KYC (Know Your Customer) is an integral part of fighting Money Laundering and Terrorist Financing. It has become one of the necessities for every organization in the financial sector.

Managing your customers’ KYC data can be very frustrating, however, there’s a solution – a data management platform.

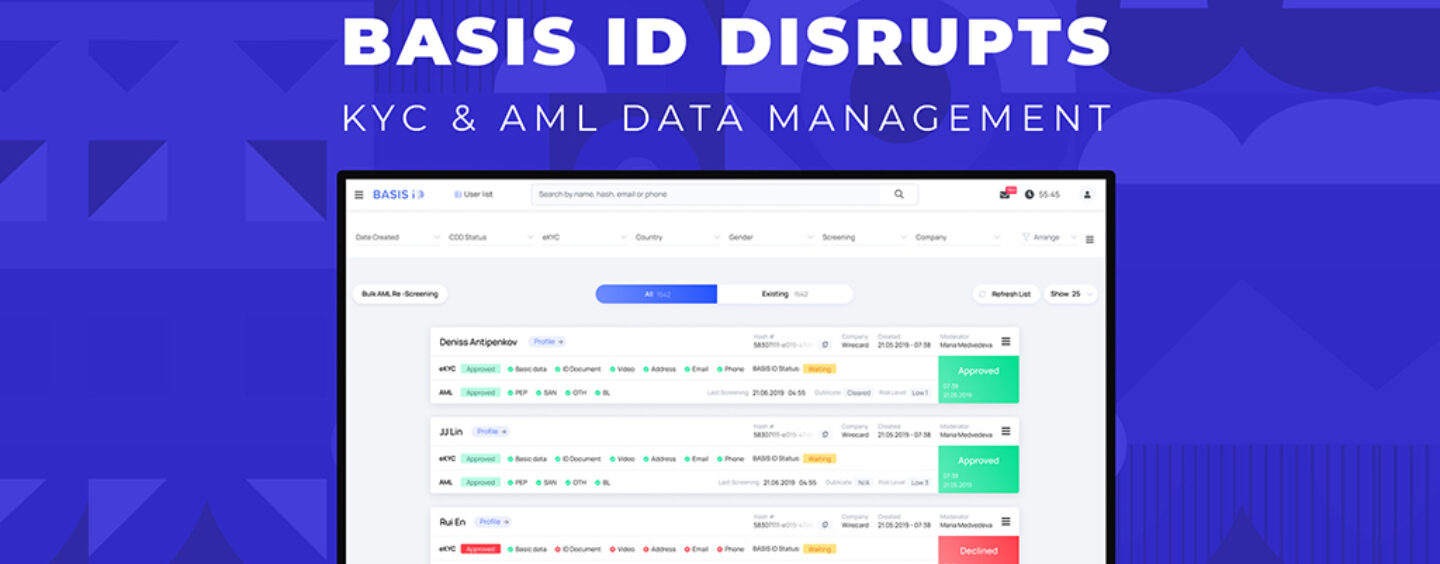

When you start screening thousands of customers, it can quickly get out of hand. There’s so much data that needs to be stored and retrieved. A KYC & AML data management platform is a CRM that allows you to manage gigantic volumes of customer information while being able to easily sort the data and view the necessary information as well as control user actions and verifications based on your risk appetite.

The goal of the data management platform is to make the life of a responsible manager easier by giving him a wide and convenient toolkit while meeting the meticulous requirements of working with personal data. Here are a few benefits of using an onboarding CRM system:

- Conveniently organized customer data backed with a huge number of databases.

- The detailed history of user actions with his or her documents at the stage of the onboarding and KYC process.

