Tag "Monetary Authority of Singapore"

Digital Securities Firm Propine Graduates From MAS’ Fintech Sandbox

Propine, a Singapore-based end-to-end securities services firm catering for digital securities services to institutional clients, has become the first independent digital asset custody service provider to graduate from the Monetary Authority of Singapore’s (MAS) Fintech Regulatory Sandbox. Since its admission

Read MoreStanChart Inches Closer to Singaporean Digibank After New Classification by MAS

Standard Chartered Bank (Singapore) Limited (SCBSL) has been awarded enhanced Significantly Rooted Foreign Bank (SRFB) privileges by the Monetary Authority of Singapore (MAS), indicating that it is making moves for a second digital-only bank after its launch of Mox. The

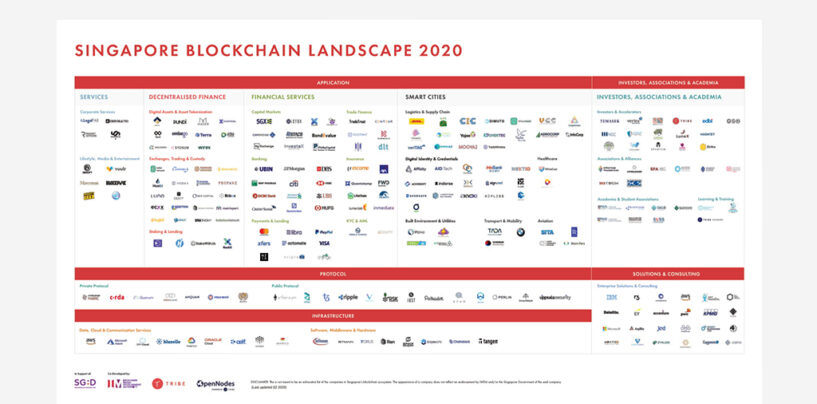

Read MoreSingapore Blockchain Ecosystem Report 2020 Unveiled At Singapore Fintech Festival

The Singapore Blockchain Ecosystem Report 2020 was launched at this year’s Singapore FinTech Festival x Singapore Week of Innovation and TeCHnology (SFF x SWITCH). The report highlights the impactful developments and trends in Singapore’s blockchain ecosystem over the past year.

Read MoreGrab, SEA and Ant Among Those Who Secured Singapore’s Digital Banking License

The Monetary Authority of Singapore (MAS) announced four successful digital bank applicants. The full digital bank license was awarded to the Grab-Singtel consortium and SEA Group best known for its brands; Shopee and Garena. Meanwhile the digital wholesale bank license

Read MoreBondEvalue Gets the Green Light From MAS for Blockchain-Based Bond Exchange

Singapore-based fintech BondEvalue has been approved as a Recognised Market Operator (RMO) by the Monetary Authority of Singapore (MAS). It operates BondbloX Bond Exchange (BBX), a blockchain-based bond exchange that aims to bring trading of a wide range of fixed-income

Read MoreMAS Commits S$250 Million to Drive Innovation and Build Fintech Talent Pipeline

The Monetary Authority of Singapore (MAS) announced that it will commit S$250 million over the next three years under the enhanced Financial Sector Technology and Innovation Scheme (FSTI 2.0) to accelerate technology and innovation-driven growth in the financial sector. Funded

Read MoreMAS Invites Applications for New Digital Bank Licences Starting Today

The Monetary Authority of Singapore (MAS) announced today that it will begin accepting applications for new digital bank licences. Interested parties have until 31 December 2019 to submit their applications. This follows the announcement in June 2019 by Mr Tharman Shanmugaratnam, Senior

Read MoreSingapore is Now Considering Virtual Banking Licenses Too—Here’s Why

The now famous Hong Kong virtual banking licenses have been a bit of a mixed bag for the region, but nevertheless, it’s gotten a lot of attention. To date, four licensees will be ready to go to market before the year

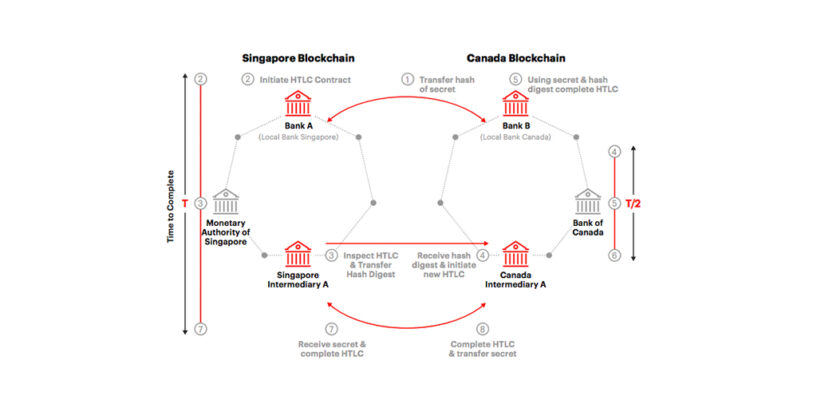

Read MoreSingapore and Canada Successfully Trials Cross Border Payments with Central Bank Backed Digital Currency

There’s a growing number of central banks taking a serious look at blockchain and distributed ledger technologies of late. The Bank of Canada and the Monetary Authority of Singapore (MAS) have conducted a successful experiment on cross-border and cross-currency payments

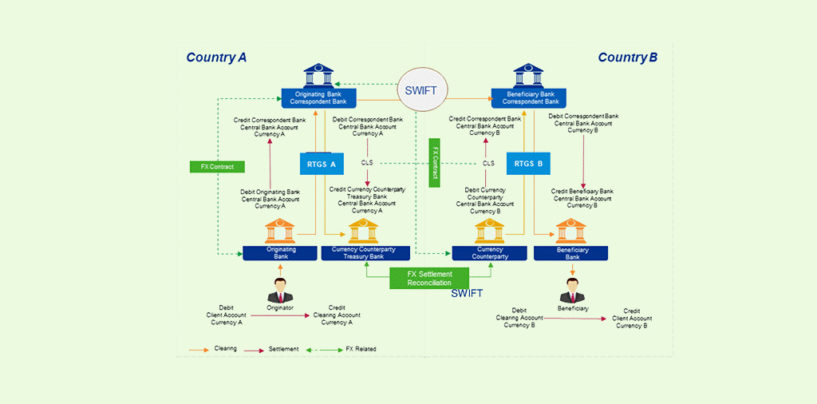

Read MoreThe Future of Cross-Border Transfers Could Be Central Bank-Backed Digital Currency

As we slowly but surely move towards a global village into a reality, the overall value of cross-border payments is also expected to rise by 5.5% yearly, increasing from US$22 trillion in 2016 to US$30 trillion in 2022. Yet, according

Read More