MAS Plans to Ease Insurance Application with Less Data Collection

by Fintech News Singapore February 5, 2024The Monetary Authority of Singapore (MAS) has put forth a proposal aimed at reducing the amount of information that financial institutions need to collect from clients for certain insurance policies.

This initiative was outlined in a consultation paper seeking public opinion on the matter in a bid to facilitate easier access to insurance for Singaporeans.

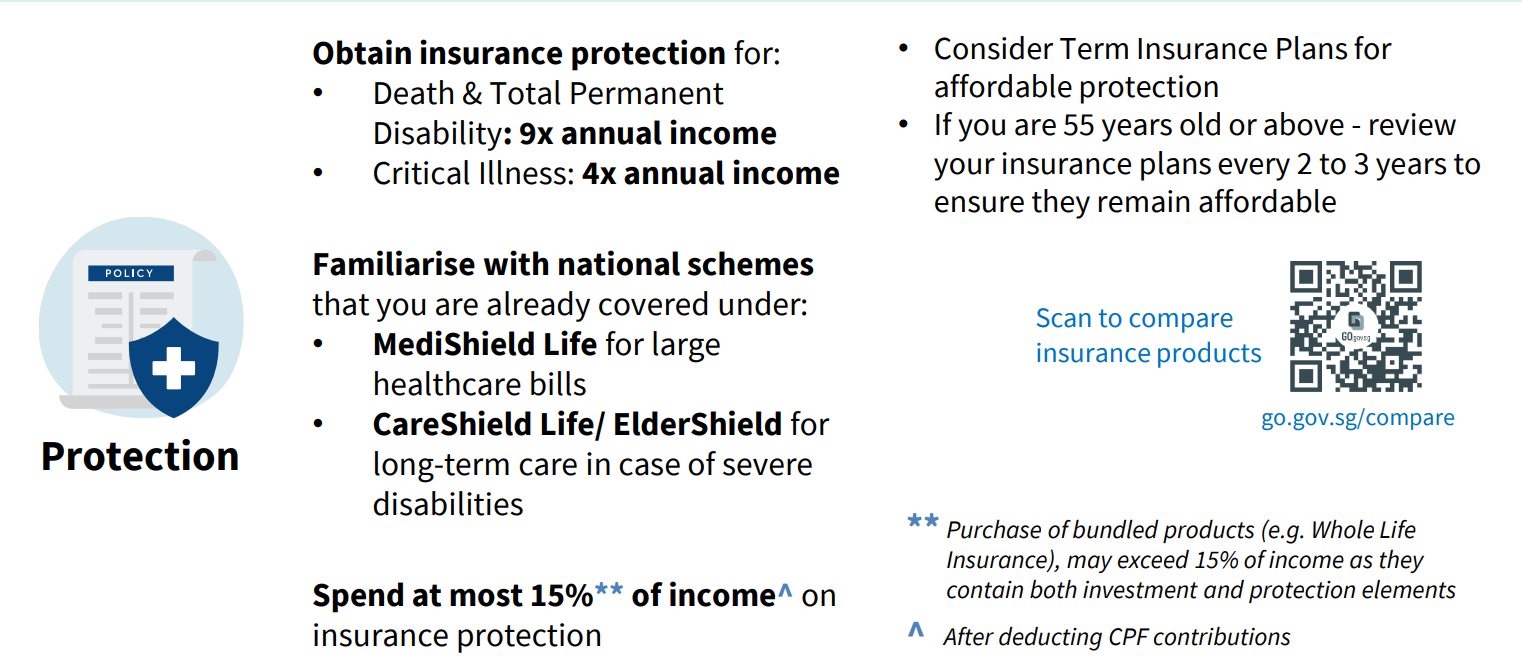

The effort is part of MAS’s collaboration with MoneySense, the Central Provident Fund Board, and various finance industry associations to enhance the financial well-being of Singaporeans through the Basic Financial Planning Guide.

Part of the Basic Financial Guide

Introduced in October 2023, the guide provides straightforward financial advice, including how much of their income Singaporeans should allocate towards insurance for different coverage needs.

The consultation paper focuses on simplifying the application process for term life and standard critical illness insurance policies.

By limiting the information required from consumers, MAS aims to make it easier for individuals to secure simple and affordable insurance products that align with the guide’s recommendations.

Financial institutions, consumers, and other interested parties can provide their feedback on the proposals until 15 March 2024.

Lim Tuang Lee

Lim Tuang Lee, Assistant Managing Director (Capital Markets), MAS, said,

“The proposals seek to simplify the financial advisory process through which Singaporeans can obtain cost-effective insurance coverage.

At the same time, the upper limits stipulated in the Basic Financial Planning Guide on insurance coverage and spending serve as safeguards to protect consumers’ interests.”

Featured image credit: Edited from Freepik