Singapore Made Up 59% of ASEAN Fintech Deals in 2023 Amid Funding Winter

by Johanan Devanesan January 18, 2024In the recent past, Singapore’s fintech sector has emerged as a beacon of innovation and growth within the ASEAN region. However over the past year, the fintech sector in Singapore, reflecting global trends, is currently experiencing a significant funding slowdown.

This period, often referred to as a ‘funding winter’, has seen levels of fintech funding in both global and ASEAN markets drop to their lowest since 2020. Despite these hurdles, Singapore has emerged as a resilient leader, accounting for a significant proportion of fintech funding in the region.

The State of Fintech Funding in Singapore and ASEAN

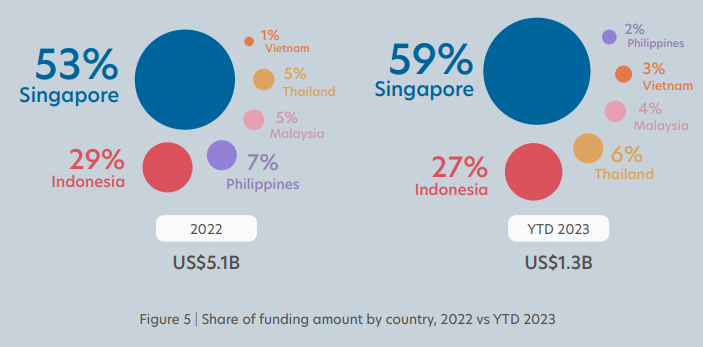

The 2023 FinTech in ASEAN report, a joint endeavour by UOB, PwC Singapore, and the Singapore Fintech Association, illuminates the current funding landscape globally and in the region. It reveals that Singapore accounted for an impressive 59% of the fintech funding in the ASEAN region last year, a substantial share amidst the downturn. However, the total funding in ASEAN was merely US$1.3 billion, representing a scant 3% of global fintech funding, marking the region’s lowest in three years.

Regionwide, the average funding amount among the top 10 funded firms saw a decline of more than half in 2023 to US$94 million as the region saw only three mega deals valued at over US$100M, which accounted for close to 50% of total fintech funding in the sector. Those mega deals were led by Singapore fintech firms Advance Intelligence Group, Bolttech, and Indonesia’s Kredivo Holding.

In ASEAN fintech funding, Singapore and Indonesia continue to lead, contributing a combined 86% to the region’s 2023 total funding. In contrast, the Philippines witnessed a significant drop in its funding share, primarily due to the absence of large-scale deals in 2023. The funding landscape also underscored a shift towards early-stage companies, which now command a larger portion of the investment pie, a stark contrast to previous years where mature companies were predominant.

Investor Behaviour in a Challenging Environment

Globally, the fintech sector grapples with the repercussions of economic uncertainties and high-interest rates, leading to a noticeable decline in funding. The total funding amassed in 2023, amounting to US$44 billion, fell short of the US$58 billion recorded in 2020, the previous lowest year. Particularly, the six biggest ASEAN markets observed a steep 75% decline in investments, with the number of deals halving and average deal sizes reverting to levels seen prior to the COVID-19 pandemic.

Interestingly, the top 10 funded companies saw their average funding fall by more than 50% in 2023 to US$94 million. However, a shift towards early-stage firms was noted, with six out of the top 10 being early-stage companies, a significant increase from only two the previous year.

The prevailing macroeconomic conditions have nudged investors towards a more cautious approach. There is an increased focus on scrutinising the fundamentals of companies before committing to new funding rounds. This shift in investor behaviour is evident in the reduced number and size of deals, as investors seek to mitigate risks in an unpredictable economic climate.

