Eighty-eight percent of small and medium-sized enterprises (SMEs) in Singapore would consider switching some services to digital banks, according to a 2020 Visa study on Digital Banking and SMEs in Singapore.

These findings come as the Monetary Authority of Singapore (MAS) looks to digital banks to help support the underserved SME segment with the expectation of three wholesale banking licenses to be issued in the second half of this year.

Existing banking challenges expressed by SMEs include unsatisfactory terms on corporate products and a lack of control over their banking experiences. When asked what they’d like improved, they expressed a desire for greater convenience, value, and the ability to track payments and manage cashflow.

This untapped segment presents a viable opportunity for digital banks, with the majority of SMEs showing a positive attitude towards digital banks.

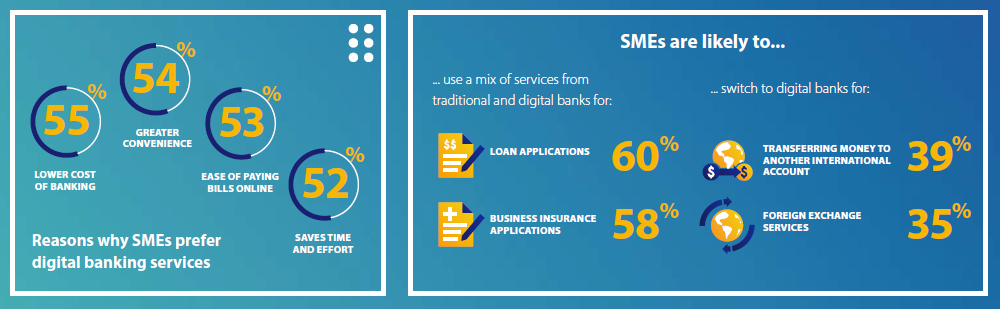

More than half the respondents believe that digital banks will provide an overall lower cost of banking (55%), increased convenience (54%), greater ease in paying bills online (53%), and save time and effort when performing banking transactions (52%).

Respondents are lured by the 24/7 availability of digital banks (58%), ease of making digital payments and transfers (56%), and efficiency of money transfers when receiving payments for goods and services (55%).

Looking ahead, most SMEs are likely to use a mix of services from traditional and digital banks, particularly for loan applications (60%) and business insurance applications (58%).

However, SMEs are most likely to switch to digital banks for services such as transferring money to another international account (39%) and foreign exchange services (35%).

Additional services that SMEs would like to see from digital banks include reduced or no rates for services (72%), alerts to relevant grants from the government, support and guidance to direct them to relevant government agencies (72%) and a consolidated dashboard to manage their expenses (70%).

Kunal Chatterjee

“The digital banking experience for SMEs has not evolved at the same pace as consumer banking and the services that exist are not as sophisticated. With traditional banks looking to become more digitally focused and new neobank challengers introducing innovative solutions to serve this segment, we believe more SMEs will embark on their digital transformation journey adopting digital banking services or embedding digital solutions into their day-to-day business processes,”

said Kunal Chatterjee, Visa Country Manager for Singapore & Brunei.