COVID-19 Has Given All Fintech Verticals A Boost Except Digital Lending

by Fintech News Singapore December 14, 2020The COVID-19 pandemic has given the global fintech market a boost, with firms in areas including digital custody, digital asset exchange, digital savings, wealthtech and digital payments recording above-average increases in transaction volume in H1 2020, according to a joint study by the World Bank, the Cambridge Centre for Alternative Finance at the University of Cambridge’s Judge Business School, and World Economic Forum.

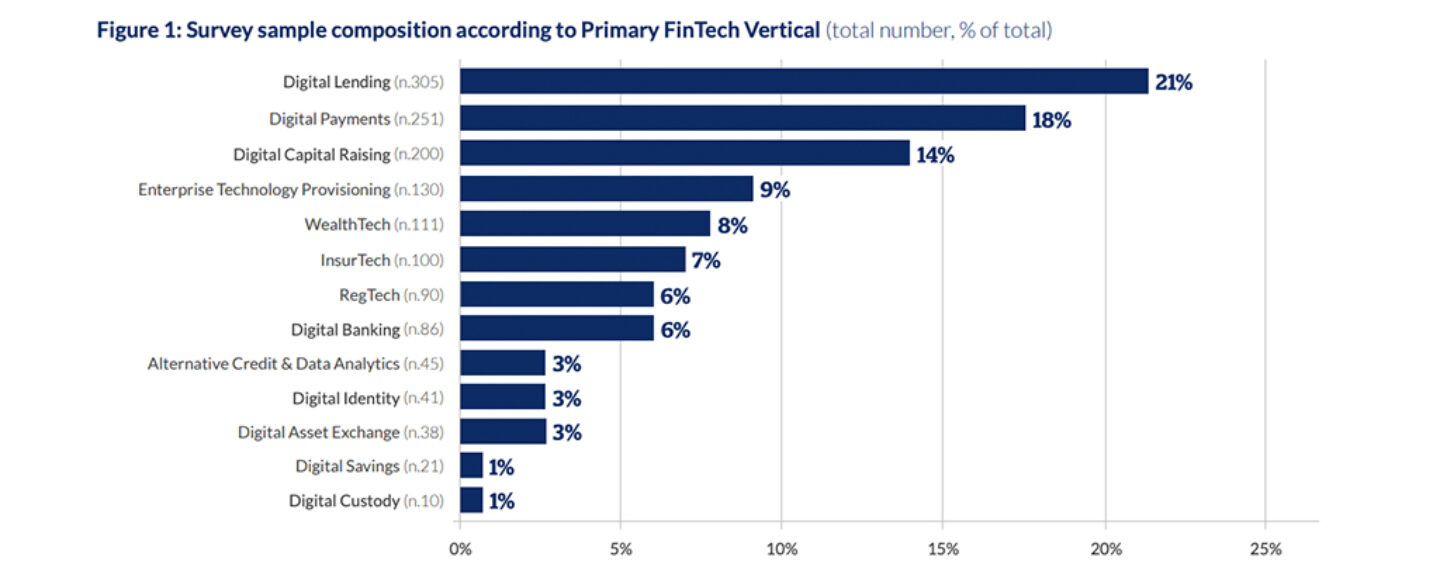

The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, released on December 3, shares findings from a survey of 1,385 fintech firms operating in 169 countries.

