Singapore Fintech Festival 2023: Top 9 Highlights You Might Have Missed

by Fintech News Singapore November 22, 2023The Singapore Fintech Festival (SFF) wrapped up its annual event on November 17, 2023, concluding a multi-day fintech program that attracted an estimated audience 60,000+ attendees.

This year’s SFF brought together leaders and experts from around the world in finance, technology, and public policy to delve into the growth and adoption of artificial intelligence (AI) and explore how the technology can potentially be used in financial services.

Like previous editions, SFF 2023 saw several corporations, startups and public agencies announce their latest initiatives, achievements and products, leveraging the visibility, audience, media coverage, and networking opportunities provided by the large-scale gathering to gain maximum exposure and garner interest from key stakeholders.

This year, the Monetary Authority of Singapore (MAS) shared some key announcements, highlighting the city-state’s achievements in instant payments, ongoing efforts and collaborations to deliver seamless financial transactions, and new cross-border payment linkage capabilities with Malaysia and Indonesia. The regulator also shared updates on its works on digital money, asset tokenization and green fintech, outlining the path forward for initiatives such as Project Guardian, Project Orchid and Project Greenprint.

SFF 2023 also saw industry leaders and fast-growing startups including Visa, Mastercard, Ant International, UBS, Additiv and Bambu unveil new products and partnerships. These initiatives span a wide range of fields, focusing on advancing digital payments, remittances and asset tokenization, but also wealthtech and embedded finance.

While SFF 2023’s biggest announcements have already been extensively covered by the media, we’ve decided today to showcase some of the developments revealed during this year’s festival that may have fallen between the cracks.

IMF managing director addresses the rise of central bank digital currencies

Kristalina Georgieva, managing director of the International Monetary Fund (IMF) at the Singapore Fintech Festival 2023, Source: IMF, Nov 2023

Kristalina Georgieva, managing director of the International Monetary Fund (IMF), delivered a keynote speech at a festival, emphasizing advancements in the international digital finance sector. She highlighted the progress made in exploring central bank digital currencies (CBDCs), stressing their potential to enhance resilience in advanced economies and promote financial inclusion.

Georgieva, however, cautioned against private forms of money, citing CBDCs as a safer alternative. She also discussed the role of AI in conjunction with CBDC, emphasizing AI’s potential to amplify some of the benefits of CBDCs and to improve financial inclusion. She stressed, however, the need for privacy protection.

Georgieva unveiled the IMF’s CBDC handbook, which is intended to collect and share knowledge on CBDCs for policymakers around the world, and revealed the IMF’s participation in Project Guardian as observers, advising on implications for the international monetary system.

Georgieva highlighted the need for regulatory guidelines which she said are necessary to prevent financial crimes, and praised solutions like regtech to reduce compliance costs. She called for open-mindedness and collaboration among policymakers and businesses for the integration and stability of the international monetary system, urging businesses and policymakers to accelerate efforts to tap into the potential of the digital money sector.

