Why Fintech Super-Apps Are Transforming the East, But Not the West

by Johanan Devanesan November 1, 2023Fintech super-apps, often defined as mobile or web applications offering a plethora of services, from payments to financial transaction processing, have seen an incredible surge in popularity. For both individuals and businesses alike, they’ve transformed the way transactions and services are accessed. Yet, while Asia has rapidly embraced this trend, Western regions like the US and Europe seem less enthralled.

The Rise of Fintech Super-Apps

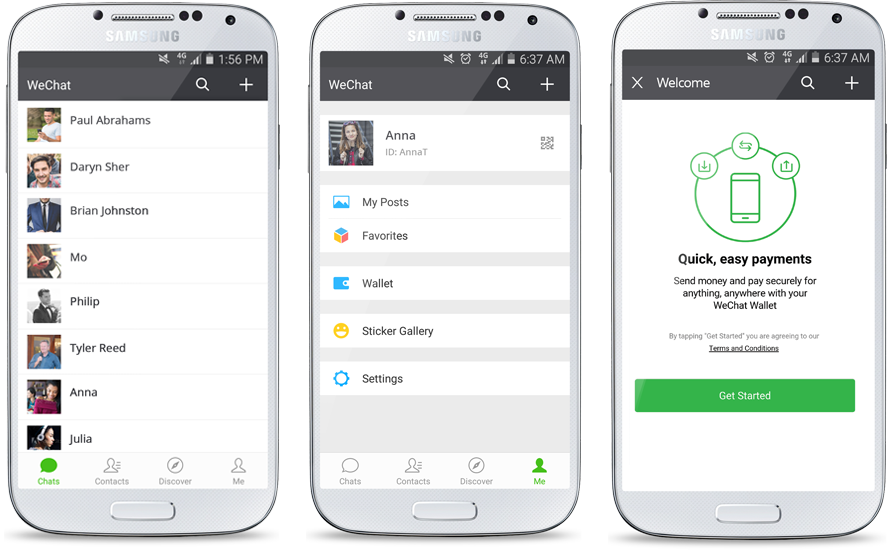

In regions such as China and Southeast Asia, super-apps with fintech functionalities are not a novelty but a part of daily life. The WeChat app originally from China, for instance, has seamlessly integrated into the everyday activities of numerous users, offering a diverse range of services from messaging and e-commerce to financial services. These apps not only simplify tasks for their users but have also introduced an array of possibilities for fintech businesses. Through them, these businesses offer a smooth, integrated experience for financial transactions.

However, the Western market’s response to super-apps is somewhat tepid. Take, for example, Elon Musk’s attempt to rebrand Twitter as X, aiming to provide a Western counterpart to WeChat, with a plethora of financial services within the single platform. This initiative was met with skepticism and raised questions. Several factors account for the West’s lukewarm reception.

Western consumers have a distinct inclination towards apps that cater to specific needs or niches. This can be traced back to the evolution of the digital landscape in the West, where the market saw the proliferation of specialised apps tailored for particular tasks. For instance, for banking, one might use a dedicated banking app, while for social interactions, distinct social media platforms are favoured.

The idea of amalgamating multiple functionalities into a single app often appears counter-intuitive to this user base. They value expertise and believe that an app designed for a specific purpose will cater to that need more effectively than a multifunctional platform.

Asia’s Adoption versus Western Hesitation

The Western regulatory landscape, especially in regions like Europe with frameworks like the General Data Protection Regulation (GDPR), is particularly stringent. These regulations are centred on protecting consumer data and ensuring companies handle it with the utmost responsibility.

Super-apps, by their nature, encompass a wide range of services, often necessitating extensive data sharing and storage across sectors. This expansive data handling can run afoul of Western regulations, requiring super-app developers to navigate a complex maze of compliance checks, thereby making their widespread adoption challenging.

The digital app ecosystem in the West is highly matured, with a multitude of specialist apps dominating various sectors. Each of these apps has built its loyal user base, optimised user experience, and entrenched itself in its specific niche. A new super-app entering this crowded space would not only have to provide superior functionalities across all its services but also convince users to transition from their trusted specialist apps. This necessitates significant innovation, user trust-building, and marketing efforts.

China’s rapid embrace of platforms like WeChat can be attributed to the country’s swift urbanisation combined with aggressive tech adoption and integration. This meant a large, rapidly modernising population was introduced to numerous services simultaneously via a unified platform.

In contrast, the Western digital infrastructure evolved more gradually, with users getting acclimated to one service at a time. This sequential adoption led to a fragmented app landscape, where each service has its platform. The lack of an integrated approach makes it challenging to introduce a unified platform after users have grown accustomed to separate apps for separate tasks.

Data privacy concerns have been a prominent topic in the West for several years. Fuelled by high-profile data breaches and growing awareness about digital rights, Western users are often circumspect about sharing personal data. They seek transparency on how their data is used and stored.

Super-apps, given their multifunctional nature, require access to a wide array of user data, from financial details to social preferences. This breadth of data collection could be daunting for Western users, making them hesitant to adopt such platforms.

The Potential of Super-Apps in Fintech

Regardless of the challenges faced in the West, it’s crucial to recognise the potential super-apps could harness in the fintech sector. They act as vital connectors, linking the fintech world with other sectors and promoting mutual growth. Their capability to simplify users’ experiences is commendable, potentially revamping processes like loan applications.

For fintech companies, the puzzle remains: how to leverage super-apps for optimal ROI, given these hurdles? To effectively utilise super-apps, fintechs must likely prioritise seamless integration and the user experience. Providing easy-to-access services within a super-app framework is fundamental for meeting users’ expectations of convenience. Ideally, user engagement would be at the helm of every decision.

The importance of personalised services can’t be overlooked either. While super-apps offer a goldmine of user data, it’s imperative to bear in mind that data privacy and compliance are paramount in the West.

The Road Ahead

In the dynamic world of fintech, platforms that provide insights into financial trends, streamline loan application processes, and deepen our understanding of user behaviour are indispensable. Such insights equip us to navigate the challenges specific to Western markets, refine services, enhance user engagement, and boost ROI.

Looking ahead into the future, it’s evident that innovations like blockchain and decentralised finance will redefine boundaries. Amidst these advancements, the constant goal remains: delivering exceptional value to customers while aligning services with the unique characteristics of Western markets.