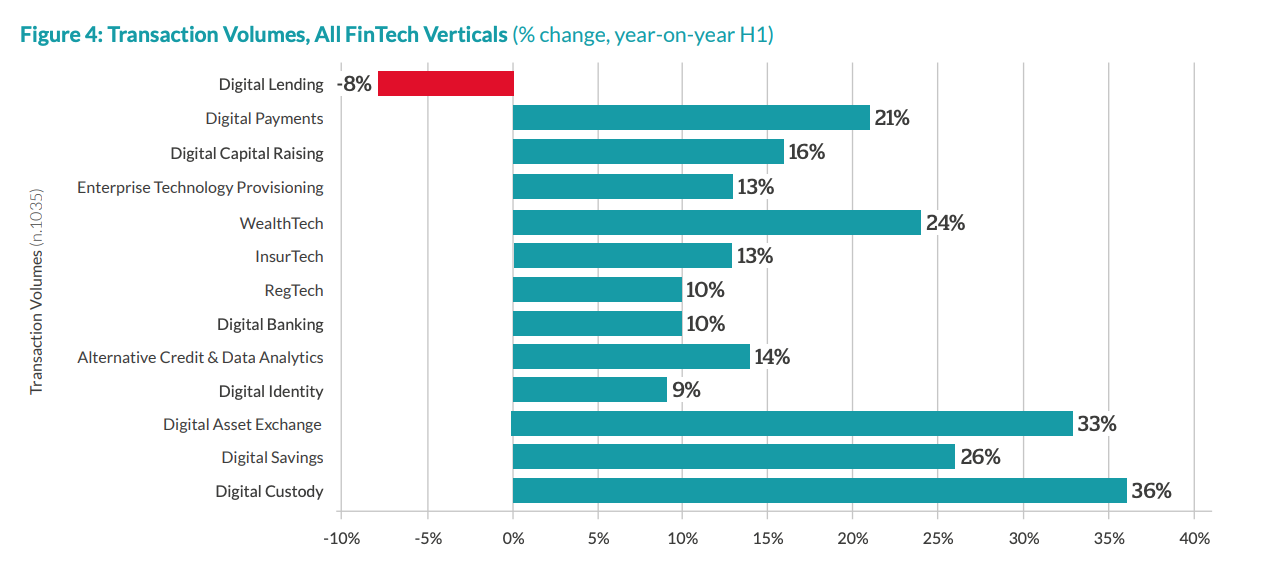

The research found that across 13 fintech verticals, only digital lending saw a contraction in H1 2020, recording a drop of 8% in transaction volume and numbers of transactions, as well as a 6% decrease in the number of new loans issued.

While digital custody (+36%), digital asset exchange (+33%), digital savings (+26%), wealthtech (+24%) and digital payments (21%) witnessed the strongest growth, digital banking, digital identity and regtech reported modest year-on-year increases of around 10% in H1 2020.

Transaction Volumes, All FinTech Verticals (% change, year-on-year H1), The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020

