Digital Assets and Sustainable Finance Take Center Stage at Singapore Fintech Festival

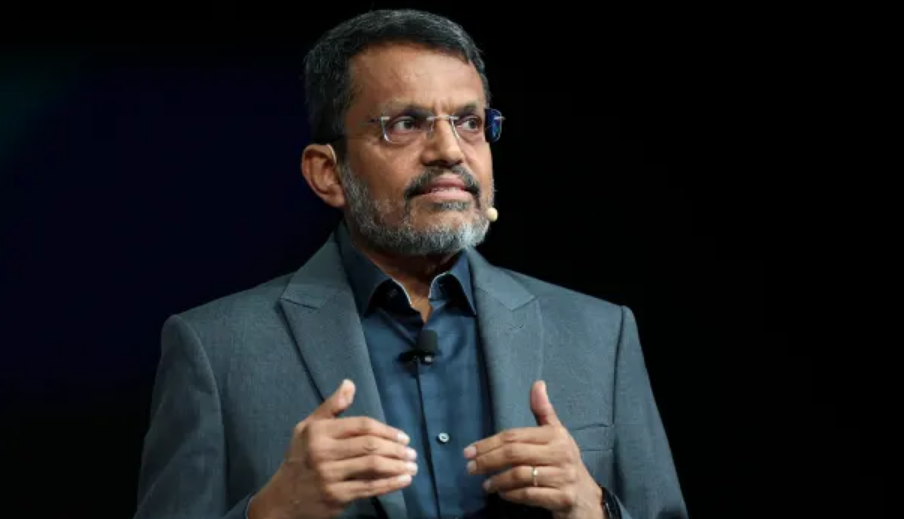

by Rebecca Oi November 21, 2023At the Singapore Fintech Festival 2023, Ravi Menon, Managing Director of the Monetary Authority of Singapore, delivered an insightful address on fintech’s current and future direction.

His speech thoughtfully reflected Singapore’s advancements in fintech since the previous year and a balanced perspective on the challenges and opportunities ahead.

Ravi articulated the nation’s approach to developing a financial ecosystem that is not only technologically advanced but also globally integrated and tuned to sustainable practices.

Instant payments revolution

Ravi Menon, Managing Director of the Monetary Authority of Singapore at Singapore Fintech Festival 2023

Ravi initiated his address by celebrating Singapore’s extraordinary progress in electronic payments. The journey in e-payments embarked on by Singapore has been nothing short of revolutionary. It commenced with domestic transfers before evolving into bilateral integrations and multilateral networks.

The bedrock of this transformation is the robust retail payments infrastructure, including Fast and PayNow, which has made seamless digital transfers across bank accounts and e-wallets possible.

These transfers are accessible 24/7 and come at zero cost. This infrastructure played a pivotal role in bolstering e-commerce and online services, particularly during the tumultuous times of the COVID-19 pandemic.

Furthermore, Singapore introduced a single QR code label, simplifying mobile payments for consumers and merchants alike. The government is actively pursuing the goal of complete QR code interoperability.

This effort will enable merchants to accept payments from various QR code-based payment systems through a single financial institution, simplifying the process.

A significant development was showcased at the Singapore Fintech Festival: a proof of concept (POC) for an upgraded system called SGQR+. This system was demonstrated at over 1,000 merchant locations at the festival venue and in the Changi district. SGQR+ included 23 different payment schemes, showcasing its wide-ranging compatibility.

The key advantage of SGQR+ is its ability to allow merchants to partner with just one financial institution while gaining access to various local and international QR code payment schemes.

This approach simplifies the payment process for merchants, making it easier to handle diverse payment methods without needing multiple agreements with different payment providers.

Cross-border payment innovations

Singapore’s prowess in the realm of cross-border payments is equally remarkable. The nation has successfully established bilateral visa payment linkages with countries such as Thailand’s PromptPay and India’s Unified Payments Interface (UPI), enabling direct fund transfers between individuals in Singapore and these nations.

Furthermore, Singapore has extended its reach by forging QR payment linkages with China, Malaysia, Thailand, and Indonesia, thereby enhancing convenience for travellers.

Another development is Singapore’s collaboration with the Bank for International Settlements (BIS) Innovation Hub on Project Nexus. This visionary initiative aims to establish a global public utility for secure, efficient, and affordable cross-border money transfers.

The ultimate vision is to build a coalition of willing partners, creating a global payment utility that allows users worldwide to send money across borders seamlessly.

Seamless financial transactions

Ravi spoke of a broader vision of an interconnected web of systems that seamlessly facilitate instant payment, clearing, and settlement. This vision hinges on three pivotal components: digital assets, money, and infrastructures.

Digital assets, represented as tokens, usher in direct exchanges without intermediaries, thus supporting atomic settlement and fractionalisation. This innovative approach eradicates settlement risk, repetitive reconciliation processes, and the need for substantial funding accounts.

Digital money, on the other hand, ensures secure and simultaneous payment, clearing, and settlement of digital or tokenised assets on a unified platform. This prevents complications from delayed clearing and settlement, especially in cross-border scenarios.

Digital infrastructures serve as the bedrock, hosting and executing digital assets and money. These infrastructures underpin the ownership and transfer of tokenised assets and digital money, with all relevant records maintained consistently across participating entities directly on the ledger.

To fully realise seamless financial transactions across digital asset networks, the key is to ensure interoperability. The goal is establishing a harmonious ecosystem where diverse digital asset networks can collaborate effectively and eliminate friction from cross-network transactions.

Digital assets and money

Project Guardian, a collective endeavour between MAS and industry stakeholders, is at the forefront of tokenising many asset classes. These include foreign exchange, bonds, and funds, aiming to unlock liquidity, streamline operational efficiency, and broaden investor access.

