Australian Fintech Startups Seek Singapore Investors to Help Fund SE Asian Expansion

by Fintech News Singapore August 31, 2021With more and more Australian fintech companies interested in expanding into Asia, nine Aussie fintech startups will be showcasing their solutions during the Singapore Fintech Festival (SFF)’s Deal Fridays.

Deal Fridays, jointly organised by the Monetary Authority of Singapore (MAS) and Enterprise Singapore, is a platform for deal-making opportunities that aims to deliver year-long, end-to-end support for global startups, investors and corporates in forging investment deals, co-innovation opportunities and business partnerships.

Singapore and Australia’s strong economic ties and ongoing efforts to enhance bilateral fintech cooperation are providing fast-growing fintech startups with a path to growth in two of the world’s most dynamic digital economies.

In June, the two countries agreed to start discussions on a so-called Australia-Singapore Fintech Bridge, which will seek to enhance cooperation on fintech policy and regulation, look for opportunities for collaboration on joint innovation projects, and facilitate investments and new business opportunities in digital trade and financial services.

During Singapore Fintech Festival (SFF)’s Deal Fridays on September 03, 2021, the Australian Trade and Investment Commission (Austrade), the country’s international trade promotion and investment attraction agency, will present nine high-potential fintech scaleups looking to take on Southeast Asia.

These fintech scaleups, which operate across a broad range of segments including AI, ML, DLT, insurtech, payments, regtech and cybersecurity, are leveraging cutting-edge technologies and digital platforms to provide consumers and businesses with more efficient products and services.

Each is looking to raise between US $500,000 and US $5 million to fuel their next growth phase and bring in new investors to help fund their expansion in Southeast Asia.

Meet the nine participating companies:

Tapp Group

Tapp is a cost-effective payment-processing marketplace for wholesalers, retail businesses and consumers that brings financial inclusion and economic empowerment.

It targets the unbanked and underbanked communities, providing them with easy access to digital, physical and financial products.

In the last year, Tapp achieved A$627 million in gross merchandise volume (GMV) and 136 million transactions on its proprietary platform.

Tapp counts over 160,000 registered merchants in Indonesia.

Daisee

Daisee has unique IP that leverages AI and machine learning for conversational analytics in call centres.

The core product enables fully Automated Quality Management for compliance and customer experience. Daisee’s proven B2B solution with excellent traction is now scaling up rapidly.

Recurring revenue grew 300% over the last 12 months and have over 20 clients. Very strong macro tailwinds – massive push to cloud telephony and work from home are driving the adoption of advanced SAAS solutions.

Daisee has won many awards, has a world-class team and very strong advocacy from its client base.

Civic Ledger

Civic Ledger is on a mission to lead young next generation technology companies building distributed digital infrastructure for emerging nature-based marketplaces by smoothing out notoriously difficult trading and exchanges towards auditable ecosystems.

Starting with water rights, they digitise and tokenise water assets enabling them to be traded in a simple and secure way using blockchain technology, improving price discoverability and regulatory oversight, as well as provide accessibility to illiquid markets estimated at US$20B in annual water trading transactional value globally.

In June 2021, the company was given the World Economic Forum’s Technology Pioneers award for the 2021 cohort – the only technology company selected from Australia.

Detexian

Detexian Detexian is a SaaS security posture manager designed for mid-market IT managers to manage SaaS risks.

Whether it’s taking stock of unused licenses, tracking user on/offboarding and data flow between SaaS apps, Detexian provides SaaS risk monitoring, review and report automation.

With data insights, the IT managers can communicate risks better to stakeholders and get buy-in to carry out improvement works.

Detexian has early traction in Singapore with fintech SMEs looking to bolster SaaS risk management in response to the Revised Technology Risk Management Guideline by the Monetary Authority of Singapore.

Enteruptors

Enteruptors augments the decision experience of financial services through a merger of workflow, human intuition and artificial intelligence (AI) to make precise decisions at speed for optimum risk regulated returns.

Its platform provides a real-time decision experience for 30,000 community institutions and neobanks across the globe to manage prudential challenges.

The company is working with an Islamic bank to deploy its solutions in Malaysia and Indonesia.

Link4

Link4 automates the invoicing process to make it safer, more efficient, and real time.

Businesses can use their current cloud accounting system and Link4 will deliver its invoice data instantly, without the need for email and PDFs which protects them from many scam attacks.

Launched in 2015, Link4 is present in four countries and trusted by more than 3,000 businesses in Australia and worldwide.