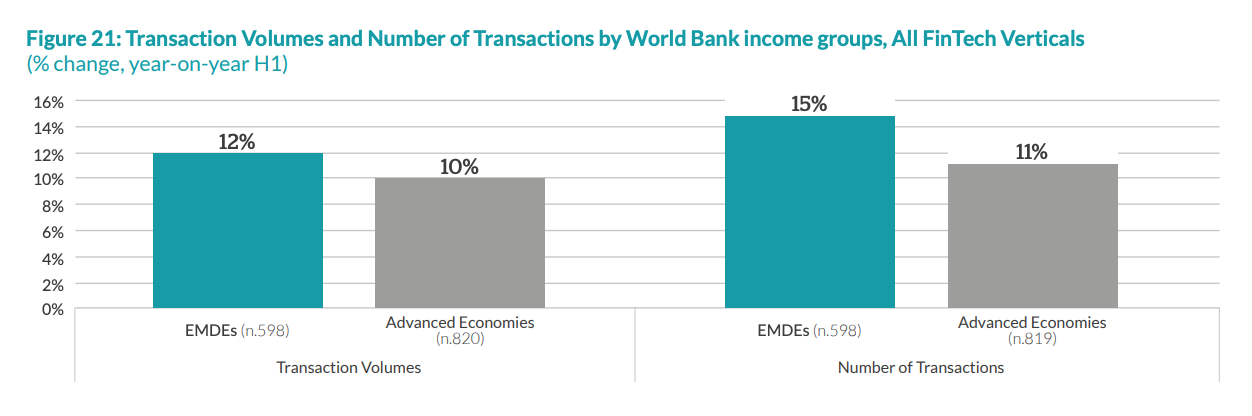

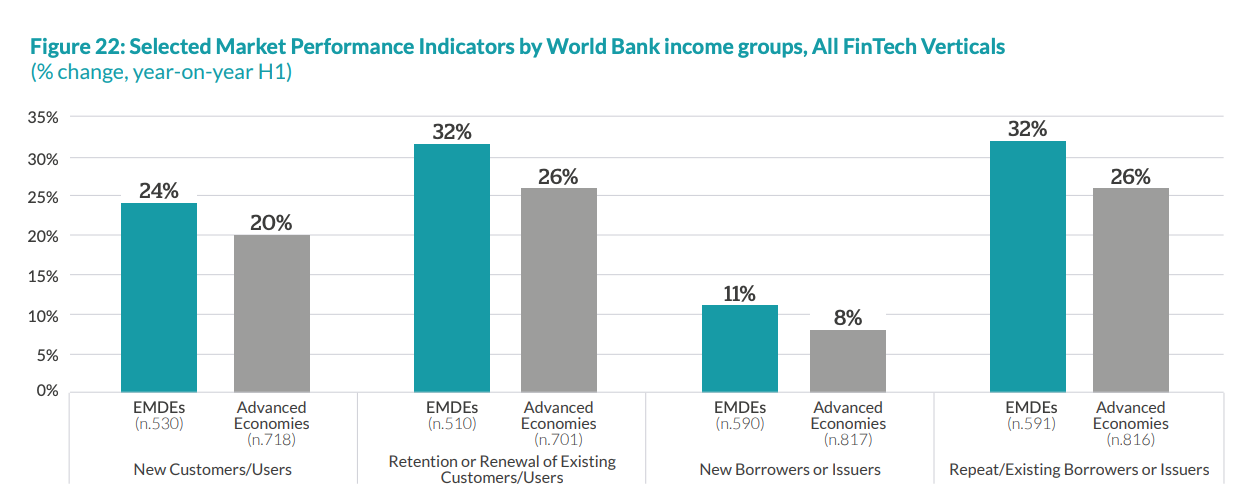

The research found that fintech companies in emerging market and developing economies (EMDEs) reported higher growth in transaction volume and numbers, as well as new customers, than their counterparts in advanced economies. In particular, the Middle East and North Africa (MENA) took the lead, rising 40%, followed by sub-Saharan Africa and North America, both up 21%.

Transaction Volumes and Number of Transactions by World Bank income groups, All FinTech Verticals, The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020

Selected Market Performance Indicators by World Bank income groups, All FinTech Verticals, The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020

Unsurprisingly, fintech companies located in markets with more stringent COVID-19 lockdown measures such as the Philippines, Myanmar and India, saw higher growth in transaction volumes, showcasing that the pandemic has forced consumers to shift to digital channels.

This trend was particularly visible in digital payments as well as for market provisioning fintechs.

Fintechs faced challenges during COVID-19

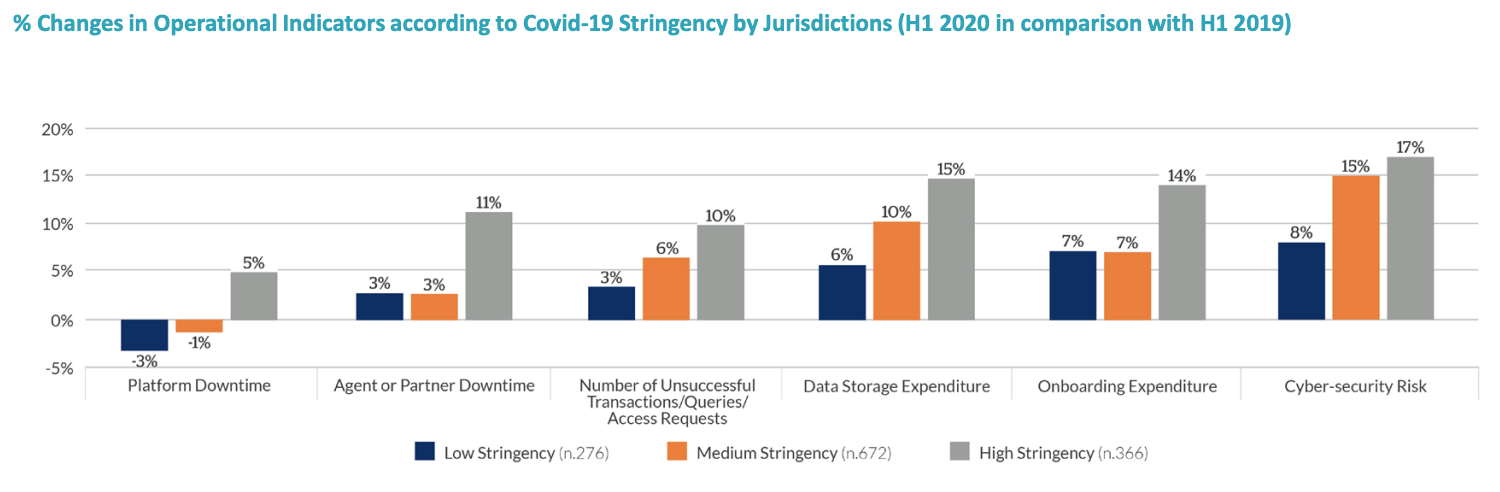

But this surge in activity during the pandemic also caused operational challenges for fintech companies, especially those in higher lockdown stringency, the survey found.

