As mentioned in the other article that Bitcoin is real while Ponzi scheme is fake, one particular opposite reality of both worlds is Ponzi schemes flunk 100 per cent in their “get-rich-quick” promises. Now opening a Bitcoin wallet in the Philippines is really easy and quick, but it is no magic trick to get rich.

There are now a few number of identified Bitcoin-based firms in the Philippines, but in this article, we’re only featuring Coins.ph and Satoshi Citadel Industries (SCI), two companies licensed by the central bank to conduct virtual currency (VC) exchange.

Both Coins and SCI even gave a brief discussion on the four kinds of Bitcoin wallets. Bitcoin is a digital currency that can be used to make online purchases, receive payments and pay bills online, among others.

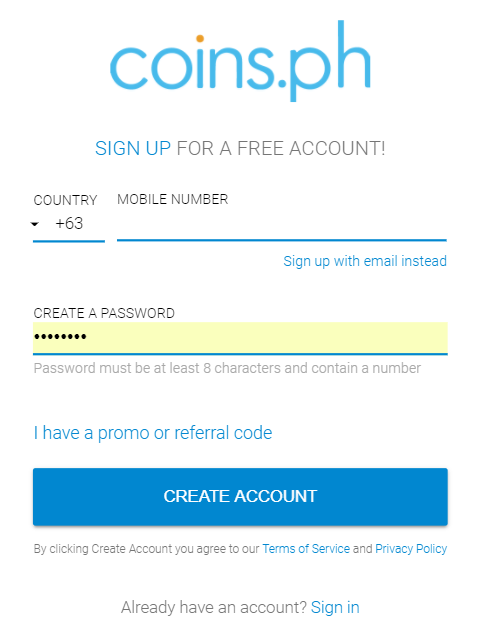

Opening a Bitcoin Wallet on Coins.ph

Coins noted a bitcoin wallet is something you would use to receive, send, and store your bitcoin. “All you need is an email address and a password of your choice. You will be able to send and receive payments immediately. You can think of your wallet as your bank account,” according to Coins on its website.

The steps are so basic just like signing up for a free social media account. There is also a mobile app available on Google Play and the App Store. Signing up for a Coins.ph account automatically gives you a Philippine Peso (PHP) e-wallet, and Bitcoin (BTC) wallet as well.

The steps are simply to tap or click sign up, fill up profile name, provide email, mobile number, create password, then get the verification code sent to the email you indicated, then input the code. You will then have your new Coins.ph account where it comes along with a PHP wallet and Bitcoin wallet.

“Just like a bank account which has an assigned, unique bank account number, your bitcoin wallet has an assigned, unique wallet address. This address consists of up to 34 random digits (consisting of numbers and letters, both uppercase and lowercase),”

Coins said on its website.

Here’s an example of a Bitcoin wallet address: 13BE7m4GnGAbdxfzrTgaV9wYmHkGbrarAP

It is important to note that addresses are case-sensitive. This means changing even just one letter from uppercase to lowercase (ex. changing a “G” into a “g”) will turn it into a different address entirely.