The next phase of fintech development

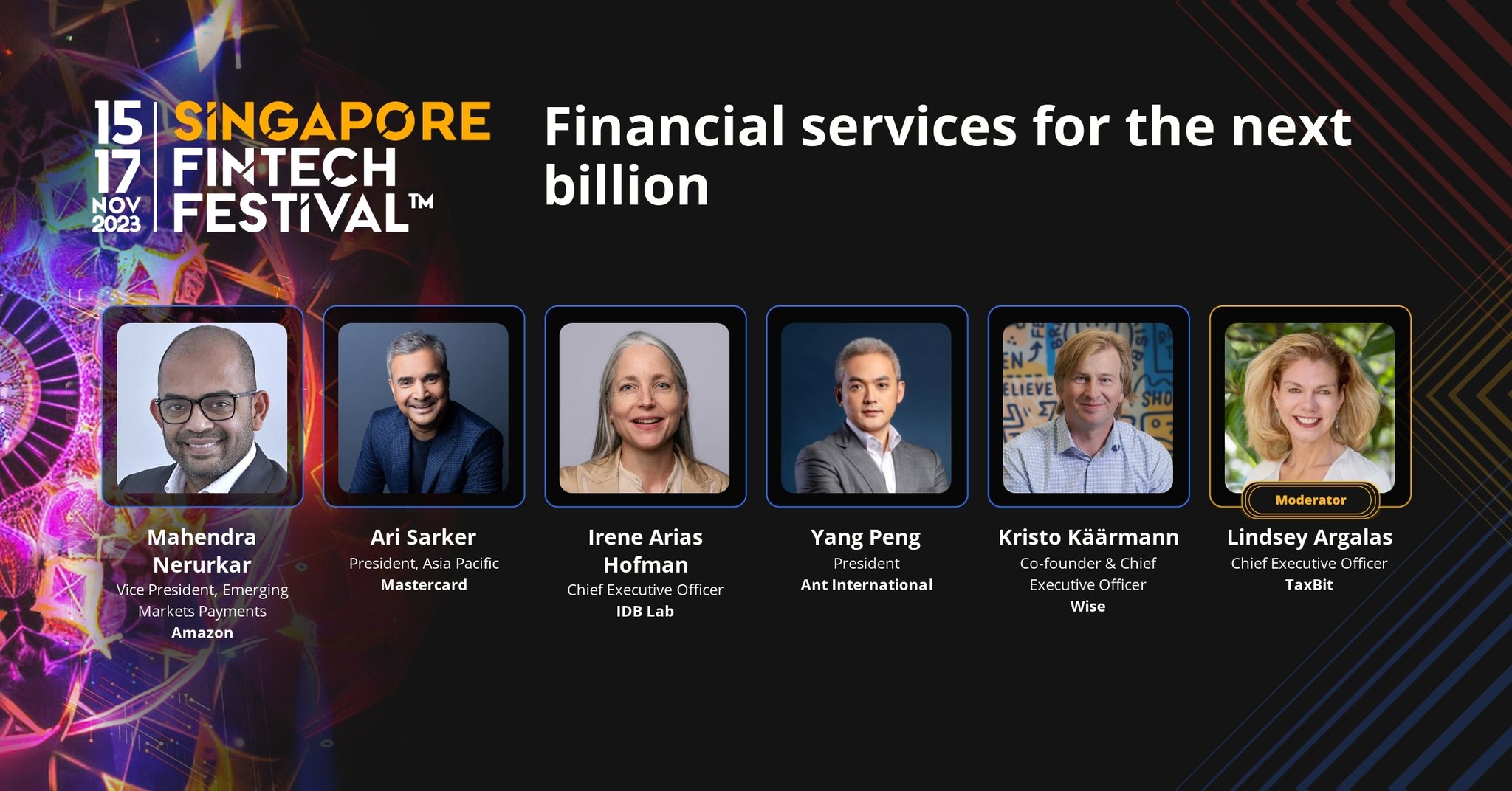

“Financial Services for the Next Billion” panel at the Singapore Fintech Festival 2023, Source: Singapore Fintech Festival, Facebook, Nov 2023

Speaking on a panel titled “Financial Services for the Next Billion”, Yang Peng, president of Ant International, the international business unit of Ant Group, cited three key points that will differentiate the next decade of fintech innovations from the past.

First, policymakers and central bankers will play a more active role in transforming financial infrastructure globally, citing the examples of open banking projects being rolled out in over 68 countries around the world, as well as real-time payment schemes such as Brazil’s Pix, which already runs 160 million instant payment transactions a day, at almost zero cost.

Second, new technologies such as AI, privacy computing, and large language models will drive new stages of financial inclusion, following prior innovations including digital wallets, paytech and credit tech which drove the first wave of fintech development and access improvement.

