Singaporeans are moving away from paper-based payments and embracing real-time digital payments and mobile wallets, a shift that has accelerated with COVID-19, a new report by ACI Worldwide Real-Time Payments and GlobalData says.

2021 Prime-Time for Real Time, a global report tracking and analyzing real-time payments across 48 global markets, shows that real-time transactions volumes and values have jumped significantly over the past years in Singapore and are further expected to grow.

In 2020, total real-time transactions reached 138.38 million, up a staggering 48% from 93.24 million in 2019, while the value of real-time transactions surged 40%, jumping from US$110 billion in 2019 to US$154 billion, the report says.

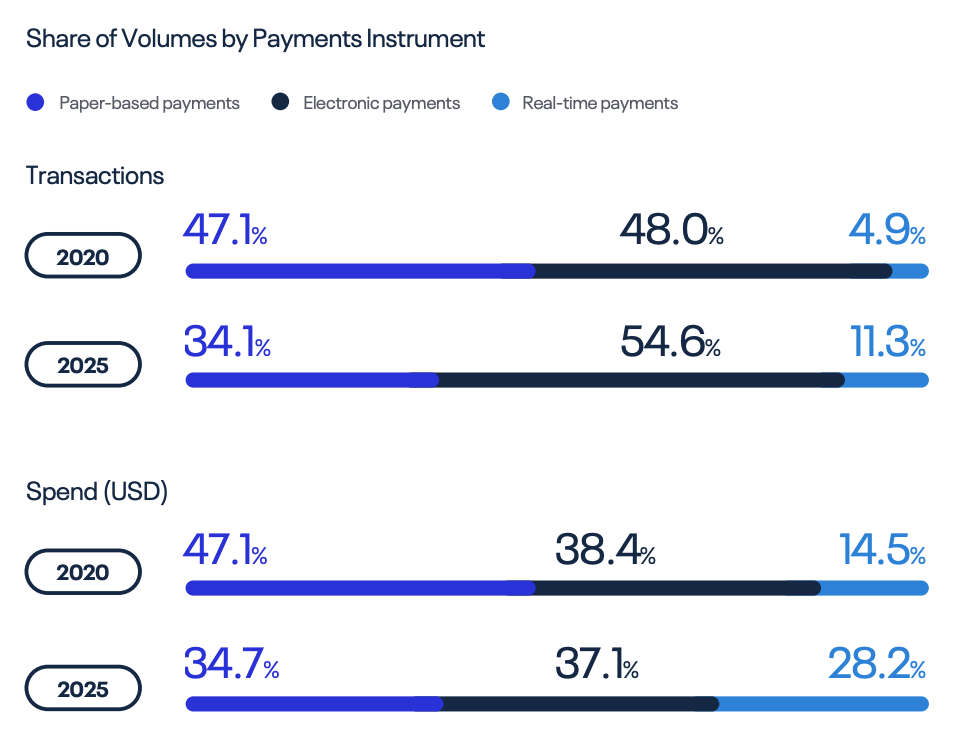

By 2025, real-time transactions volume is projected to grow at a compound annual growth rate (CAGR) of 23.2% to reach 392.94 million, and total value is set to rise at a CAGR of 17.74%. Real-time digital payments will represent 11.3% of all transactions by 2025, up from 4.9% in 2020, the firms project.

Share of Volumes by Payments Instrument in Singapore, via 2021 Prime-Time for Real Time, ACI Worldwide Real-Time Payments and GlobalData, May 2021

Singapore has two established real-time payments schemes in place. Fast and Secure Transfers (FAST) was launched in 2014 and enables retail and corporate customers of participating banks to transfer funds 24/7/365. FAST can be accessed via banks’ Internet banking services, and has a maximum transaction limit of S$200,000.

The second scheme is PayNow and was launched to consumers in 2017. PayNow is a peer-to-peer (P2P) real-time fund transfer service built on the FAST infrastructure and allows users to transfers funds from one bank account to another using a mobile number or national ID card number. Transaction limits are consistent with FAST. PayNow Corporate went live for businesses in 2018.

Booming PayNow usage

Recent data from the Monetary Authority of Singapore (MAS) indicate that individual registrations for PayNow rose by 1.6 million in 2020, while business registrations doubled to about 240,000. This means that 80% of residents and businesses are currently on the real-time payments scheme.

In December 2020, the volume of money transacted through PayNow doubled from a year ago to S$5 billion, showcasing that the pandemic has fueled digital payments adoption.

At Singapore’s United Overseas Bank (UOB), the value of PayNow transactions by customers grew 220% in the first 10 months of 2020, while volume expanded 127% in the same period, compared with pre-COVID-19 levels, Jacquelyn Tan, head of group personal financial services at the bank, wrote in a commentary for the Straits Times. Meanwhile, QR payment transactions jumped 272%, compared with the same period in 2019.

By contrast, physical cash deposits and withdrawals at UOB branches or ATMs fell by more than 30% year-on-year from March to November 2019, Tan said.

In 2021, Singapore began opening up PayNow to non-bank financial institutions, a key development that’s set to further increase adoption of digital payments. This came on the back of already surging mobile wallet usage, which quadrupled between 2014 and 2019, and accelerated in 2020 amid COVID-19, the 2021 Prime-Time for Real Time report says.

With direct access to FAST and PayNow, third-party providers like GrabPay, Liquid Pay and Singtel Dash are able to provide their customers with real-time payments capabilities to top up their wallets, transfer funds, and more.

Thailand and South Korea take the lead in Asia

Across Asia, Thailand and South Korea have the most developed and mature real-time payments markets, according to the study.