MAS has been collaborating with international regulators, such as the International Monetary Fund (IMF), to craft international standards and frameworks for asset tokenisation, thereby promoting trust and cooperation on a global scale.

Digital money, encompassing central bank digital currencies (CBDCs), tokenised bank liabilities, and well-regulated stablecoins, is instrumental in achieving an atomic settlement.

MAS is preparing to launch a pilot program in 2024 to issue wholesale CBDCs. Previously, MAS had only conducted simulations of issuing a CBDC within controlled test environments.

However, Ravi has announced that the central bank will soon collaborate with local banks in Singapore. The purpose of this partnership is to explore the use of a CBDC as a means of settling domestic payments.

In parallel, the provisional approval of stablecoins, compliant with MAS’ regulatory framework, illustrates the potential of well-regulated stablecoins to elevate the use cases of digital money.

Singapore has approved three entities issuing stablecoins compliant with MAS’s upcoming regulatory framework.

Two approvals will facilitate the issuance of StraitsX XSGD and StraitsX XUSD, stablecoins pegged 1-1 to Singapore Dollars and US Dollars, respectively. The third approval is for Paxos Digital Singapore to issue a new stablecoin backed by the US Dollar.

Foundational digital infrastructure

Ravi spoke on the critical need for a foundational digital infrastructure to foster interoperability among diverse networks.

The Global Layer One (GL1) initiative, spearheaded by MAS and key industry players, is poised to usher in a new era of global financial interoperability.

GL1 promises to serve as a global public good, facilitating seamless cross-border transactions while adhering to stringent regulatory requirements.

A facet of GL1 lies in its potential to facilitate regulatory compliance by design, whereby policy and regulatory requirements can be programmatically incorporated and automatically enforced in real-time.

This initiative underscores the paramount importance of open and interoperable networks in translating the vision of seamless financial transactions into reality.

The collaboration with financial institutions and international policymakers will be pivotal to the success of GL1, establishing an open and interoperable network that complies with regulatory demands.

Building a trusted sustainability ecosystem

In his concluding remarks, Ravi underscored the imperative of forging a robust sustainability ecosystem.

He brought attention to the pivotal Project Greenprint, a collaborative endeavour uniting MAS and the financial sector in their quest to establish a resilient data ecosystem to drive sustainable finance.

Project Greenprint represents a joint initiative between MAS and the financial industry to rationalise the collection, accessibility, and effective utilisation of environmental, social, and governance (ESG) data.

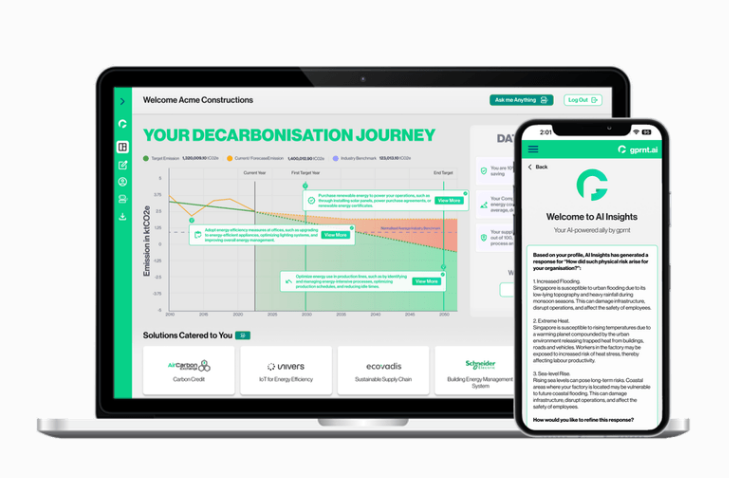

Recognising the hurdles posed by manual data collection, the intricacies of verification, and the fragmented nature of ESG reporting, Project Greenprint introduced “Gprnt.ai,” an innovative platform guided by Greenprint Technologies.

This comprehensive platform is geared towards streamlining and elevating ESG data reporting capabilities. It takes a proactive stance in addressing the specific needs of SMEs, simplifying their intricate reporting procedures. Through the strategic deployment of AI tools,

Greenprint aspires to establish a gold standard in how companies report their ESG data. In doing so, it offers crucial support for climate risk management and paves the way towards achieving net-zero emissions.

During his address, Ravi proudly heralded the launch of the Greenprint integrated platform, Gprnt.Ai, and the establishment of Greenprint Technologies, with valuable support from prominent partners such as HSBC, KPMG, UOB, and Microsoft.

In a significant development, Temenos has become the first core banking software vendor to collaborate with Gprnt.ai, further solidifying the platform’s role as a game-changing force in streamlining ESG reporting, particularly for small and medium-sized enterprises (SMEs). The announcement of this collaboration was made at the Singapore Fintech Festival.

Towards a smarter and more sustainable financial ecosystem

Singapore’s achievements in electronic payments, cross-border innovations, asset tokenisation, digital money, and foundational digital infrastructure showcase its commitment to shaping the future of finance.

Additionally, the focus on building a trusted sustainability ecosystem underscores the importance of responsible and sustainable finance.

The fintech industry, as outlined by Ravi, is not just about profits; it is about solving real-world problems, improving lives, promoting inclusivity, and securing a sustainable future for all.

The Singapore Fintech Festival continues to be a global hub for these transformative discussions and collaborations.

Ravi concluded,

“Fintech is more importantly about solving real-world problems, about improving people’s lives.” The journey towards a smarter and more sustainable financial ecosystem continues, fueled by innovation and collaboration.