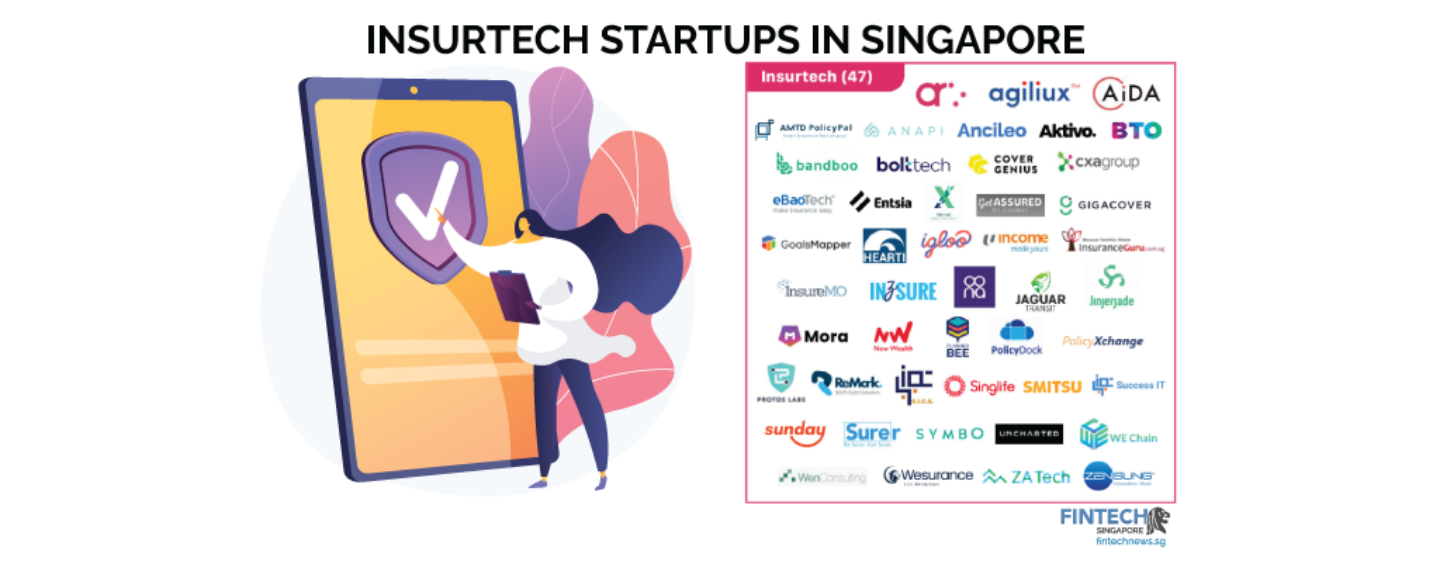

Insurtech Startups in Singapore

Explore the 46 insurtech startups in Singapore based on Singapore Fintech Map 2023.

List of Insurtech Startups in Singapore

Advisers use our solution to know their clients really well, propose and illustrate well rounded plans, providing the best client experience. Arrange had been featured on channel 8 and is also the Insurtech winner of the Asia Trusted Life Agents & Advisers Awards 2020.

Agiliux is a cloud-based insurance software with extensive policy and claims management capabilities.

AiDA is a leading provider of AI and machine learning solutions for the banking and insurance sector in Asia.

Under AMTD Group and AMTD Digital, AMTD PolicyPal Group is a leading Singapore-based Fintech and InsurTech company. AMTD PolicyPal Group consists of: PolicyPal Pte. Ltd., Baoxianbaobao Pte. Ltd., PolicyPal Tech Pte. Ltd., and ValueChampion.

Anapi is the easiest way to insure any startup or small business. By combining software and insurance expertise, we help startups and entrepreneurs save time to get best-in-class business insurance solutions.

Ancileo empowers insurance distribution with B2B2C partnerships, using 360º technology solutions for insurers, re-insurers and affinity partners.

Aktivolabs was founded to provide a product that objectively measures the healthiness of our lifestyle in a meaningful way, to let us make informed choices on how we could and should live!

At Bandboo, members form communities and insure one another against any pre-defined risks. Insurance on their platform is based on peer-to-peer networks whereby people can get themselves insured without going to an insurance company.

Better Trade Off (BTO) is a Singapore-headquartered FinTech that’s revolutionising financial advice with online solutions that help simplify and demystify financial planning; making it possible for everyone, regardless of financial acumen, to make better financial decisions.

bolttech is an international insurtech with a mission to build the world’s leading, technology-enabled ecosystem for protection and insurance. Headquartered in Singapore, bolttech serves customers in 30 markets across North America, Asia and Europe.