Third, collaboration across sectors will become essential, facilitated by technologies like privacy computing. With privacy computing, all parties can pool data and information to create greater, broader-based growth, without sacrificing privacy and protection, providing new guardrails of trust, Yang Peng.

The executive also shared Ant International’s strategic approach, highlighting the firm’s focus on cross-border payments, merchant services, small and medium-sized enterprise (SME) support, and micro-business banking.

Citi unveils blockchain-powered FX solution under Singapore’s Project Guardian

American banking group Citi announced that it had developed a new application that uses blockchain infrastructure to price and execute bilateral spot foreign-exchange (FX) trades.

The on-chain solution is able to provide real-time streaming of price quotes while recording trade executions on a blockchain, which supports the immutable, cryptographically secure record-keeping of trade data, the bank said. It uses a private permissioned instance of the Avalanche blockchain to capture price quotes, as well as trade confirmations specific to each counterparty.

The solution allows for compliance and conformity with institutional practices and regulatory requirements, and only gives access to the underlying trade details to the counterparties to a quote or trade, it added.

While the current phase of the application is only being tested for spot FX for USD/SGD, the underlying solution could be used for any fiat currency pair, Citi claimed.

The application is part of Project Guardian, a collaborative initiative by MAS and the financial industry which seeks to test the feasibility of applications in asset tokenization and decentralized finance (DeFi). For the project, Citi collaborated with T. Rowe Price Associates and Fidelity International.

SBI announces forthcoming launch of Yono Global app in Singapore and the US

Yobo SBI app illustration, Source: Google Play

The State Bank of India (SBI) will soon be launching its mobile banking app Yono Global in Singapore and the US, offering digital remittance and other services to its customers, Vidya Krishnan, deputy managing director of IT at the central bank told the Press Trust of India, the country’s largest news agency, at SFF 2023.

In Singapore, SBI will be integrating its Yono Global app with PayNow, the city-state’s near-instant real-time payment system, and the app will be launching soon, the official said.

At the event, Krishnan held talks with Singapore-based digital platform enablers as well as MAS. “We are constantly working on the remittance story between India and Singapore, given the large number of Indian diaspora in the city state,” Krishnan stated.

SBI currently offers its Yono Global app in nine different countries. The Indian central bank claims its foreign operations have a total balance sheet size of US$78 billion.

UnionDigital Bank to launch sachet loan product in 2024

UnionDigital Bank, the digital banking unit of Unionbank of the Philippines, is planning to introduce a “configurable” sachet loan product in 2024.

UnionDigital Bank CEO Henry Rhoel R. Aguda told reporters at the event that the new product will target micro-entrepreneurs that typically fall victim to loan sharks.

“We’re moving to more frequent lending and shorter tenors,” he said. “Imagine a day where you want to borrow, you can say that you only want it for six weeks and you want to pay for it weekly. We want to make it configurable.”

The product will be introduced in the UnionDigital app next year and Aguda said it will allow borrowers to configure the tenor of the loan based on their capacity to pay—from weekly to as short as a day. Borrowers will be able to take out micro-loans of PHP 500 (US$9) and the interest rates will be determined by the bank’s AI solution that calculates risk based on alternative data and spending patterns.

The product will target the mass market, addressing the day-to-day financial needs of typical Filipino households, sari-sari store owners, wet market vendors, fisherfolk, and farmers, he stated.

Philippine public-private partnerships to reinforce fintech ecosystem

Philippine president Ferdinand Marcos Jr. delivers holographic speech at the Singapore Fintech Festival 2023, Source: UnionDigital Bank, LinkedIn, Nov 2023

At the event, Philippine president Ferdinand Marcos Jr. delivered a holographic speech, emphasizing that both local and global public-private partnerships are playing a vital role in enabling the Philippines to adopt new technologies and strengthen the country’s fintech ecosystem.

Earlier this year, the Marcos Jr. administration’s Private Sector Advisory Council (PSAC) created the GoDigital Pilipinas movement to provide practical recommendations and empower Filipino citizens through technology. PSAC comprises industry leaders and experts spanning six primary sectoral groups, including agriculture, digital infrastructure, jobs and healthcare.