These fintechs reported a 11% increase in agent or partner downtime and a 10% increase in the number of unsuccessful transactions, queries or access requests compared to the same period in 2019.

They also reported an 14% rise in onboarding expenses and an 15% increase in data storage expenditure.

Additionally, these respondents indicated a 17% increase in cybersecurity risk perception, with those operating in the digital asset exchange, digital banking and digital payments space reporting the highest rise, up 32%, 20% and 19, respectively, the research found.

% Changes in Operational Indicators according to Covid-19 Stringency by Jurisdictions, The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020

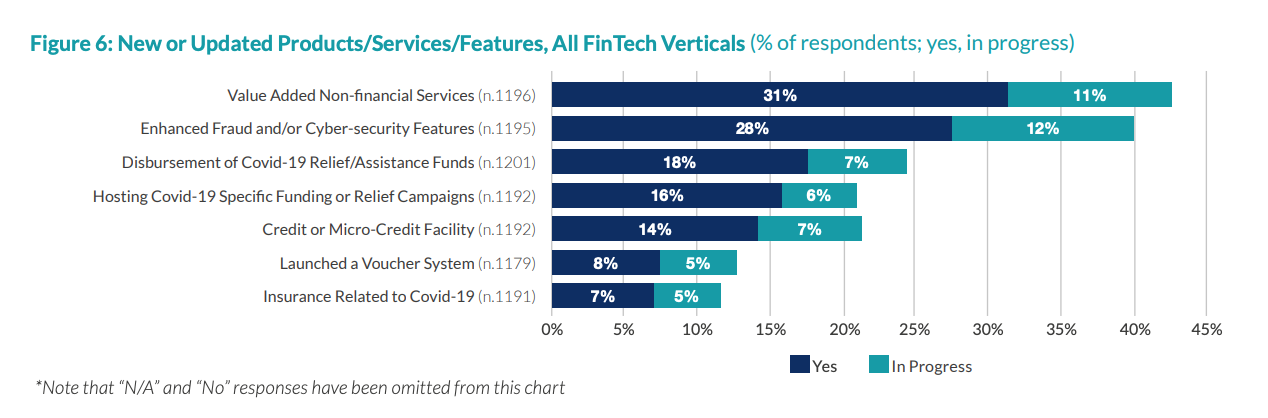

In light of these arising challenges, 40% of firms said that they have either introduced or are in the process of introducing enhanced fraud or security measures as a response to business conditions under the pandemic.

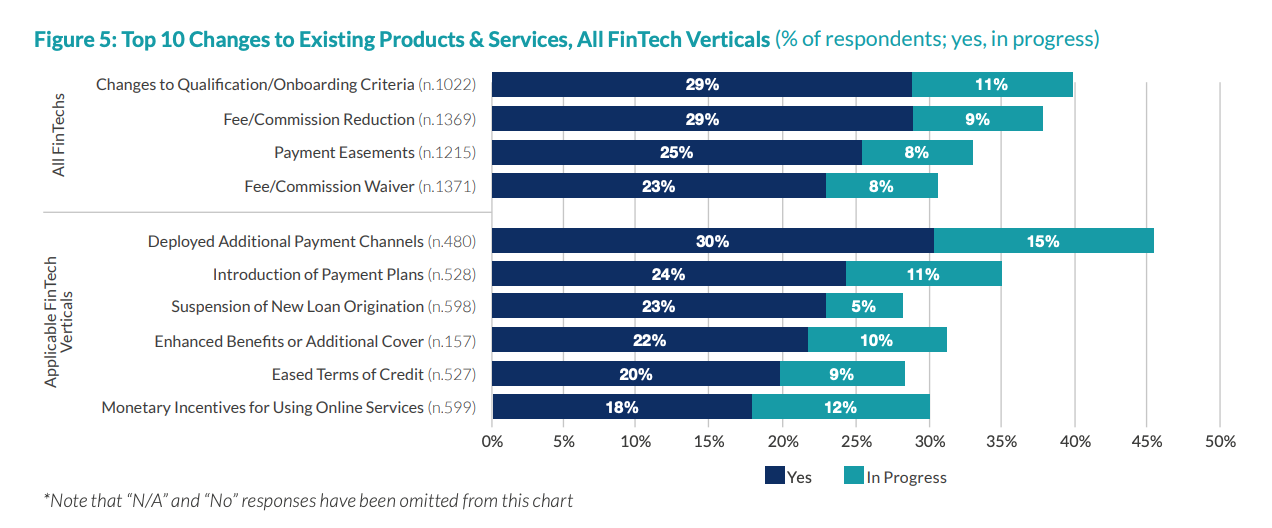

Overall, fintech companies have been responsive to the pandemic with many adjusting their products. Two thirds of firms reported making two of more changes to their existing products or services, and 30% said they were in the process of implementing changes. Most prevalent changes include reducing fees, changing qualification criteria and easing payment requirements.

