Global Funding Trends Indicate a Rebalanced Fintech Sector in 2024?

by Johanan Devanesan February 8, 2024The year 2023 marked a pivotal moment for the fintech industry, with the prevailing global funding trends encapsulating a period of introspection and recalibration amidst a backdrop of economic fluctuations, including notable bank failures and precipitous cryptocurrency downturns.

This era, while challenging, underscored the sector’s resilience and its capacity for innovation, navigating through valuation reassessments and the ebb and flow of “mega” deals to continue its trajectory of reimagining financial services, as discussed in the Financial Technology (FT) Partners Research report, The FinTech Journey Continues: What to watch for in 2024.

Global Funding Trends and Dynamics in the Fintech Ecosystem

As the fintech sector weathered the storms of 2023, a significant global transformation was observed in the dominant funding trends of the year. The volume of fintech deal activity in 2023 fell by approximately 70% from its peak in 2021, closely mirroring the figures from five years earlier. A decline in M&A volume was largely responsible for this downturn, with fewer deals exceeding US$1 billion being announced.

However, private capital raising concluded the year on a positive note after rising for three quarters, with fourth-quarter volumes reaching US$15 billion, a year-on-year increase of 30%. The public markets in 2023 saw a resurgence of international fintech IPO activity, although the debuts and performances were somewhat underwhelming.

In terms of the number of deals, both financing and M&A have remained more resilient compared to the volume. Over the past two years, there has been a tilt towards earlier-stage or smaller deals, with 65% of funding rounds being below US$10 million (in contrast to 46% in 2021). Seed funding notably hit a record high in 2022, with volumes exceeding US$5 billion across 1,100 deals. This significant activity at the seed stage continued into 2023, with both volume and the number of deals surpassing those of 2021 and previous years.

Source: The FinTech Journey Continues: What to watch for in 2024. FT Partners Research

This nuanced approach to financing was exemplified by significant funding rounds in the Asia Pacific region, with Indian digital payments firm PhonePe and Australian-based Rakuten Securities securing substantial growth stage funding amounting to US$850 million and US$576 million, respectively. Hong Kong-headquartered Micro Connect put together US$458 million in a Series C round.

Moreover, early-stage financing in the Middle East, as demonstrated by the Islamic-oriented crypto assets exchange Haqqex, further illustrated the global confidence in fintech’s potential.

On the M&A front, the likely acquisition of Singlife by Japanese insurer Sumitomo Life — expected to be completed in the first quarter of 2024, subject to regulatory approvals in Japan and Singapore — will place Singlife’s valuation at SG$4.6 billion, representing one of Southeast Asia’s most substantial insurance deals. The flurry of deal activity further attested to the dynamic nature of the sector and its attractiveness to significant investments.

Ushering in Insurtech 2.0

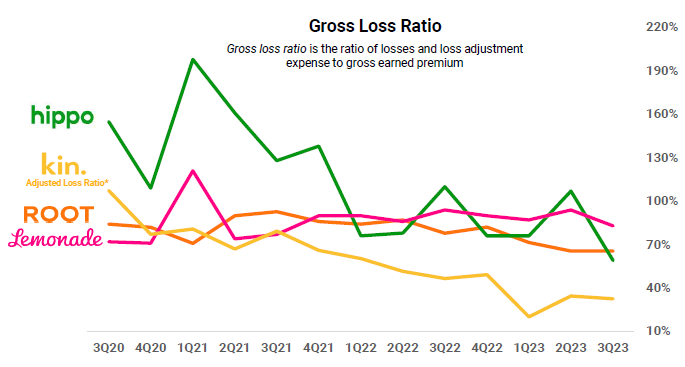

The insurance sector, traditionally perceived as resistant to change, has witnessed a wave of innovation over the past decade, culminating in what the report dubs as “Insurtech 2.0”. This new phase is characterised by a strategic pivot towards business-to-business (B2B) models, diversified distribution channels, and a heightened focus on underwriting performance.

Insurtech 2.0 seeks to build upon the foundations laid by its predecessor, which introduced digital, consumer-friendly solutions, thereby pressuring incumbent insurers to modernise their offerings.

Source: The FinTech Journey Continues: What to watch for in 2024. FT Partners Research

In this evolving landscape, Insurtech 2.0 candidates such as Singapore’s bolttech and Oona Insurance have emerged as front-runners, successfully raising significant funds and showcasing the potential for innovation within the insurance industry. bolttech is a platform that connects insurers, distributors, retailers, and customers, streamlining the process of buying and selling protection and insurance products. It raised US$196 million in Series B funding last year, bringing its total valuation to US$1.6 billion.

Oona Insurance leverages technology to simplify the insurance process, improve customer experience, and enhance transparency. It raised US$350 million in Series A funding. And solving early insurtech headaches in India is PolicyBaazar, an online insurance marketplace that aims to bring transparency and prevent mis-selling and policy lapses. It has over nine million customers and offers top insurance plans from leading insurers on the Indian subcontinent.

These entities exemplify the sector’s shift towards leveraging technology to streamline processes, enhance customer experiences, and foster transparency, setting new benchmarks for the industry.

B2B Fintech Models Draw Investor Interest

The prevailing economic conditions have steered investors’ preference towards B2B fintech models, distinguishing them from their business-to-consumer (B2C) counterparts. This shift is attributed to the inherent advantages of B2B models, such as lower marketing costs and a quicker path to profitability, which are particularly appealing in the current market environment.

B2B fintech companies, by providing critical infrastructure and services, enable incumbents to digitise their operations, offering a more sustainable and efficient alternative to the direct consumer approach. Nonetheless, these entities have traditionally concentrated on expanding their primary offerings rather than exploring diverse solution sets.

Source: The FinTech Journey Continues: What to watch for in 2024. FT Partners Research

Historically, large banks have considered small and medium businesses (SMBs) a low priority, often perceiving them as high-risk, whereas numerous smaller banks are technologically unequipped to cater to SMBs digitally. Today, established fintech firms like merchant acquirers, payroll processors, and alternative lenders serve SMBs.

Embedded finance emerges as one of the most promising B2B fintech models, facilitating the integration of financial services within non-financial platforms. This innovation has gained significant momentum, driven by applications in banking-as-a-service (BaaS) and embedded payments.

The model’s success is further illustrated by the dominance of ‘super apps’ in Asia, such as Southeast Asian heavyweight Grab and WeChat from China, which have revolutionised the delivery and accessibility of financial services ranging from microlending to ‘pay later’ to embedded insurance products within the same app ecosystem, embodying the potential of embedded finance to reshape the immediate financial landscape.

The Outlook Beyond 2024

As the fintech sector advances into 2024, global trends indicate that it stands on the cusp of further transformation, driven by the continued growth of early and growth-stage funding, the evolution of Insurtech 2.0, and the ascendancy of B2B models, especially in embedded finance. These trends not only reflect the industry’s enduring adaptability and commitment to innovation but also promise a dynamic and transformative journey ahead.

The fintech sector, amidst the trials of 2023, has demonstrated a remarkable capacity for resilience and evolution. By adopting a strategic focus on early-stage funding, embracing the next wave of insurtech innovation, and prioritising B2B models, the industry is poised to continue its upward trajectory.

The journey of fintech is far from over, with the years ahead set to bring further advancements, disruptions, and opportunities. This vibrant and ever-evolving sector remains at the forefront of redefining the financial services landscape, heralding a future where technology and finance converge to create more inclusive, efficient, and innovative solutions.

Featured image credit: Freepik

Get the hottest Fintech Singapore News once a month in your Inbox