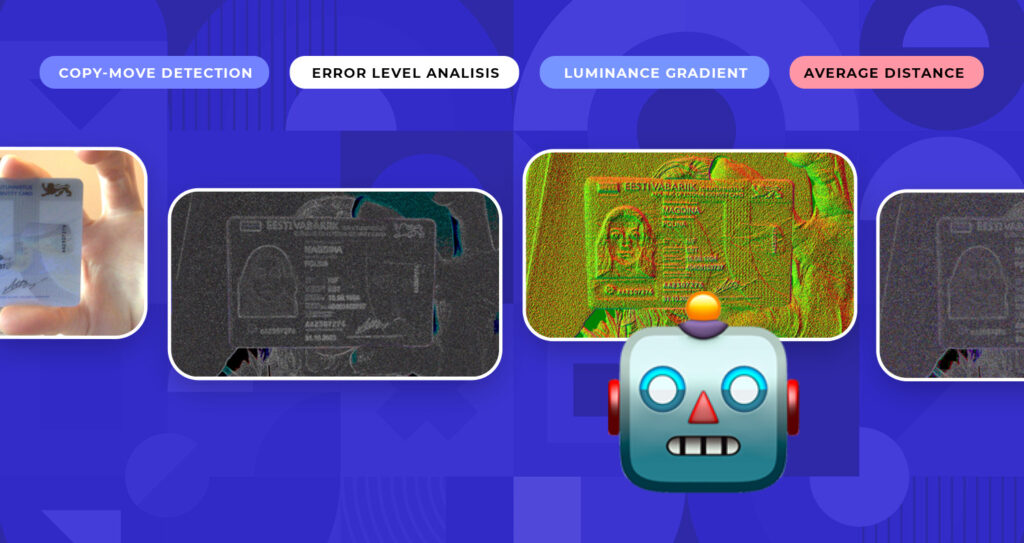

- The transparency of the algorithms of the verification tools, which gives a full view of magical processes that usually happen behind the scenes.

BASIS ID has been famous for its data management platform for many years. However, in 2020 they have released a newly updated onboarding system, which is focused on transparency of the verification process, the security of personal data, and convenience of the officers who will be using the platform.

Let’s take a closer look at some of the key features.

Convenience

The new platform was created with users in mind and client feedback. We have worked in cooperation with our customers to create a perfect system that suits your needs. It’s intuitive and does not require a long training process.

BASIS ID onboarding platform provides a simple overview of all of the users you have.

- The main account list displays the key information about users alongside the decision of their approval. Moreover, it shows which specific parts of the KYC process were approved or declined.

- There’s an option to customize the CRM to show the data that is the most relevant for you.

- There’s a filtering system, which allows you to find users quickly and take required actions within seconds. You can, for example, sort the data based on the risk level.

- You will get alerts about specific accounts that need to be reviewed through the smart notification system.

The dive into the details

The CRM also makes sure that you can view each user individually.

- You can easily view if a user wants to submit additional documents or change their data.

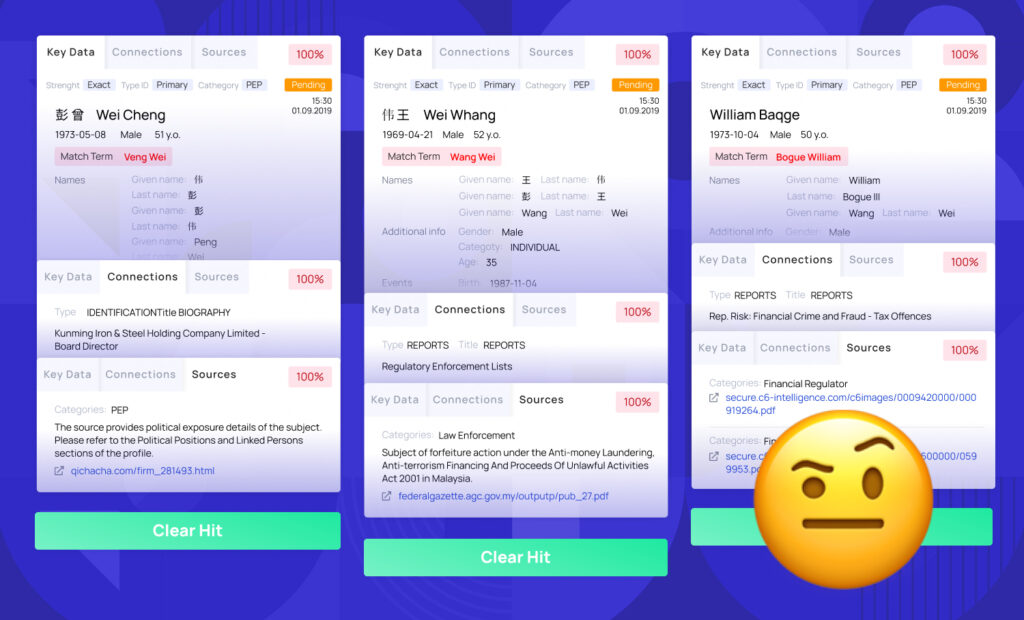

- User profiles have a simple-to-understand summary of AML screening.

- Compliance officers do not need to type any data manually because BASIS ID uses advanced OCR technology. BASIS ID is the only KYC provider to perform OCR on hieroglyphic characters, which allows it to work in such countries as China, Malaysia, Thailand, Indonesia, etc.

- You can view only certain parameters depending on your risk appetite.