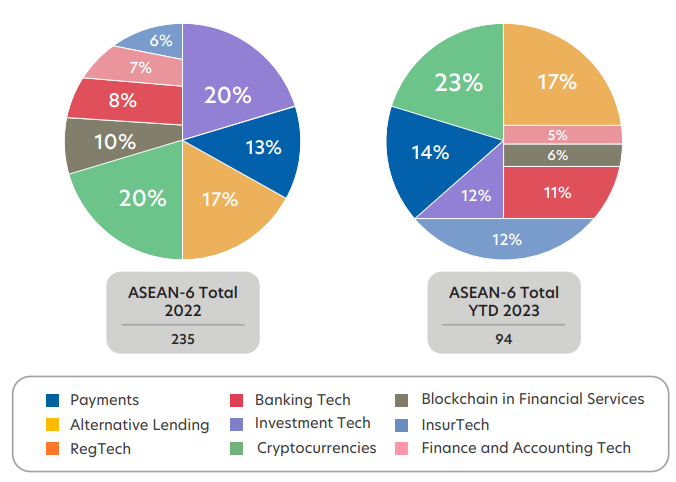

The fintech funding landscape in 2023 marked a departure from the previous year’s trends. Unlike 2022, where the payments category dominated the top deals, 2023 witnessed a more diverse distribution across various fintech categories.

In 2023, four out of the top five fintech funding deals in ASEAN were from Singapore, with the exception being the biggest deal going to alternative lender Kredivo’s Series D valued at US$270 million. This diversification indicates a maturing market where investors are spreading their investments across different fintech solutions.

Top Deals and Emerging Patterns

Whilst Singapore and Indonesia dominate in ASEAN fintech funding, together accounting for a whopping 86% of the regional pie, other countries like Vietnam and Malaysia are also creeping up as slightly more notable contributors. Alternative lending, representing nearly a third of ASEAN fintech funding, alongside insurtech, bucked the overall decline in funding for 2023. In Malaysia, for instance, alternative lending firms stood out, securing the most funding, a trend observed the previous year as well.

The resilience of the fintech sector is further exemplified by the performance of specific sectors like alternative lending and insurtech. These sectors defied the overall downtrend by exceeding their total funding amounts for 2022, partly due to significant deals involving fintech firms based in Singapore and Indonesia.

Number of funding deals by fintech categories, 2022 vs 2023. Source: 2023 FinTech in ASEAN: Seeding the green transition; UOB, PwC Singapore, and SFA

Despite regulatory caution in Singapore regarding cryptocurrencies, this sector remained vibrant in terms of deal numbers, albeit its share of funding observed a decline. Crypto firms inked the highest number of deals in the region, exactly a third (33%) out of Singapore’s total 51 deals last year. However, its share of funding amount declined by 10%, as investors steered clear of overvaluation.

While alternative lending made up nearly a third of ASEAN fintech funding in 2023, that was not the case for Singapore where it was only 12% of the total. Instead, insurtech dominated Singapore with a third (33%) of funding thanks to the aforementioned mega deals.

The Role of Singapore in Regional Fintech

Singapore’s position as a leader in the ASEAN fintech space is not merely about funding. The country has developed a robust ecosystem that supports fintech innovation through favourable regulations, a skilled workforce, and a culture of entrepreneurship. This ecosystem has enabled Singapore to attract not only funding but also talent and technology, reinforcing its status as a fintech hub.

As the fintech sector navigates these challenging times, the trends observed in 2023 are indicative of the sector’s resilience and adaptability. The focus on early-stage companies, diversification across various sub-sectors, and the strategic positioning of Singapore and Indonesia as leaders in the region are signs of an evolving landscape. The forthcoming years will likely see continued innovation and adaptation as the sector seeks to rebound from the current funding winter.

Singapore’s fintech sector, mirroring global trends, is navigating a challenging funding landscape characterised by a downturn in investment. However, the nation’s significant influence in the ASEAN fintech funding arena, coupled with its robust ecosystem and sturdy regulatory oversight, positions it well to weather these challenges.

The trends and shifts observed in 2023 underscore the sector’s resilience and adaptability in the face of global economic uncertainties. As the industry continues to evolve, it will be imperative to monitor how these trends develop and what new dynamics emerge in the fintech funding ecosystem.

Featured image credit: Edited from Unsplash