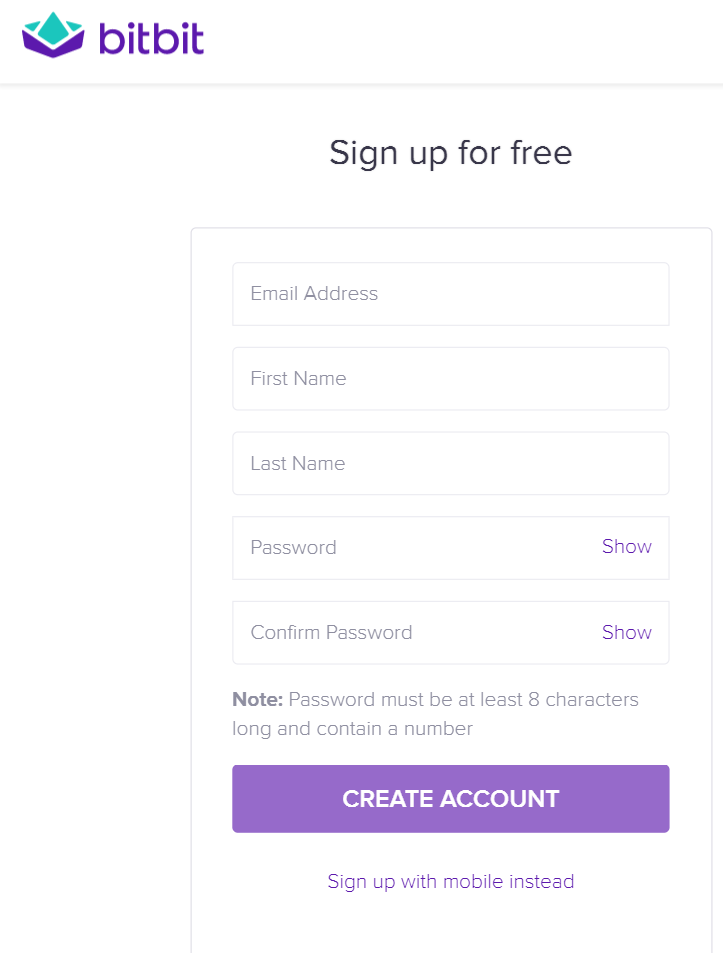

Opening a Bitcoin Wallet on SCI’s Bitbit.ph

Almost like reiterating Coins.ph, SCI co-founder and chief community officer Miguel Cuneta said, setting up a Bitcoin wallet is really easy, and it is usually free. Just download or create an account on a website, and you’re done.

SCI recommends making a Bitcoin wallet via its very own Bitbit.ph. It allows you to send, receive and share money with friends and family with just a few taps over email, mobile and social media.

Bitbit is claimed to go beyond storing Bitcoin, keeping your funds in Peso and freeing it from the Bitcoin’s price votality.

Similar to Coins.ph, getting a Bitbit e-wallet/Bitcoin wallet only requires you to provide a name, email, and password of your choice.

Four kinds of Bitcoin wallets

Coins wrote there are four different kinds of wallets: desktop wallets, browser-based wallets, mobile wallets, and hardware wallets. They differ mainly in where they are stored (i.e. either on your laptop, on a third party website, on a mobile device, or on a specialized offline device), and thus, they each come with their own pros and cons.

Cuneta discussed hardware and paper wallets are considered “cold storage”, while custodial and non-custodial ones are called “hot wallets”.

Miguel Cuneta, a co-founder of Satoshi Citadel Industries (SCI).

“The hardware wallets (trezor.io, ledgerwallet.com) are considered the most secure. They store bitcoins and other cryptocurrencies in a usb device, keeping the private keys always offline and therefore safe from hackers,”

he said.

“Paper wallets are literally sheets of paper with the private and public bitcoin keys printed on them. They are also offline and therefore considered to be cold storage. Their vulnerability is that they can get lost or damaged, but they are safe from online hackers and the like.”

As for hot wallets like the custodial, Cuneta said it is similar to SCI’s Bitbit.ph or US-based Coinbase.com. They are wallet services where users can hold bitcoins but leave the keys to the provider.

“The advantages are ease of use and convenience. If a user forgets his password or loses account access, they have a recourse. Disadvantages as that the wallet provider can get compromised and lose their users funds. These services usually collect KYC from users,”

he added.

For non-custodial, Cuneta cited they are free to download Bitcoin wallet apps (blockchain wallet, bread wallet, mycelium, etc). These apps are basic bitcoin wallets and are usually free, and dont collect KYC. Users are left to take care of their keys and have no recourse if they forget their passwords or lose access without backups.

To learn not to fall for Bitcoin Ponzi schemes, click here

Featured image via Pixabay