Indonesia Hosts Second Highest Number of Fintech Unicorns in Southeast Asia

by Fintech News Indonesia December 18, 2023Across Southeast Asia, Indonesia is rapidly emerging as a prominent fintech hub, a burgeoning industry that’s been growing on the back of economic growth, increased technology adoption and government support for fintech development.

Data from market intelligence firm CB Insights reveal that Indonesia is currently home to seven unicorn startups, among which four fintech companies. The number is the second highest in Southeast Asia behind only Singapore, a well-known regional fintech leader, which now houses seven fintech unicorns.

Indonesia’s billion-dollar fintech startups are worth a cumulative value of US$5.13 billion, and have raised a total of US$2 billion in venture and debt funding, the data show. These companies operate across a wide range of industry sectors which include digital payments, neobanking and wealthtech.

Today, we take a close look at Indonesia’s fintech unicorn startups, delving into their offerings, value propositions and growth strategies.

Akulaku – US$2 billion

Indonesia’s most valuable fintech startup is Akulaku, an online banking and digital finance platform valued at US$2 billion.

Founded in 2016, Akulaku provides digital banking, financing, investment and insurance brokerage services, targeting financial underserved demographics. Its products include the Akulaku virtual credit card and e-commerce platform, the Asetku online wealth management platform, and Bank Neo Commerce, a digital and open banking platform.

Akulaku, which has a presence in China, Indonesia, the Philippines and Malaysia, claimed 26 million users in 2021, representing a 242% annual growth rate. Total revenue, meanwhile, grew by 122% to US$598 million and total gross merchandise value (GMV) increased by 136% to US$5.8 billion.

Akulaku has raised US$665 million in venture and debt funding so far, data from CB Insights show. The startup’s last round was a US$200 million investment from Japanese megabank Mitsubishi UFJ Financial Group announced in December 2022. At the time, Akulaku said it would use the proceeds to expand into new territories, markets, and products.

Despite business growth, Akulaku has faced some regulatory setbacks this year. In October, the Financial Services Authority (OJK) of Indonesia imposed restrictions on the company’s buy now, pay later (BNPL) business, citing Akulaku’s failure to carry out supervisory actions requested by the regulator.

Dana – US$1.13 billion

With a value of US$1.13 billion, Dana is the second most valuable fintech startup in Indonesia.

Launched in 2018, Dana is a digital wallet-based technology financial company that provides payment platforms and financial services in Indonesia. The company offers a complete digital transaction suite that is safe, easy and convenient for users, merchants and financial institutions.

For consumers, the Dana digital wallet allows them to add their cards or bank accounts to make a payment, transfer funds, pay bills, shop online, and top-up their mobile account.

For merchants, the technology provides wide developer integration options and easy onboarding, supporting the national QR Indonesia Standard (QRIS) network, as well as the national open API payments standards (BI-SNAP).

Dana claims it serves more than 135 million users in Indonesia. As of mid-2022, the company processed an average of over 10 million transactions a day and said that its technology was accepted by over 18 million merchants on the national QR Indonesia Standard network.

Dana raised US$250 million in VC funding in August 2022 from local conglomerates Sinar Has and Alibaba Group’s Lazada Group to expand in its home country. The company said at the time that it would use the proceeds to invest in new tech and roll out more financial services.

Most recently, Dana has been making inroads into social commerce and introduced a group buying platform called BoraBora. The platform, an initiative under Dana’s venture studio arm Dana Ventures, will build products that align with the digital payment firm’s core financial services, a top executive told DealStreetAsia in February.

Xendit – US$1 billion

At the third position is Xendit, a payment services company valued at US$1 billion.

Founded in 2015, Xendit provides payment solutions and simplifies the payment process for businesses. It allows merchants to accept payments in various methods including direct debit, virtual accounts, credit and debit cards, e-wallets, retail outlets, and online installments; disburse payroll; run marketplaces and more, on an easy integration platform supported by 24/7 customer service.

Xendit, which serves businesses in Indonesia, the Philippines and Malaysia, claims more than 3,000 customers, including Samsung Indonesia, GrabPay, Ninja Van Philippines, Qoala, Unicef Indonesia, Cashalo and Shopback. In 2022, the startup said it tripled annualized transactions from 65 million to

200 million and increased total payments value from US$6.5 billion to US$15 billion. Further, the company continued its dynamic growth by increasing sales 10% month-over-month since its inception.

Xendit has raised US$538 million in funding so far. Its last round was a US$300 million Series C secured in May 2022 to enter new markets, enhance its payment platform, and expand its business lines.

A spokesperson told Katadata.co.id in July that the company was now reportedly looking to enter Thailand and Vietnam by the end of the year. Most recently, it announced a partnership with lending infrastructure provider Finfra to provide small and medium-sized enterprises (SMEs) across Indonesia with revenue-based financing.

Ajaib – US$1 billion

Finally, the fourth and last fintech unicorn from Indonesia is Ajaib, an online brokerage platform valued at US$1 billion.