Truuth

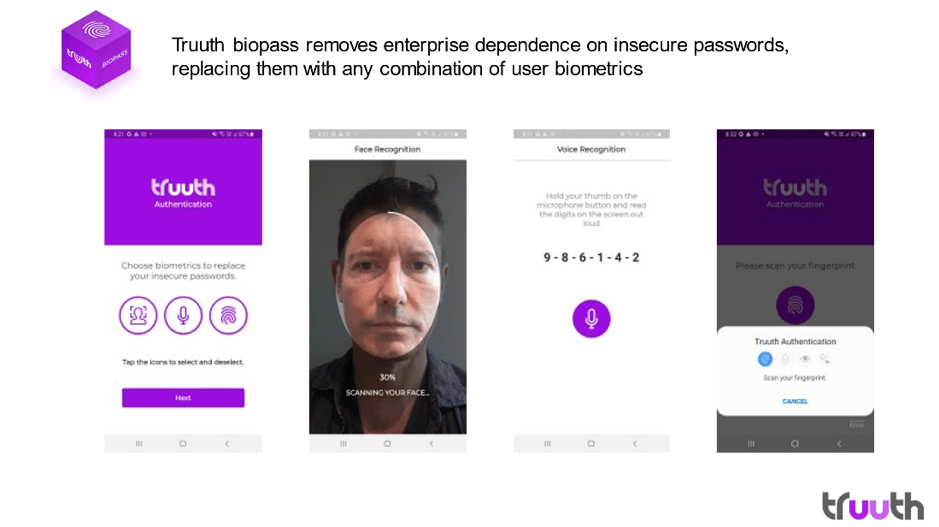

Truuth, a startup providing an integrated suite of digital identity services, has a mission to deliver the world’s most accurate, secure, and user-friendly digital identity services.

Truuth biopass is a “passwordless” authentication solution that delivers the highest possible level of assurance in user identity for high-risk use cases such as large financial transfers, and access to sensitive sites, documents, and data repositories.

Truuth’s key differentiator is the ability to identify the human behind the device. All digital identity services are delivered through a globally scalable SaaS platform for easy plug and play by enterprise clients.

Founded in 2018, Truuth is already serving clients like Macquarie Bank and Australian Finance Group (AFG).

Aiculus

Aiculus is a cyber-AI company that specialises in API security, visibility and privacy. It uses AI to detect and respond to API security threats across all your API traffic in real time.

Aiculus’s network management platform is designed to help organisations take advantage of advances in technology while securely protecting their privacy, data, and systems.

The company’s platform uses advanced AI and machine learning (ML) to monitor API traffic in real-time and screens traffic to automatically detect and stop fraudulent calls that try to infiltrate an organisation’s data and services.

This enables organisations with high privacy standards and security to utilise technology in a secure manner.

Aiculus empowers financial institutions to gain the confidence to expand and innovate with APIs.

Zetaris

Zetaris has developed and validated a new way of processing data for analytics and BI in the cloud. Rather than moving data to a central place (data lake or data warehouse) to analyse it, Zetaris brings the analysis to the data no matter where it is.

It means that users can connect multiple databases and analyse them together in real-time, without the time, cost and fail rate associated with moving the data to a central location.

Some of Zetaris’ enterprise clients including Telstra, BUPA, Optus, Singtel, Nokia and MCRI.

A booming digital economy and middle class

Despite a challenging economic environment induced by the COVID-19 pandemic, Southeast Asia’s internet sectors continue to see strong growth. In 2020, 40 million people came online for the first time, bringing the total number of I\internet users in the region to 400 million.

A report by Google, Temasek and Bain & Company forecasts that Southeast Asia’s internet economy will surge to US$300 billion by 2025 from just US$100 billion in 2020.

This growth will be driven by a booming rising middle class and tech-savvy population. By 2030, 65% of the region’s population is expected to join the middle class, with 60% of them under the age of 35.

For fintech companies, the opportunity lies in the region’s large population of unbanked and national reforms to improve financial inclusion.

Out of the Southeast Asia’s 670 million people, half remain unbanked with no access to financial products and a further 18% are underbanked, meaning that they are lacking access to anything other than a bank account, according to an analysis by Australian financial institution Macquarie Group.

For countries including Vietnam, the Philippines and Indonesia, improving financial inclusion has become a priority and key in achieving stronger and more sustainable economic growth and development.

Vietnam seeks to have at least 80% of the adult population with a bank account by 2025, while the Philippines aims to expand account penetration to 70% by 2023.

In Indonesia, the Digital Finance Innovation Roadmap and Action Plan 2020-24, seeks, among other things, to enable inclusive financial services that are affordable, convenient and scalable, and support digital financial services that empower Indonesians and micro, small and medium-sized enterprises (MSMEs).

Register for SFF’s Deal Fridays – Australia Fintech Special here.

Visit the Australian Trade and Investment Commission’s website here.

If you are interested to connect with one of more companies above, email Austrade at singapore@austrade.gov.au.

Featured image: Sydney Opera House from Unsplash