Emerging technologies are critical for wealth management firms as economies faced a dampened investment environment in 2023, with disappointing equity returns and sky-high interest rates. As a result, wealth preservation became the most crucial goal for high-net-worth individual (HNWI) investors last year. So, how will this shape the wealth management trends in Asia in 2024

Expect a renewed focus on emerging technologies, stable returns, and newer customer segments for wealth management firms.

Looking back at 2023

Last year, Capgemini’s Wealth Management Top Trends 2023 anticipated that wealth management firms would expand their digital capabilities and offerings to include digital assets; this trend played out as firms pursued rapid digital expansion.

The report also highlighted firms expanding asset classes, with forays into ESG-focused assets, as improving ESG metrics became a key priority.

The report also foretold the growing importance of an expanding customer base for wealth management firms, with the affluent wealth band becoming a key focus in 2023.

It also anticipated the need for enhanced digital tool adoption for wealth advisors, and Capgemini’s World Wealth Report 2023 showed 55 percent of HNWIs reported that their experience in digital channels is a critical factor for selecting a wealth management firm.

The rise of the affluent segment

In 2023, the affluent wealth segment, comprising individuals with investable assets between US$250,000 and US$1 million, emerged as a critical focus area for wealth management firms.

Capgemini’s World Wealth Report 2023 highlighted the segment’s substantial market size, controlling nearly US$27 trillion in wealth. However, profitability and service offering challenges have limited the segment’s potential growth.

Meanwhile, in the Asia Pacific region, the wealth management sector is experiencing an extraordinary boom. Assets under management are on track to balloon from US$18.50 trillion in 2023 to US$33 trillion by 2028.

This growth trajectory translates to a robust compound annual growth rate (CAGR) of 12.27 percent throughout the forecast period, as detailed in a recent research report.

In Southeast Asia, firms like Apex Private Wealth Management and Fargo Wealth Management in Singapore are evolving to meet changing demands. Apex offers a range of financial services, from retirement and investment planning to insurance, addressing its clients’ varied needs.

Fargo, a digital-first multi-family office, delivers extensive wealth management solutions, including asset allocation, risk management, and wealth planning, with a particular focus on China and the Asia-Pacific. These changes signify a broader industry move towards digitalisation and bespoke services in wealth management.

In 2024, wealth management firms are expected to leverage personalisation strategies to attract affluent investors and expand their client base.

The affluent segment’s demand for digital-only, cost-effective services is prompting firms like UBS and Merrill Wealth Management to introduce innovative platforms and services catering to this demographic.

As the affluent population and investable income grow, competition among banks, wealth management firms, and WealthTechs will intensify, focusing on client relevance and lifecycle stage-specific offers.

The return of fixed-income investing

In the wake of rising interest rates and uncertain equity returns, fixed-income investing is making a comeback as a safe and profitable vehicle for wealth growth and stability.

The bond markets experienced a significant rebound in 2023, and wealth managers are increasingly focusing on fixed-income instruments to hedge risks and grow their clients’ wealth.

The trend towards fixed-income investing is driven by evolving customer demands for wealth preservation and lower-risk investment avenues. Firms like Schwab Asset Management and BlackRock have introduced new fixed-income products, acknowledging the growing interest in this asset class.

In the context of Southeast Asia, Syfe, a digital wealth manager based in Singapore, has partnered with Pimco, an established investment management firm, to introduce two fixed-income products.

These products, part of the Syfe Income+ series, are designed to cater to investors’ preferences for stable and potentially profitable investment avenues, featuring actively managed funds from Pimco’s portfolio.

In 2024, fixed-income markets are expected to be attractive additions to investment portfolios, providing a buffer against volatility and generating dependable returns.

Generative AI enhancing client engagement.

Generative AI is revolutionising client engagement in wealth management by generating insightful, personalised content. This technology enables wealth managers to understand client needs better, optimise investment strategies, and deliver higher value.

The market for generative AI in wealth management is poised for significant expansion, with a projected value of roughly US$ 2.5 trillion by 2032.

Leading wealth management firms embrace generative AI to improve services, with firms like Vanguard, JP Morgan Chase, and Morgan Stanley launching AI-driven platforms and bots.

For instance, HSBC Global Private Banking clients in Asia are presented with an investment opportunity in the form of a structured product that is tied to the bank’s AiGO8 index (Artificial Intelligence Powered Global Opportunities), a multi-asset index driven by AI.

This particular offering is a product of a collaborative effort with EquBot, a San Francisco-based investment advisory firm.

Generative AI holds immense potential for wealth managers to revolutionise advisory services, offering efficient and personalised solutions that optimise workflows, save time, enhance efficiency, and cut costs.

Capitalising on intergenerational wealth transfer

The wealth management industry prepares for a significant demographic shift as an ageing high-net-worth population transfers wealth to the next generation.

Firms need to focus on early engagement with clients’ heirs, tailoring services to meet the unique needs of younger generations.

Providing digital advisory services with a human touch, understanding their values and preferences, and shifting investment strategies to include ESG investments and alternative assets is vital to retaining and growing this segment.