Founded in 2018, Ajaib is an online wealth management solution that allows users to buy and sell financial products including stocks, exchange traded funds (ETFs), and mutual funds. The platform targets first-time millennial investors in Indonesia, with the goal of increasing financial inclusion.

Ajaib does not offer commission-free trading, but does apply lower fees compared to its competitors. The company also claims it is the first online stockbroker in Indonesia to have scrapped minimum capital requirements.

Ajaib said in July that it had recorded 3 million retail investors for its stock trading and Ajaib Crypto products in the first half of 2023, a 50% increase from November 2022. The company claims it is now one of the largest brokerages in the country by number of transactions.

Ajaib joined the unicorn club in October 2021 after a US$153 million Series B fundraise. The round brought the startup’s total funding to about US$243 million.

This year, Ajaib has been focusing on launching new features and services, including the Ajaib Prime service for premium customers, as well as new capabilities for stock traders and advanced investors.

Indonesia’s booming fintech sector

Indonesia’s fintech sector has witnessed rapid growth over the past decade. Between 2011 and 2022, the number of fintech players in the country increased six-fold, rising from a mere 51 active companies to 334, a 2023 report produced by AC Ventures and Boston Consulting Group says.

Driving this growth has been the surge of customer engagement with fintech offerings. According to the report, Indonesia recorded more than 63 million e-wallet transactions in 2021, representing a compound annual growth rate (CAGR) of 123% from 2017.

In the wealth vertical, the total number of investors in the Indonesian capital market increased 37.5% year-on-year, reaching 10.3 million investors in December 2022 from 7.48 million investors at the end of December 2021, according to data from Kustodian Sentral Efek Indonesia (KSEI), a central securities depository in the Indonesian capital market.

Customer penetration for payments, lending, and wealth in Indonesia, Source: Indonesia’s Fintech Industry is Ready to Rise, AC Ventures/BCG Group, March 2023

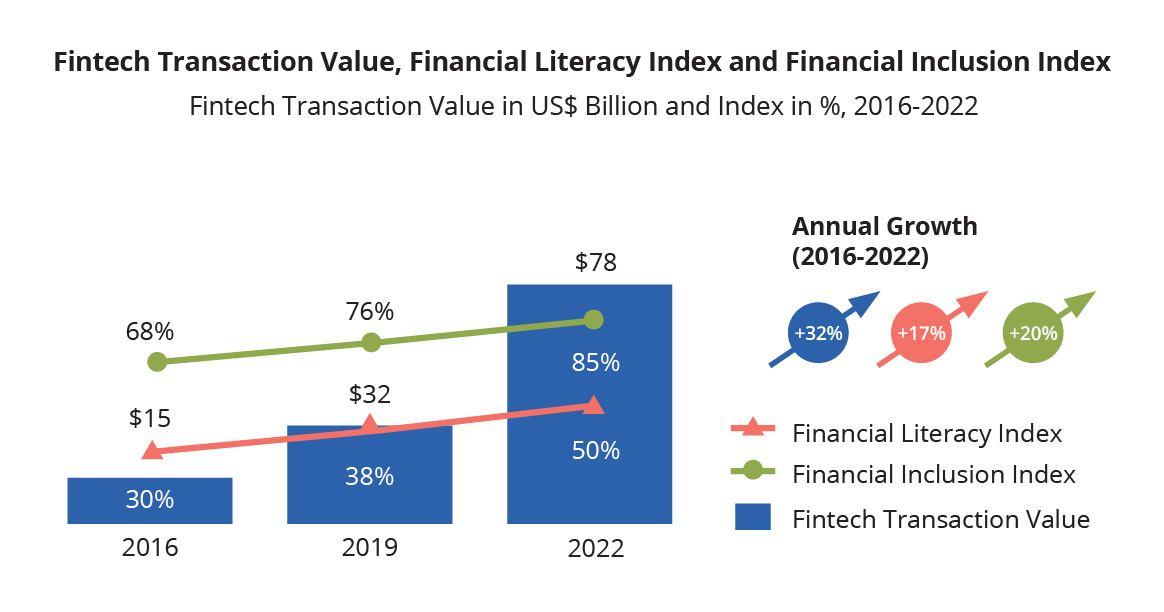

With fintech adoption in Indonesia on the rise, the country is also observing a simultaneous improvement of financial literacy and financial inclusion, a 2023 study by East Ventures, Katadata Insight Center (KIC) and PwC Indonesia found.

The research, which looked at the digital competitiveness in 38 provinces and 157 cities/regencies in Indonesia, revealed a remarkable increase in digital transactions, surging by 32% this year compared to 2019.

This surge was accompanied by a 17% rise in financial literacy and a substantial 20% improvement in financial inclusion, metrics which indicate progress in awareness and access to financial tools fueled partly by the proliferation of fintech solutions.

Fintech transaction value, financial literacy index and financial inclusion index, Source: East Ventures – Digital Competitiveness Index (EV-DCI) 2023, East Ventures, Katadata Insight Center (KIC) and PwC Indonesia, Sep 2023

Featured pictured: editied from freepik