Startupbootcamp, PwC Report: Asia-Pacific Fintech Ecosystems Are Thriving

by Fintech News Singapore April 22, 2016Fintech is booming as a growing number of innovative companies are emerging in hope to disrupt the financial services industry. Banks and traditional players are also starting to recognize the opportunities related to using cutting-edge technologies to serve their clients better and become more efficient.

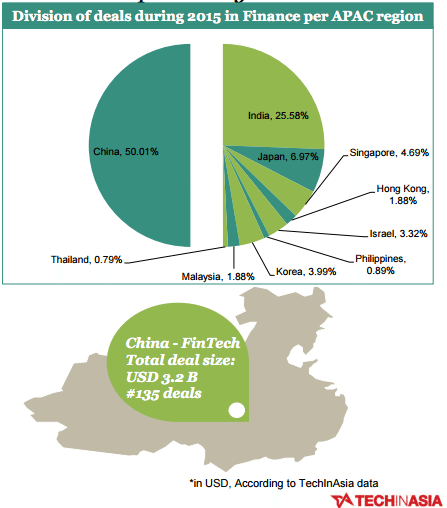

Money is pouring in, with fintech ventures in Asia-Pacific (APAC) closing over 340 investment deals in the region, according to a study.

In a new collaborative report entitled ‘Fintech APAC Landscape Developments,’ Startupbootcamp and PricewaterhouseCoopers addressed the major developments within APAC and provides an overview of the state of fintech industry in the region.

In a new collaborative report entitled ‘Fintech APAC Landscape Developments,’ Startupbootcamp and PricewaterhouseCoopers addressed the major developments within APAC and provides an overview of the state of fintech industry in the region.

Startupbootcamp Fintech Singapore, a notorious acceleration program dedicated to fintech startups in APAC, engaged with over 400 fintech startups in 16 locations for its 2016 fintech accelerator program – where insights were gathered for the report. TechInAsia (formerly TechList) provided a funding data, while PwC, a strategic sponsor of Startupbootcamp Fintech, provided regulatory insights.

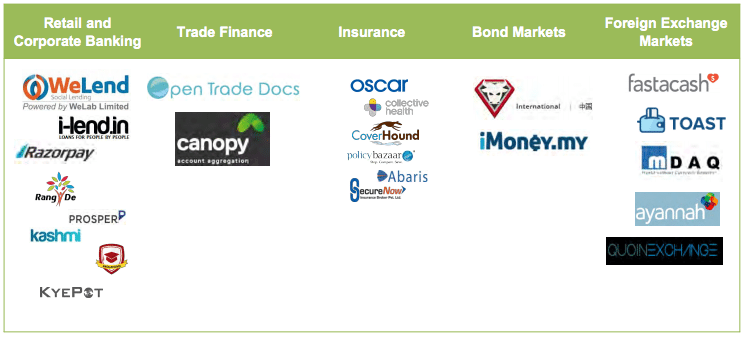

A number of Asian startups are impacting the five major areas of financial services. The report cites the likes of WeLend, Kashmi, KyePot, in the domain of retail and corporate banking, Canopy and Open Trade Docs in trade finance, Oscar and CoverHound in insurance, iMoney.my in bond markets, and Fastacash and Toast in foreign exchange markets.

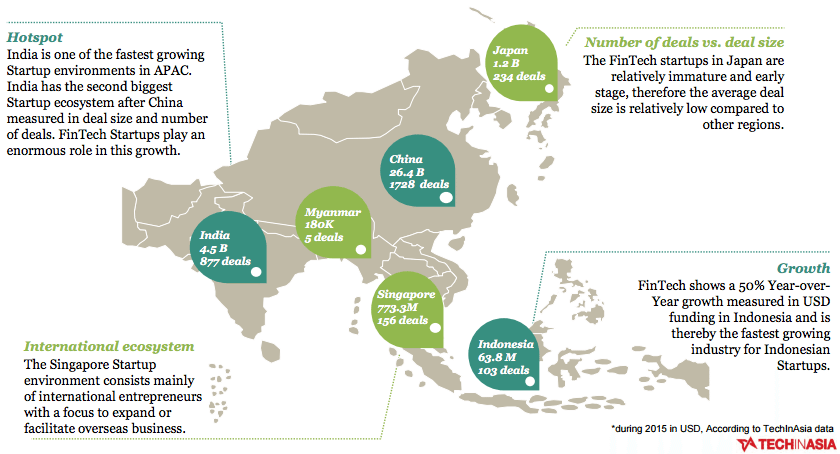

While Japanese startup ecosystem is still in a relatively early stage, India is recording a notable growth and is emerging as a hotspot for startups in the APAC region, closing 877 deals totaling US$4.5 billion in investment. That said, China remains the dominant player with 1,728 deals and a total raised of US$26.4 billion.

Indonesia is also recording notable development with 50% year-over-year growth measured in USD funding. In Indonesia, fintech is the fastest growing industry in the startup ecosystem.

India is one of the fastest growing startup environments in APAC and the second biggest ecosystem after China in deal size and number of deals. In India, fintech startups are playing a key role in this growth expansion from India.

“Based on the FastTrack events organized throughout APAC India is arguable the ecosystem that is most matured compared to other ecosystems in APAC,” the report says.

China remains the biggest player in the APAC region in deal size and number of fintech deals done, attracting half of investments in the region. Chinese fintech ventures attracted US$3.2 billion across 135 deals; or 50% of the APAC region’s total funding.

Chinese startups are mainly focused on domestic success prior to expansion as the China domestic market provides sufficient growth opportunities.

Japanese fintech startups raised a total of US$66.6 million across 13 deals. The ecosystem is in a relatively early stage in comparison with China, India and Singapore, with most of the local startups are currently standing at the seed or Seed-A funding stage.

These startups are building products rather than expanding globally and are primarily focused on replacing core financial services, or building products related to payments or cloud environment.

That said, innovation in Japan has the advantage of being heavily supported by corporates. Conglomerates are internally funding and creating internal ventures.

Regulatory environment

Government bodies are increasingly nurturing the growth of fintech startup ecosystems by implementing new rules and regulations on a global level.

“All regulators in APAC are attempting to catch-up with the [Financial Services Authority] in London, and within Asia, the [Monetary Authority of Singapore] is argued to have a leading position,” Startupbootcamp wrote in a blog post.

Singapore, which triggered the daunting project of becoming the world’s first smart nation country, is heavily supporting the fintech industry as part of building a “Smart Financial Center.”

Its central bank and financial regulatory authority, MAS, is committing S$225 million (US$167 million) over five years in fintech projects and has recently announced a number of hairy initiatives to foster the industry.

This includes the development of a nation wide all-in-one payment system, as well as the inaugural Singapore Fintech Festival set to take place from November 14 to 18, 2016. The event is expected to bring together global financial community, and should demonstrate that the city-state is serious about becoming an international fintech leader.

Read the full ‘Fintech APAC Landscape Developments’ report: http://www.pwc.com/sg/en/publications/fintech-apac-landscape-devt.html

Featured image: Chinatown in Singapore, by r.nagy, via Shutterstock.com.