The Asia Pacific region is grappling with an alarming escalation in scams and financial fraud.

These increasingly sophisticated and diverse deceptive practices undermine the financial stability of consumers and institutions and erode the trust and reputation upon which these entities stand.

From phishing scams and identity theft to complex financial fraud schemes, the methods employed by scammers are evolving rapidly.

This evolution in tactics targets individuals and institutions, leading to substantial financial losses and undermining the confidence in these systems.

This trend, if left unchecked, poses a grave threat to the economic and social fabric of the region.

The scam pandemic in APAC

The phenomenon of scams in the Asia Pacific (APAC) has evolved into a significant concern, mirroring the spread and complexity of a global pandemic.

This trend is alarming given the region’s cultural disposition towards trust, which scammers exploit with impunity.

In the APAC region, scams initially observed in the United Kingdom (UK) and Europe have found fertile ground, adapting to local contexts while retaining their core deceptive strategies.

“The prevalent phishing and SMS-based scams, though less aggressive than those in the UK, are steadily growing in complexity and impact,” said Tom Clifford, Strategic Accounts Director at Feedzai.

Singapore’s proactive approach to scam prevention

Singapore has emerged as a leader in proactive scam prevention measures within the APAC region.

Tom said that the government has not only applied significant pressure on financial institutions to ramp up their anti-scam measures but has also established dedicated centres for scam prevention.

These centres, alongside initiatives by the Singapore Police Force, underscore the seriousness with which the nation-state addresses the issue.

However, challenges lie in the liability held by financial institutions and payment service providers. Victims in some APAC countries have struggled to recover their losses.

To address this, the Monetary Authority of Singapore (MAS) advocates a shared responsibility policy, marking a potential watershed moment in the region’s approach to scam prevention.

Tom said that inspired by Singapore’s efforts, regulatory changes are expected to address this issue in Hong Kong, Australia, and more.

Feedzai and Chartis survey

To shed light on this growing challenge, Feedzai, in collaboration with Chartis, conducted a comprehensive survey among payment fraud professionals across the APAC region.

This survey, strategically timed with the Singapore Fintech Festival 2023 and International Fraud Awareness Week, sought to unravel financial institutions’ strategies and preparedness levels in combating scams.

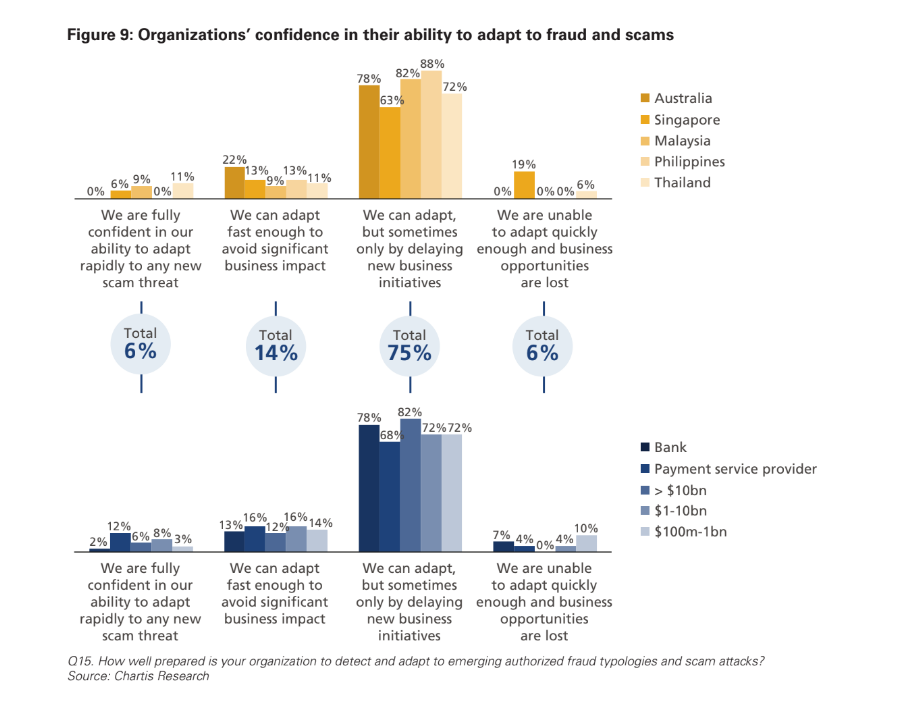

The findings were revealing, if not disconcerting; a mere 6 percent of respondents expressed confidence in their ability to adapt to the evolving nature of scams, highlighting the urgent need for enhanced measures and strategies.

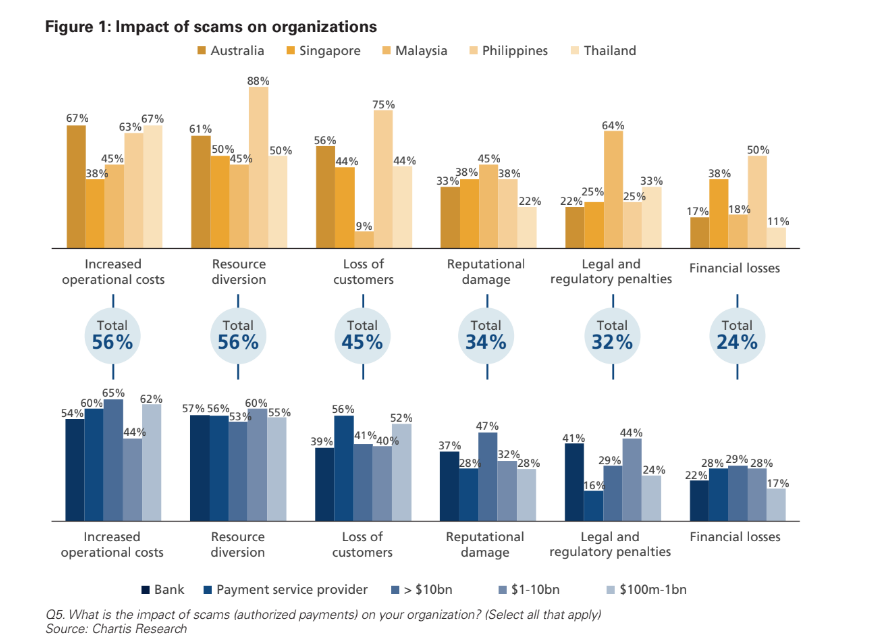

The impact of scams goes well beyond the immediate financial losses they cause. They inflict serious reputational damage on financial institutions, eroding the trust of customers — a fundamental aspect of the banking industry.

