Tag "uob"

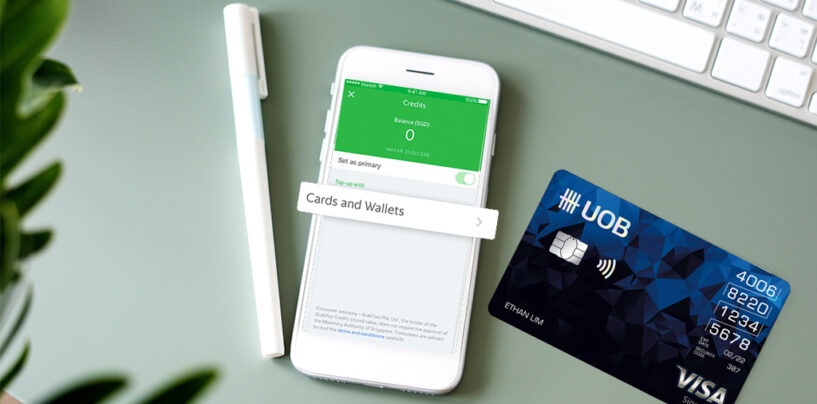

UOB Ties up With Visa’s New API to Simplify Digital Payments

United Overseas Bank (UOB) has teamed up with Visa to tap its new application programming interface (API), claiming to be the first bank in the world to do so. This partnership will enable customers to add their Visa credit and debit

Read MoreUOB Launches Digital Bank TMRW in Indonesia

UOB Indonesia launched TMRW, its digital bank to serve the Indonesian market as part of the group’s strategy to accelerate growth of its regional customer franchise, which follows their initial launch in Thailand in 2019. A key feature that they

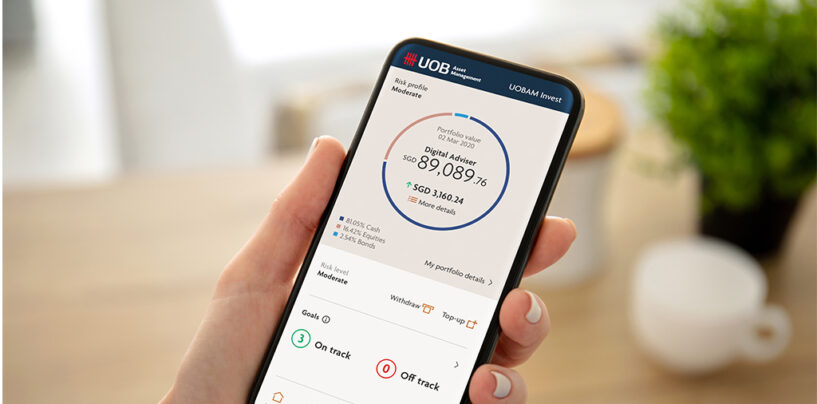

Read MoreUOB Launches Robo-Advisor for Retail Investors in Singapore

UOB Asset Management (UOBAM) has launched UOBAM Invest, a robo-advisory mobile app that offers retail investors in Singapore personalised and dynamic investment portfolios. The mobile app is the retail version of the UOBAM Invest online portal, which was first launched

Read MoreUOB Launches AI-Powered Personal Financial Management Tool

United Overseas Bank (UOB) has launched Mighty Insights, an artificial intelligence (AI)-based digital banking service to help their customers better manage their finances. With this digital service, UOB will anticipate and provide insights that enable its customers to track their

Read MoreNew Digital Banks Unlikely To Threaten DBS, OCBC and UOB, Fitch Ratings Says

Singapore’s granting of up to five new digital bank licenses is unlikely to threaten the dominance of the country’s three largest banks, DBS Bank, OCBC Bank and UOB, Fitch Ratings says. The ratings agency believes that DBS, OCBC, and UOB

Read MoreSingapore Airlines’ KrisFlyer Now Offers a Credit Card That Rewards You with Miles

UOB and KrisFlyer, Singapore Airlines mile reward program, announced the launch of the KrisFlyer UOB Credit Card. This is the first credit card in Singapore which can be combined with a savings account to earn bonus KrisFlyer miles when customers

Read More10 Fintechs Stand a Chance to Present Their Solutions to Singapore’s Investment Industry

A Singapore industry group representing the city’s asset management firms, IMAS, has launched an accelerator programme which could position 10 Fintechs to present their solutions in front of leading VC firms, hedge funds, asset management firms and family offices. Applications

Read MoreUOB’s Banking Services Now Available on Your Grab App

UOB and Grab have announced that Grab will begin offering a suite of UOB Cards solutions and privileges directly on Grab’s mobile app. This follows their earlier partnership announcement during the Singapore Fintech Festival last year For a start, consumers

Read MoreFintech and Digital Finance Innovation Initiatives of Banks in Singapore

Fintech has become one of the key drivers of innovation in the financial services industry. In Singapore, the Monetary Authority of Singapore (MAS) was quick to realize the potential of fintech, acting swiftly to build up a vibrant ecosystem in

Read MoreFinlab Opens Accelerator in Thailand to Teach SMEs How to Digitise Their Businesses

The Finlab announced the launch of its Smart Business Transformation Programme to help Thailand-based small- and medium-sized enterprises (SMEs) transform their businesses via digital solutions. The programme is supported by United Overseas Bank Thailand (UOB Thai) and the Digital Economy

Read More