Top 10 Changes to Existing Products & Services, All FinTech Verticals, The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020

About 60% launched new products and value-added services in light of the pandemic, and a further 32% reported being in the process of doing so. Value added non-financial services were amongst the most readily introduced products or services (31%), with an additional 11% of respondents working towards this introduction.

New or Updated Products:Services Features, All FinTech Verticals, The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020

The survey results echo the numerous reports released this year that have attested to consumers’ shift to digital financial services. In Southeast Asia, digital payments grew 3% this year, and usage of mobile banking apps surged across the region with Vietnam, the Philippines and Indonesia recording the strongest growth rates, according to the e-Conomy SEA 2020 report by Google, Temasek and Bain & Company.

Globally, Mastercard’s contactless transactions increased over 40% in Q1 2020. In Latin America, 13 million Visa cardholders made e-commerce transactions for the first time ever in that same quarter, showcasing a “massive acceleration toward e-commerce adoption” amid COVID-19, Visa’s CPO Jack Forestell told MarketWatch in May.

Need for additional regulatory support

But as the pandemic accelerates digital adoption and transforms the way people transact, regulators must now adjust legislations so rules are more in line with the rapidly changing financial landscape.

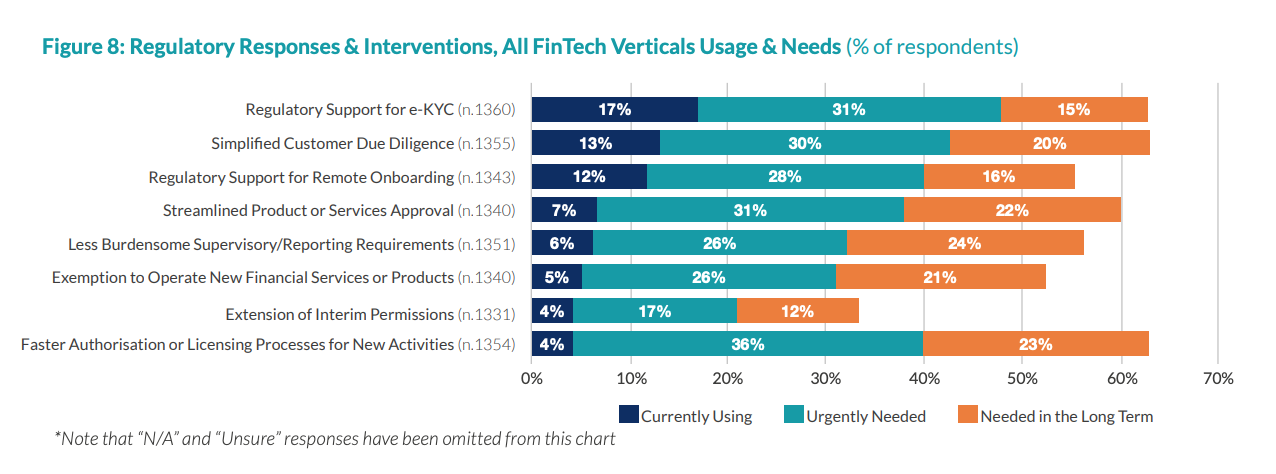

About half of the respondents that took part in the 2020 Global COVID-19 Fintech Market Rapid Assessment Study reported the need for regulatory measures that support simplified customer due diligence. A similar proportion cited the need for regulatory support for electronic know-your-customer (eKYC) (46%), as well as remote onboarding (44%).

Other regulatory measures fintechs believe are needed include faster authorization or licensing processes for new activities (59%), streamlined product or services approval (53%), and less burdensome supervisory and reporting requirements (50%).

Regulatory Responses & Interventions, All FinTech Verticals Usage & Needs, The 2020 Global COVID-19 Fintech Market Rapid Assessment Study, Dec 2020