“Additionally, these scams have a significant human cost, often leaving victims in financial and emotional distress. This dual impact underlines the profound personal consequences these scams can have on individuals,” said Tom.

The issue’s complexity is further exacerbated by the fact that these scams are pervasive and continually evolving, posing a substantial challenge to traditional security measures.

As scams become more sophisticated, they necessitate equally advanced countermeasures, highlighting the need for constant vigilance and innovation in the ongoing battle against financial fraud.

Adapting to the evolving threat landscape

Tom shared critical insights on the changing landscape of scams within the Asia-Pacific region, focusing on Singapore. He highlighted that financial institutions across APAC are currently navigating a crucial juncture.

The challenge lies in striking a balance between embracing innovative financial solutions and implementing robust measures to prevent scams.

Tom acknowledged the commendable efforts made by Singapore in addressing scams. However, he spoke of the need for regional financial institutions to enhance their approach.

“In APAC, most financial professionals tend to be reactive rather than proactive in dealing with scams. For better adaptability, it’s essential to shift towards real-time proactive detection. This shift must begin with a thorough understanding of the available data and its application in behavioural analytics,” explained Tom.

He stressed the importance of integrating sophisticated technological solutions and cultivating a culture of vigilance and swift action in response to emerging threats.

With the advent of real-time payments, scams are becoming more sophisticated, exploiting these new channels. Tom underscored the challenge of maintaining control and security amidst this wave of innovation.

As APAC positions itself as a leader in the digital economy, it is imperative to develop robust control frameworks in tandem with these new payment methods to mitigate the associated risks effectively.

Feedzai’s technological edge in scam prevention

In the ongoing struggle against escalating scam threats in the Asia-Pacific region, Feedzai’s approach is a standout, exemplifying the power of technology in combatting financial crime.

At the core of their strategy is the robust integration of data analysis and machine learning (ML), bolstered by advanced artificial intelligence (AI). Their system is adept at processing vast amounts of real-time data, enabling a comprehensive analysis of customer behaviour, transaction patterns, and emerging trends.

This analytical prowess extends beyond traditional fraud detection methods, offering financial institutions a proactive shield against scammers.

A pivotal element of Feedzai’s approach is using behavioural analytics, empowered by ML, to pre-emptively identify and flag unusual or potentially fraudulent activities. This is particularly crucial in an environment where the nature of scams is constantly changing, necessitating technologies that can swiftly adapt to new data and evolving scam patterns.

By offering a data-driven fraud detection and prevention solution, Feedzai ensures that the whole story behind each transaction is unveiled, encompassing user behaviour, device information, and contextual data.

Such an innovative use of data and ML is not just about enhancing the ability to identify potential scams; it’s about fortifying the overall security of financial transactions across the Asia-Pacific region.

Feedzai’s commitment to continuously learning and adapting to the latest scam tactics positions financial institutions to stay one step ahead of scammers, creating a more secure financial landscape for all involved.

Tom recounted a compelling story demonstrating the efficacy of Feedzai’s technology in real-world scenarios. In this case, a Singapore customer fell victim to a tele-scam.

The scammer, cunningly posing as a government authority, convinced the customer to transfer money to a different account under the guise of offering protection.

“Our technology would be able to detect red flags such as ongoing calls, unusual behaviour on the user’s device, and hesitation in the transaction,” said Tom

He added, “We will promptly alert the customer, advising them about the potential scam and urging them to verify the transaction. This intervention could have potentially saved the customer from losing their money.”

Building a resilient financial ecosystem

The Asia-Pacific region is at a pivotal juncture in its fight against the rising tide of financial scams and fraud. Central to this battle is the MAS initiative for a shared responsibility policy.

This impending regulatory change promises to revolutionise the landscape of scam prevention in Singapore by more evenly distributing the responsibility of scam prevention among banks, payment service providers, and consumers.

If executed effectively, such a policy could significantly shift the approach to combating financial deceit, ensuring that all parties play a crucial role in safeguarding the financial ecosystem.

Additionally, collaborative efforts within the industry, as demonstrated by the Feedzai-Chartis survey, are essential. These collaborations facilitate the exchange of best practices, insights, and strategies, fostering a united and potent response across the region to counteract scams.

The necessity for a resilient financial ecosystem in APAC is more pronounced than ever in the face of these challenges. To achieve this, there must be a dual focus: integrating advanced technological solutions and fostering a cultural shift towards increased awareness and preparedness among all stakeholders.

Financial education, consistent updates on emerging scam trends, and clear, transparent communication between banks and their customers are critical to this resilience.

As the region navigates these complex challenges, the insights and initiatives of organisations like Feedzai and regulatory bodies will be critical in sculpting a more secure and trustworthy financial environment. The strategies and solutions developed and implemented today are laying the groundwork for a more resilient future to financial scams and fraud.

Click here to learn more about how Feedzai’s solutions reshape scam prevention in Asia-Pacific.