Open Banking

Unlocking the Value in Payments Data With Technology and Partnerships

Over the years, banks have been creating exponentially growing mountains of data – much of it with huge potential value. However, despite their ability to create it, banks have not always been good at making the best use of it.

Read MoreOpen Banking Platform Railsbank Sees Strategic Investments from Visa

After raising US$ 10 million and expanding to Singapore, the open banking platform Railsbank announced today that it has received yet another round of investments from Visa and Global Brain, a Tokyo-based VC firm. The sum of the investment was

Read MoreSingapore Leads Asia Pacific in Open Banking

In its Open Banking APAC report, released earlier this month, the EPAA provides an overview of developments in the region and shares findings from a survey of industry participants and experts from APAC. Unlike the regulator-led approach in the European

Read MoreWhy Platformification is Key to The Next Banking Revolution

Driven by technological innovations and increased online connectivity, the world is going through a major economic revolution with the rise of the platform economy. The platform economy refers to the current transition most companies are making from being product-centric to

Read MoreOCBC Enables Account Opening for Startups Immediately After Incorporation

Start-ups are now able to open an OCBC business banking account in Singapore immediately after incorporation, rather than having to wait one day. This is made possible by an API between the bank and global information services provider Experian. Once

Read MoreGrabPay Users Can Now Increase Transaction Limit to $SGD 30,000 After KYC Process

Grab users will now be able to authorise the retrieval of personal data from MyInfo, a digital identity service from GovTech, to complete the verification process easily. This comes after GrabPay became a relevant stored value facility (SVF), licensed and

Read MoreTemasek and Tencent to Invest US$35 Million in TrueLayer

Tencent and Temasek is set to invest US$ 35 Million in UK-based open banking startup True Layer’s US$40 Million Series B round. This fresh round of funding brings the startup’s total funding to US$ 51.8 Million, according to Crunchbase. Temasek’s

Read MoreWith Britain Done, Can Revolut Convince Asians to Try Neo-Banks?

Founded in 2015, Revolut is one of Britain’s fastest-growing fintech players, now valued at US$1.7 billion, serving its Apple-levels cult following of 2.8 million users across 28 markets in Europe. Revolut claim to fame is a payments card that offers

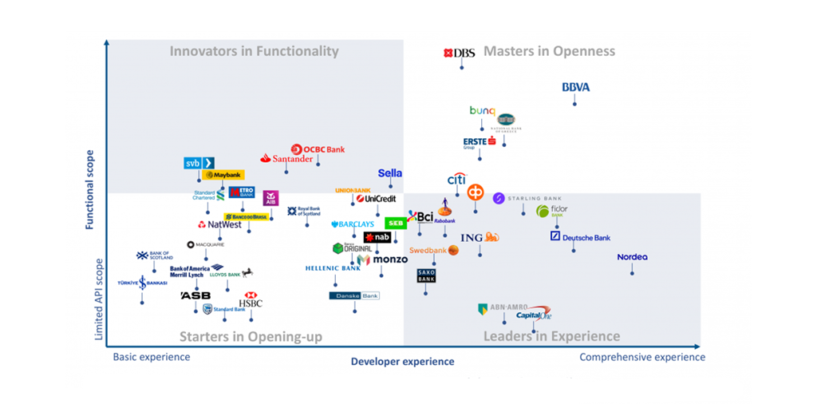

Read MoreHow DBS and OCBC Global Leadership Shows Singapore’s Success in Open Banking

Singapore’s DBS Bank and OCBC are regional leaders in fintech and pioneers in open banking according reports from Accenture and Innopay Open Banking Monitor. The positioning of these banks gives us a good sense of where Singapore stands in the global

Read MoreOpen Banking’s Biggest Challenge to Global Acceptance is, Ironically, Regulation

The World Payments Report by BNP Paribas and Capgemini highlights some interesting trends when it comes to key regulatory initiatives. Despite general global interest in embracing open banking, we still have a fragmented ecosystem of regulations and frameworks. This is in part

Read More