Embedding social equity and inclusion

Wealth management firms are increasingly focusing on creating, measuring, and communicating impact to meet the needs of socially conscious clients.

Impact investing exceeded US$1.1 trillion in assets in 2022, and firms strive towards a more diverse workforce and comply with regulatory requirements.

Firms like Fidelity Investments, Wells Fargo, and Morgan Stanley are driving social impact through initiatives targeting minority and underserved groups.

In Singapore, the Impact Investment Exchange (IIX) has emerged as a significant entity in sustainability and impact investing since its inception in 2009. IIX’s operations are geared towards directing catalytic capital into underserved communities, offering a range of investment avenues, including ventures, bonds, and funds.

The demand for impactful investments is substantial, and firms that successfully leverage data and communicate their investment impact will be positioned for success.

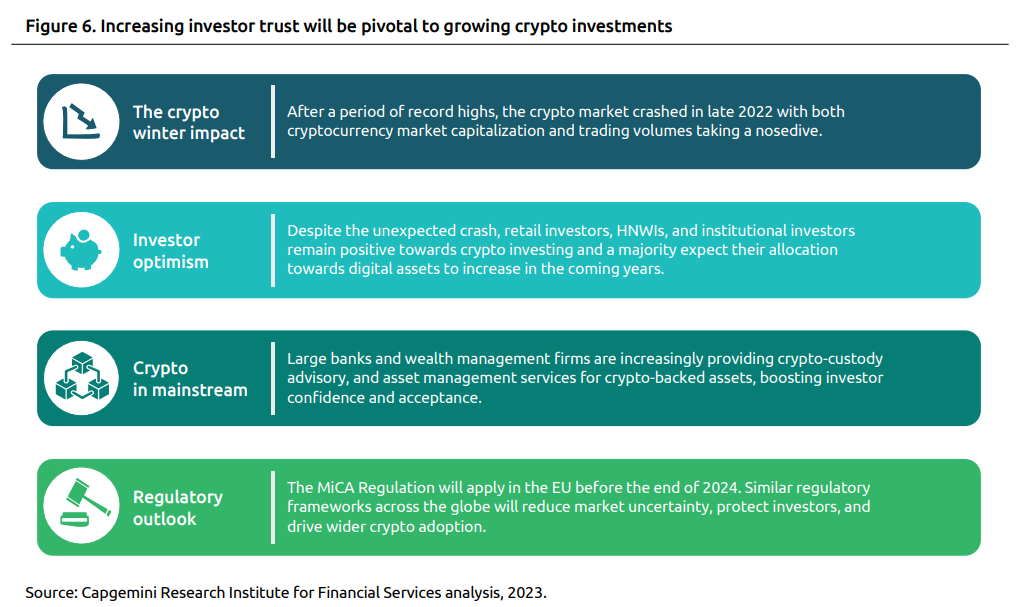

Rebuilding trust in digital assets

The cryptocurrency market is at a crossroads following high-profile collapses and a prolonged bear market.

However, investor interest persists, and with regulations taking shape worldwide, more widespread adoption is expected. Establishing trust is pivotal for expanding exposure to cryptocurrencies.

Institutions like Fidelity Investments and Julius Baer are enhancing investor trust by integrating crypto trading and reporting into their platforms and offering advice and custodial services on digital assets.

The future growth of digital assets and crypto hinges on regulatory clarity and offerings from trusted, established institutions.

Asset tokenisation driving efficiency.

Asset tokenisation revolutionises the global asset market by providing unprecedented financial and economic opportunities.

Tokenisation transfers ownership rights of tangible or intangible assets into tokens based on blockchain technology, offering liquidity, transparency, and accessibility to global investors.

Institutions like J.P. Morgan and KKR actively participate in the asset tokenisation ecosystem, strengthening its legitimacy and acceptance.

Asset tokenisation can transform financial services by opening investments to a larger global pool and increasing liquidity. Financial institutions can prepare for this trend by determining the necessary infrastructure to support tokenisation and integrating it with legacy systems.

A recent report indicates that approximately 86 percent of asset managers in Asia are preparing to include tokenised funds in their product offerings over the next three years.

SC Ventures, the innovation and fintech investment unit of Standard Chartered, has introduced a tokenisation platform named Libeara. This platform has facilitated FundBridge Capital, a fund manager, in establishing the inaugural tokenised fund based on Singapore dollar government bonds, tailored explicitly for accredited investors.

Synthesising wealth management trends in 2024

As we look towards 2024, wealth management firms find themselves at a crucial juncture, steering through a sea of emerging trends, each heralding its own set of challenges and prospects.

The wealth management industry in 2024 is set to be shaped by these seven key trends, each driving innovation, efficiency, and growth in unique ways.

The industry’s trajectory is being shaped by a blend of technological advancements, demographic shifts, and evolving market dynamics.

To thrive in this evolving landscape, firms must embrace adaptability, harness innovation, and maintain a steadfast focus on client-centric strategies. The synthesis of these trends presents a multifaceted roadmap, guiding firms toward sustained growth and resilience in a rapidly changing financial ecosystem.