GoDigital Pilipinas will assist the government in creating policies and programs to promote the development of digital infrastructure and services, expanding access to digital technologies and digital literacy, and promoting digital entrepreneurship and innovation, among other things.

TiE Global Summit 2023 debuts in Singapore

The annual TiE Global Summit was held in conjunction with SFF this year, encouraging the exchange of ideas between the world’s largest entrepreneurship event and the world’s most impactful fintech festival.

The year’s TiE Global Summit, themed “#GoodForTheWorld”, highlighted the role of entrepreneurship in driving innovative solutions and addressed emerging trends in sustainability, technology, and social impact. It attracted over 2,000 attendees and featured thought leadership sessions and panel discussions with speakers from companies like Ant Group, GitHub, Microsoft, and DBS Bank.

Some key highlights at the event included:

- TiE Women Global Pitch Competition, a program designed to embrace, engage and empower women entrepreneurs globally irrespective of size of enterprise, origin, and background;

- TiE-KPMG SEA Entrepreneur of the Year Awards, which recognized the top business leaders from the Southeast Asia region; and

- The Big Spark, an episodic show bringing the most promising startups and the biggest judges, investors and ecosystem players together to shine the spotlight on Southeast Asia’s most innovative, inspiring entrepreneurial talent and their game-changing business ideas.

Subsequent to the 2023 TiE Global Summit, the Indus Entrepreneurs (TiE) launched the TiE Indonesia Chapter on November 19 to foster entrepreneurship and nurture Indonesian startups and micro, small and medium enterprises (MSMEs) with the motto “Better Business Better World”.

Founded in 1992 in Silicon Valley, TiE claims to be the largest entrepreneur and investor community in the world, boasting over 15,000 members and a track record of 25,000+ startups supported.

MYbank showcases digital MSME financing solutions

At SFF 2023, MYbank, a digital bank in China and an associate of Ant Group, showcased digital solutions with the goal of improving accessibility to financial services for MSMEs and the agricultural sector, Asia Tech Daily reported.

The showcased solutions included Tomtit for rural finance, Goose for supply chain finance, and Lark for automated credit line management. These solutions were specifically designed to assist MSMEs in overcoming financing barriers and enhance the accessibility of financial services for MYbank’s 50 million MSME clients.

SMEs account for approximately 90% of businesses globally and contribute to over 50% of worldwide employment, according to the World Bank. Despite their substantial presence and the critical role they play in the global economy, SMEs often face challenges in accessing finance.

Leveraging innovative risk-management technologies, MYbank claims it has been able to extend credit lines to SMEs while maintaining a controlled non-performing loan (NPL) ratio. According to the firm’s 2022 annual report, the NPL ratio of SME business loans was 1.94% by the end of 2022, lower than the industry average of 2.18% at the time.

New study reveals Asia-based businesses have strong decarbonization aspirations

GoNetZero, a decarbonization solutions platform backed by Singapore Stock Exchange-listed Sembcorp Industries, conducted a survey of members of the American Chamber of Commerce in Singapore and European Chamber of Commerce in Singapore to understand Asia-based firms’ decarbonization aspirations, challenges in sustainability initiatives, and net-zero target actions.

Results of the survey, presented at SFF 2023, show that businesses in Asia have strong intentions to decarbonize, with 67% of the surveyed firms having already set net-zero targets. However, findings also reveal that firms are facing external and internal challenges contributing to the gap between their net-zero aspirations and actions.

These challenges include insufficient knowledge on how to decarbonize (53%), difficulty in attaining budget approvals for decarbonization initiatives (42%), inadequate clear measurement and reporting frameworks of carbon emissions (36%), and limited affordable renewable energy options to offset carbon emissions (23%).

Infographic: Top challenges to decarbonization among Asia-based businesses, Source: GoNetZero, Nov 2023