Cover Genius is the global insurtech for embedded protection. Through XCover, their award-winning global distribution platform, they protect the customers of the world’s largest digital companies.

CXA Group is Asia’s one-stop, predictive and data intelligence platform for better health, wealth and wellness choices. Through the CXA platform, employers can empower employees with access to personalised health and lifestyle offerings.

eBaoTech® is a technology solution provider for global insurance industry. They have clients in more than 30 countries across all continents, serving numerous insurers, agents, brokers, InsurTech startups and others in the insurance ecosystem.

Entsia – a solution focussed digital player that’s changing the way insurers reach their markets. An end-to-end digital platform that simply works.

World’s 1st Marketplace for Tradable Insurance Policies, leveraging on Blockchain Technology to disrupt the status quo. fidentiaX is a marketplace and repository of insurance policies for the masses that leverages on blockchain technology.

GetAssured for Business is Singapore’s first life insurance based employee benefits portal. They started with one sole purpose: to empower companies to value-add to their employees at no cost.

Gigacover delivers essential worker benefits to the self-employed economy. They work with insurers and financial institutions to bring flexible and right-sized insurance, healthcare and financing solutions in South East Asia.

GoalsMapper™️ is the first fintech / insurtech company in Singapore with the vision to redefine financial planning, through its real-time, scenario-based and customer-facing financial planning software.

Hearti envisions to redefine Financial Inclusion in South East Asia through the Micro-Financing and distributing Micro-Insurance products with our strategic partners.

Igloo is a full stack insurtech startup founded in 2016. It leverages big data, real-time risk assessment and end-to-end automated claims management to create innovative B2B2C insurance solutions for platform partners and insurers.

Income Insurance Limited (Income Insurance) is one of the leading composite insurers in Singapore, offering life, health and general insurance.

InsuranceGuru is established for customer empowerment and to bring you the best value-for-money insurance plans!

InsureMO (Insurance Middle Office) is an insurance middleware platform for insurers, brokers, agents, channels, InsurTechs and start-ups; enabling use cases for any product and channel.

At Inzsure they believe they can change how corporate managers think about insurance permanently by establishing themselves as a leading InsurTech firm and developing a ground breaking solution.

Headquartered in Singapore and founded in October 2022, Oona is focused on becoming the most customer driven provider of general insurance in Southeast Asia.

As The World’s First Secure Transit InsurTech, Jaguar Transit can help you with the pay-as-use Secure Transit solution that comes with all the Insurance that you need and a reduced requirement on your security set up.

Mora helps insurance company and brokers to build their own Virtual agent or customer assistant.

New Wealth is a B2B FinTech provider that offers modular white-label solutions, to boost the distribution of mutual funds and wealth management services.

Planner Bee is creating a new way for consumers to manage their finances. With the help of technology, we empower our users with the tools to guide them towards better financial health.

PolicyDock is a Platform-as-a-Service (PaaS) solution for insurers, brokers and agents. The platform digitizes and automates insurance workflows, and drastically reduces the time to launch insurance products online.

The digital marketplace for Traded Endowment and Life policies in Singapore. PolicyXchange strives to be a convenient e-portal that connects Insurance Policyholders, Traded Endowment/Life Policies (TEP/TLP) market makers and investors.

Protos Labs is a Singapore-based cyber insurtech company founded by ex-Booz Allen cyber leaders in 2021.

Success IT is a leading provider of software applications for automotive, insurance and wholesale industries.

Singlife was built because we believe that the world needs a better kind of insurance company: using the smartest technologies to make insurance totally digital, with automated efficiencies to make it more convenient and affordable.

SMITSU is a Singapore-registered FinTech Company certified by SFA as an InsurTech provider. They provide quick and fast insurance comparisons across the different insurers that insurance brokers’ partnered with.

Sunday is a fully-integrated sales and services InsurTech that uses artificial intelligence and digital platforms to offer personalised insurance products and services that suits all types of individual and business risks.

Surer is a cloud-based, web platform with a market-first technology in the region, that helps all parties in the General Insurance segment automate processes and drive network collaborations.

At Uncharted, they are focused on providing compact, powerful and scalable platform solutions for the SME, consumer and speciality insurance markets.

Since 1998, Wen Consulting has been in the forefront of providing integrated solutions to financial services organizations in Asia and the Middle East.

Founded in 2017 and expanding to the UK in 2021, Wesurance is a trailblazer in the insurance technology sector.

ZA Tech is redefining the insurance landscape by enabling digital ecosystems to easily embed relevant protection within their customer journeys.

Image by vectorjuice on Freepik