Reports for the regulators are generated automatically.

Transparency

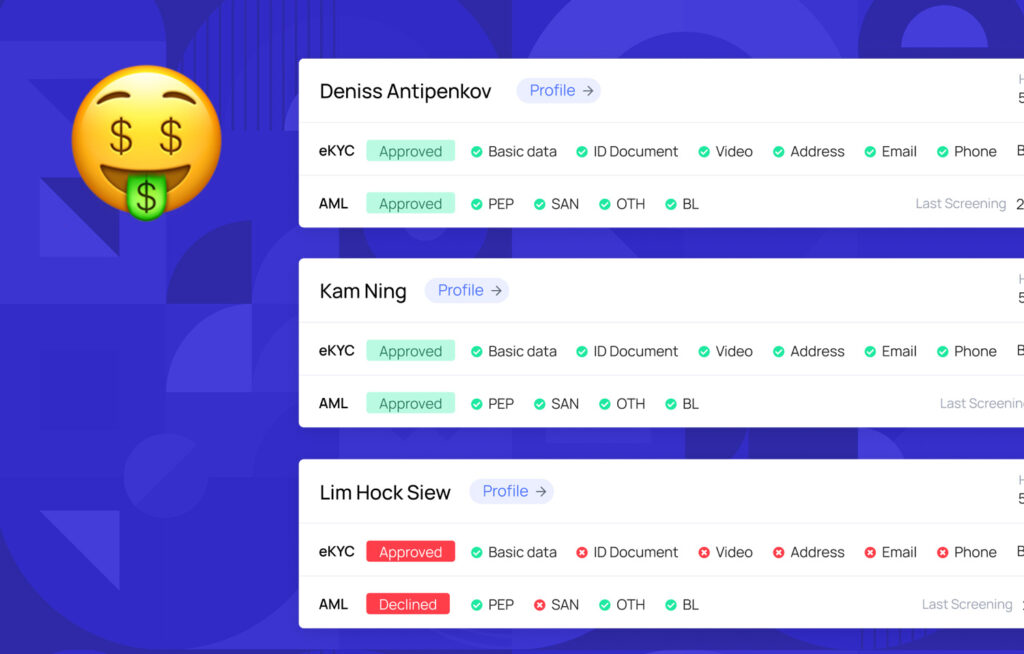

One of the main goals for creating a new CRM was to provide as much transparency as possible. BASIS ID wanted to make sure that for the compliance officers it is crystal-clear why certain individuals were accepted and others rejected.

Such clarity also makes customer communication very easy. Compliance officers can request missing or additional data instead of making users redo the whole KYC process from the beginning.

Finally, knowing which users got rejected and why allows you to easily optimize verification settings to mitigate false positives and optimize the KYC process. Moreover, BASIS ID architecture allows to track all the verification attempts a user takes and provides targeted customer support.

The transparency is achieved by displaying detailed data about each user instead of a generic decision (approved/rejected).

The profile of the user also provides lots of useful data.

- You can view the history of user actions: document uploads, information changes, etc.

- Requests to amend data or re-upload the documents.

- Cross-comparison of OCR data, manually input data, and the picture of the document.

- The results of blacklist screening and descriptions of the matches along with the links to the data source.

- The mechanism of biometric verification uses 500 frames from the video to create a 3D model of a user’s face to do the liveness check and biometric matching. 50 frames are displayed in the CRM for a visual representation.

All of these features allow you to understand why a certain user was accepted or rejected and have the whole process under your control.

Security

Making sure that the collected data is well protected is essential. Security measures, which are approved by members of TOP 500 banks and TOP 10 cryptocurrency exchanges worldwide, allow you to stay compliant with international and local data protection regulations as well as mitigate risks of data breaches while gaining trust from your clients. The data storage is decentralized and encrypted.

The system encrypts every bit of data received, sent or stored. As an integral part of the infrastructure, BASIS ID uses highly durable cloud systems operated by Amazon which are designed for their only critical mission – data storage. TLS, SSL, HTTPS, AES, RSA, GnuPG, Lz4 and many other contemporary encrypting protocols are in use.

KYC is not an obstacle

With the breakthrough KYC & AML data management system, enterprises have a powerful tool for compliance, while optimizing the onboarding process. The solution allows you to make life easier, achieve maximum efficiency and save money by automating work with AML. Besides, you will increase your conversion rate and offer the best solution built into an existing software setup.

The BASIS ID team understands the real value of each user. Therefore, they are doing everything possible to make KYC an advantage rather than an obstacle.