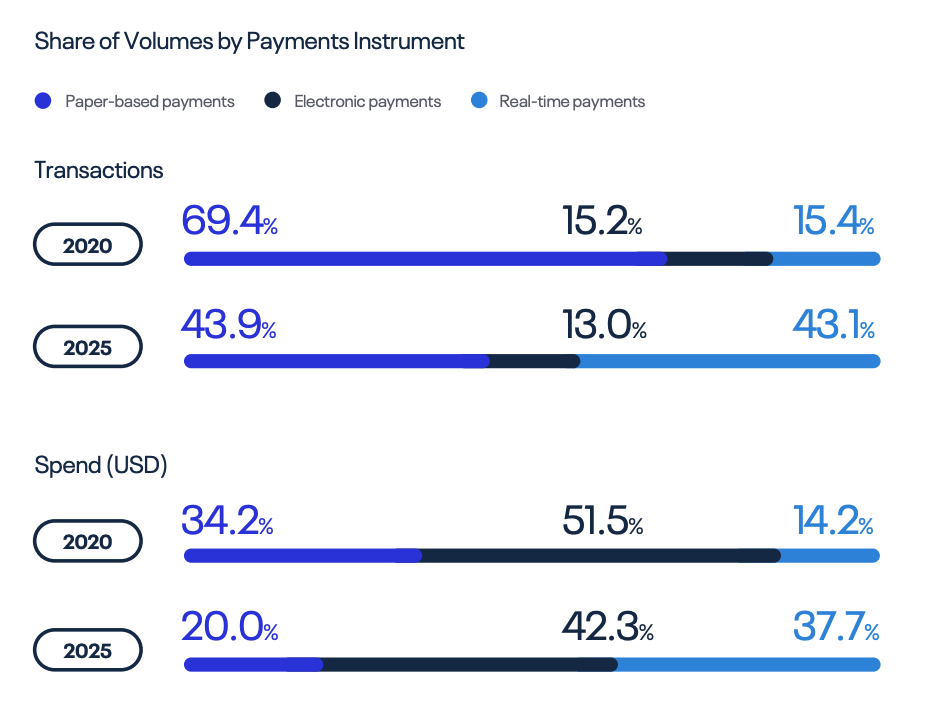

In Thailand, high levels of mobile wallet adoption, real-time payments integration, and low usage rates for payment cards have contributed to high growth rates since 2016. In 2020, real-time payments through PromptPay made up 15.2% of all transactions, a figure projected to rise to 43.1% by 2025.

Share of Volumes by Payments Instrument in Thailand, via 2021 Prime-Time for Real Time, ACI Worldwide Real-Time Payments and GlobalData, May 2021

Singapore and Thailand recently linked their two real-time payments systems to allow seamless cross-border mobile payments between the two countries. The PayNow-PromptPay linkage is a key collaboration under ASEAN Payment Connectivity that was initiated in 2019 and which seeks to build capabilities for more efficient digital payments across the whole Southeast Asian region.

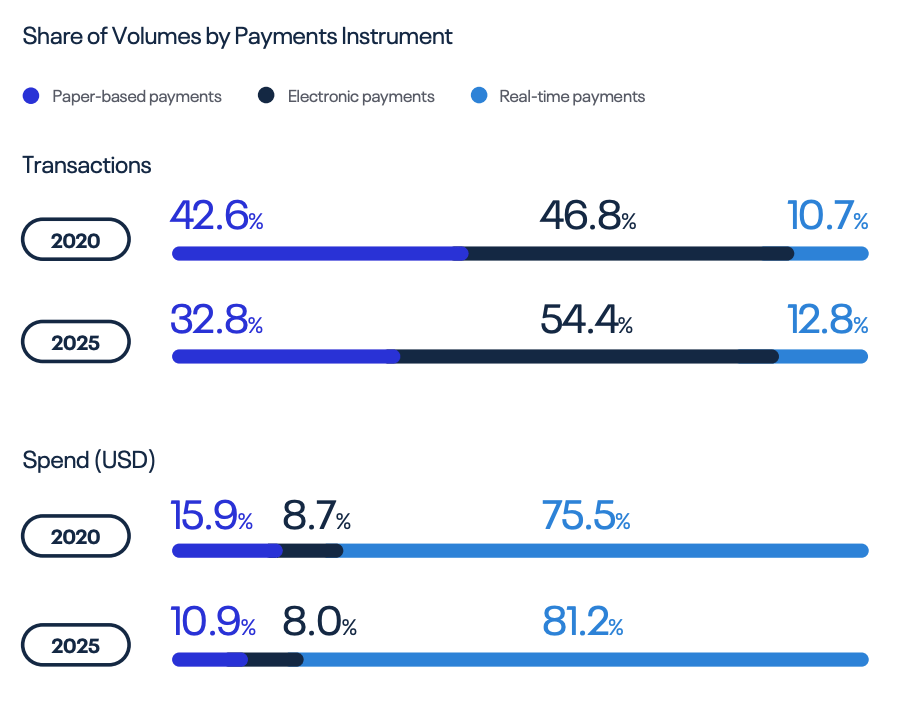

South Korea, an early innovative in real-time payments, has one of the longest running schemes in the world. The CD/ATM network dates back to 1988, but it’s only been since 2007 that it has provided near-real-time payments and near-24/7 operations. In 2020, real-time payments accounted for 10.7% of all transactions in South Korea, but the figure is expected to grow to 12.8% by 2025.

Share of Volumes by Payments Instrument in South Korea, via 2021 Prime-Time for Real Time, ACI Worldwide Real-Time Payments and GlobalData, May 2021