystem works together to deliver excellence for our clients. We are very pleased that our partnership with our colleagues in Commercial Banking has resulted in this new and differentiated service.”